Winklevoss Bitcoin ETF “application rejected” — remember Bitcoin Futures Expiration is Friday (FUD news story)

Source: https://cointelegraph.com/news/cnbc-winklevoss-twins-bitcoin-etf-application-rejected-by-sec

To me, the Winklevoss story is “just in time” for the CBOE Bitcoin Futures expiration (where contracts are traded on the $ price of Bitcoin). These contracts expire the 3rd Friday of the month. If you look at the past 6 months , the average price decrease before Bitcoin options expiration is +5%..

The SEC will give the Bitcoin ETF “go ahead” to the CBOE first..not the Winklevoss Twins.

Watch what happens.

On the Bitcoin futures...at some point by October the tide will turn immensely (in timing with the Bitcoin ETF approval). Then the future market will go long is my guess and we will see a change.

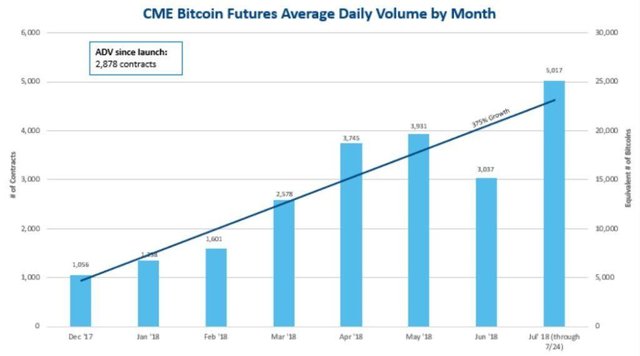

CBOE Bitcoin Futures have only grown and have been an easy way to make money shorting bitcoin this year —- note 300% increase in volume since December 2017.

Let’s watch the action when the Bitcoin ETF is approved for the CBOE —- then they will like Bitcoin :-)

🚀🚀🚀🚀

It’s coming

I am still suspicious with ETF after what they have done to precious metals. I am hoping it is different with bitcoin

I know what you are saying. The older Clif High data talks about the attempted efforts to manipulate Bitcoin via the CBOE and other “fails” and this changes everything in cryptos, precious metals etc... Watch what comes about with the banks in Northern Italy, Deutsche Bank ...this will have an impact on many things.

So bitcoin morphs into and investment/gambling tool.

The financial world in general is a big gambling tool that has been “gamed” by the cabal for decades. However, Bitcoin futures will soon find out that this is not like how they rig silver or LIBOR rates. Let’s watch.

@floridanow Taram-pam-pam