Crypto Market Update (25 April 2018)

MVIS-CryptoCompare Index

The MVIS CryptoCompare Digital Assets 10 Index has closed at 7,712.62 with a gain of 7.27% for the day.

See the live index here

Market Update

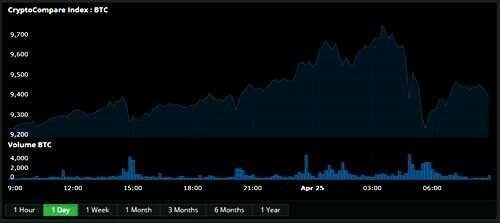

At the time of writing, the Bitcoin price is sitting at $9,400 representing a gain of 1.8% in the last 24 hours. More than $1.4 B worth of BTC were exchanged in the BTC/USD market representing a 24.6% share of the global daily volume. The BTC/JPY pair represents a 52% share.

The Ethereum price is down 2.73% over the past 24 hours and is currently sitting at $660, with over $700 M worth of Ether exchanged in the past 24 hours on the ETH/USD pair which has a 41% market share of the daily trading volume.

See live charts here and here

16 Japanese Cryptocurrency Exchanges Launch Self-Regulatory Body

Yesterday, sixteen cryptocurrency exchanges currently registered and licensed by the Financial Services Agency (FSA) launched a self-regulating body that will be known as the ‘Japanese Cryptocurrency Exchange Association’, according to a report by Japanese news outlet Asahi Shimbun.

Taizen Okuyama, president and CEO of Money Partners will serve as the chairman of the newly formed group. Okuyama said:

“We are working hard to develop security measures and internal control, we will promptly promote the rules of transactions and advertisements and the information we disclose. We want to eliminate customers’ concerns and work to restore confidence in order to develop healthy markets.”

Read more here

Binance Leads $30 Million Funding Round for Crypto MobileCoin

MobileCoin announced the conclusion of the funding round on Tuesday, adding that Binance had made its investment in the project through Binance Labs, its blockchain incubator. Binance Labs stated.

“A mobile-first, user-friendly cryptocurrency, like MobileCoin, plays a critical role in driving mainstream cryptocurrency adoption."

Read more here

Federal Reserve Bank of St Louis Attempts to Define Bitcoin

The federal reserve bank of St Louis has published a paper that attempts to define Bitcoin and whether it has a use case along with virtual and physical forms of money. To do this, the bank used a number of dimensions to help them categorize the currencies, namely representation, transaction handling, and creation. The bank states that while different currencies have their uses, there is a big demand for virtual assets issued by trusted parties.

"Each form of money has its benefits and drawbacks. This is why many forms of money coexist. We believe there is great demand for a virtual asset issued by a trusted party that can be used to save outside of the private financial system."

Read more here

Congratulations @baizid! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @baizid! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!