How blockchain will fix esports’ broken business model

It’s often been stated “blockchain is a solution looking for a problem”.

And having read many white papers, I’d have to admit many blockchain projects, especially game blockchain projects, fall into this category.

It’s also hard to argue given its +$100 billion of annual revenues and decade-long growth that the games industry is struggling or in any way needs blockchain to ride to its rescue.

Still, there are specific areas in which blockchain technology could improve the status quo.

Formalizing the current grey area of game, game account, and in-game item ownership and resale is an obvious one. Blockchain will enable developers, especially indies, to more creatively interact with, and monetize, their players.

There’s some interesting, if early, work going on in terms of using blockchain to build and detoxify game communities too. Indeed, one key element of blockchain gaming’s decentralization will be to break down the barriers between game developers and game players.

To my mind, however, the biggest failure of the games market in recent years – and the biggest opportunity for the blockchain game sector – is esports.

“Esports, a failure?”, you might be thinking at this point, and in some respects your incredulity would be justified.

In terms of large scale audience participation, the esports explosion started in South Korea in the early 2000s, with professional teams owned by the likes of Samsung and SK Telecom battling for supremacy in tournaments of StarCraft in large arenas and on national TV.

Since then, games such as Dota 2, League of Legends and Counter-Strike: Global Offensive have gone global, with online tournaments attracting tens of millions of viewer hours on Twitch, while offline tournaments are now a regular part of the gaming calendar from Berlin, Malmo and Warsaw to Shanghai, Seoul, Sydney and all points to Anaheim, CA.

Yet, as a business, esports is horribly fragmented.

The most powerful players are the game makers, notably League of Legends’ developer Riot Games and Dota 2 studio Valve.

But even they rely on myriad third parties ranging from: the esport team owners and players; to tournament companies; arena providers; advertisers including hardware and gaming accessory manufacturers; media partners such as Twitch and other broadcasters; streamers; and finally the fans themselves to build awareness and provide growth.

Each one of these relationships create complexity, friction and misalignment. In terms of creating a synergetic business in which all parts gain appropriate rewards from top line growth, you could hardly construct anything more convoluted or flawed.

Indeed, at present, the system doesn’t even work for the vast majority of the esport teams, who at least have the potential to earn the most through winning tournaments. But only those who win the most lucrative events such as League of Legends’ World Championship or Dota 2’s The International make money, and that cash isn’t recycled back into esports.

That’s the reason Activision Blizzard invested over $100 million creating the infrastructure, event support, specific software, and wider business partnerships to launch its Overwatch League.

It’s the first and (to-date) only vertically integrated esports business in which everyone who can afford to buy into the league is guaranteed a share of the profits.

Of course, that’s great for those esport teams who could drop $20 million to buy a slot etc, but it’s not a scalable solution for the rest of the esports sector, which requires a bottom-up not another top-down approach.

And this is where blockchain comes into play.

Simply put blockchain enables companies to take the money flowing into esports from various sources, mainly advertising, and create ways in which that cash is equitably distributed to the teams, players and users who interact in some way with that content.

In turn, it also provides a return path for that money to flow back into the ecosystem as teams, players and users spend their rewards within the platform to enter tournaments, buy game content including limited edition skins, merchandising etc.

Equally significantly, any decent blockchain esports platform will attract a wider range of advertising sources.

So as well as the usual suspects – Intel, Razer, Coke, Nike etc – who will cut direct deals, esports teams themselves will get involved, perhaps through their own sponsors, while key streamers and influencers will act as secondary markets to attract eyeballs to build their own brands and hence attract more advertising spend.

Tying all this activity together will be the blockchain esport platform’s underlying token, which will enable the platform’s growing social and financial value to be constantly recycled and, if/when required, cashed out.

No doubt, this will also create new opportunities, such as the creation of new blockchain games specifically designed for esports, new teams, influencers and stars, as well as new models for broadening the spectator audience for a sector that up-to-this point have been dominated by typically male gaming tropes such as combat.

Esports’ road ahead

Of course, this isn’t to say all, most, or even some of the blockchain companies targeting the esports sector are going to succeed.

There are already too many, and too many hoping to resuscitate the status quo by adding gambling. The vast majority will fail, not because they are inexperienced, don’t understand why they’re using blockchain, or don’t understand how to create a synergetic blockchain-based esports economy, although most don’t.

No, as with any new market, most companies will fail because only a handful can manage to attract a viable numbers of users within a new product that can scale; something that’s a particular problem for blockchain companies at the moment. Those companies will either attract the bulk of the audience and advertisers and/or use their success to acquire viable competitors.

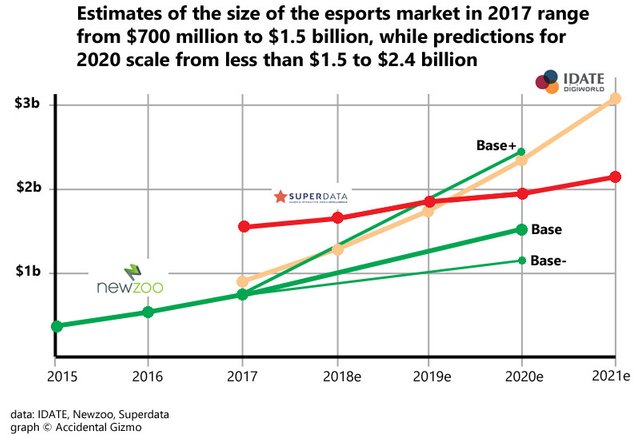

What’s more significant, however, is that blockchain esports companies as a whole will provide the catalyst to finally take the value of the global esports market from the sub-$1 billion annual level in which it’s been becalmed in recent years to the +$2 billion size that market intelligence companies have for years been predicting.

Hopefully as well as fixing esports’ broken business model, they’ll innovate in terms of game experiences and audiences too.