Here Is What I Found Trading ERC20 Tokens in Decentralized Exchanges

I am not a trader but wanted to test out how decentralized trading works. In decentralized trading the exchange doesn’t hold your crypto assets, the trade happens directly between traders wallets. I tested out four popular exchanges built on the open protocol 0x.

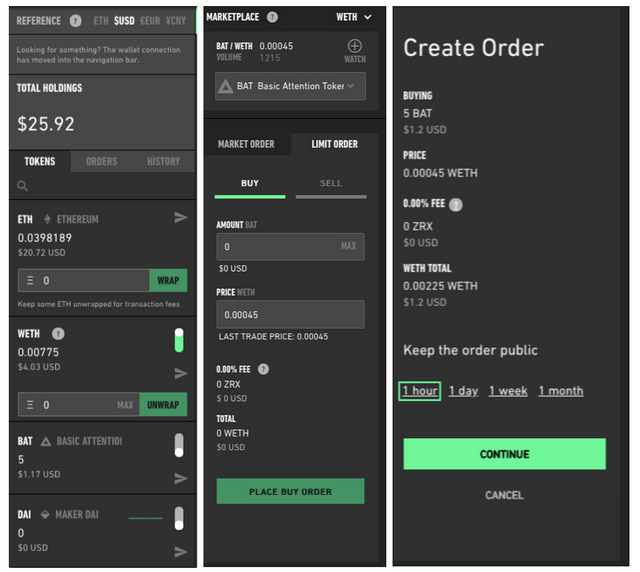

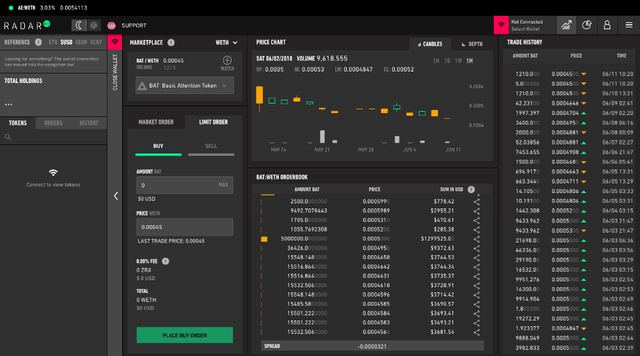

Radar Relay

Radar relay provides a rich trading experience. It has an intuitive user interface, thus it’s a great tool for first-time traders. You can start trading with a few clicks, it has no signups, filling up forms or verification.

Click on the “Select Wallet” button on the top right corner, select your wallet, approve the request and you are good to go.

The interface is intuitively divided into four sections. In the leftmost part of the screen, you have your wallet functionalities. It shows your ETH balance, token balances, helps you wrath ETH to WETH(a necessary step for trading ERC20 tokens), enable/disable tokens, etc.

In the second section from the left, you can select the token you want to buy or sell and place a market/limit order.

The third and fourth section shows you the stats of the selected token such as price chart, order book, trade history, etc.

In the top right corner, you have buttons, that shows you the volumes of each token and your account section when you can check the orders you placed. Our order on Radar Relay was filled faster when compared to other relayers.

A wide variety of tokens is supported by Radar Relay. They link with other relayers to provide liquidity. You can integrate their APIs to your dApps to help users exchange tokens seamlessly. They provide you with Rest and WebSocket APIs. You can list, place and subscribe to orders using their APIs.

I had a chance to interview the team at Radar Relay.

How do you plan to stand out with respect to other relayers in the market?

Like all relayers, we’re living in the future, and trying to work backwards. Along the way, we’ll each need to find our niches. We expect relayers to compete on user experience, token inventory, fees, regulatory strategy, brand equity, product ecosystem, and liquidity. Compared to most relayers we are unique in that we’ve invested heavily in educational resources on Radar itself and, more importantly, the ecosystem as a whole. We believe education is critical to bringing people to the 0x ecosystem as well as into the token economy.

What are the challenges you face as one of the pioneers in the decentralized industry?

Relayers like us are defining this category as we create it. It’s a big responsibility and we want to do it right. One of the challenges of category creation is finding regulatory clarity. We hate regulatory arbitrage, it’s naive. We’re working side by side with our attorneys and with regulators to ensure we are role models for regulatory accountability. This takes time and is a challenge, but it’s one we are excited to take on!

Tell us about your team and what makes you special.

What started as a small group of guys working in a basement in Colorado has turned into a team of almost 30 people working around the world. We have different backgrounds and experiences, but we’re united in our goal to onboard the world to the token economy. As a team focused on building a multigenerational enduring company, our values of accountability, vision, and impact are hardwired into everything we do.

What are your challenges in acquiring, educating and retaining customers?

The flipside of category creation is stewardship and education. To be a citizen in the token economy or to use Radar Relay new mental models are needed and technical hurdles need to be overcome. For example, some new users struggle understanding the difference between having an account on a centralized exchange and having a wallet where they control their private keys and tokens. Once we can get a user to trade, our value proposition clicks, and they become a relayer evangelist!

Do you plan to bring additional products to the market?

To execute on our mission of onboarding the world to the token economy we’ll need multiple products for different customer archetypes and use cases. Since launching Radar Relay in October we’ve been average 500%+ monthly volume growth, but we’re just getting started! Our product roadmap includes different types of user interfaces, user tools, and supporting other token categories like collectibles and securities.

How do you plan to offer liquidity?

The majority of volume on trading venues comes from automated traders who are typically financial engineers trading programmatically. These automated traders find Radar Relay because they are frustrated and scared to trade on centralized exchanges because of all the hacks and lost funds. We’ve just released our updated API and SDK, hired a business development team, and are excited to grow our network of liquidity partners!

Have you guys closed any rounds of funding?

Yes, we raised $3m from an amazing group of investors in the winter of 2017. We optimized for mission alignment, conviction on the space, and ability to move mountains for us. You can read more about the raise here: https://medium.com/radarrelay/radar-relay-fundraising-9873d52a5de5

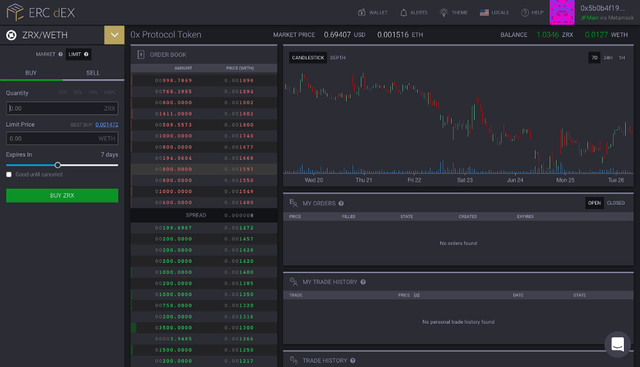

ERC dEX

ERC dEX has a simple UI, like most decentralised exchanges it has no signup. You can start trading with a few clicks. Unlike Radar Relay you have to buy ZRX tokens to start trading. In the upcoming version of their product traders who make market order doesn’t need to hold ZRX at all.

You have to select the token pairs, specify the amount you want to buy/sell to create your order. You can specify a time limit to your order after which the order expires. It provides with candlesticks, order book, etc like most exchanges.

ERC dEX has a strict verification process to list tokens, this measure will protect traders to a certain extent. They also have taken certain measures and initiatives to promote high liquidity. However, our order on ERC dEX took a few days to fill.

They have built a trading toolkit called Aqueduct, it provides APIs developers can use to automate trading. They also have a flexible program that incentivizes partners who can promise them liquidity.

They also have a market-maker program which traders with no coding experience can use to automate trading and backtest strategies. When compared to other decentralized exchanges, ERC dEX has put in more efforts to ensure liquidity.

ERC dEX is built by a strong team with great industry experience. The CEO, David Aktary has worked with companies like IBM, JP Morgan, etc. The CTO, Luke Autry was part of Sharefile which was later acquired by Citrix. We noticed one more thing, all the c-level employees in the team are coders and have maintained a decent Github profile.

I had a chance to interview the CEO of ERC dEX, David Aktary.

How do you plan to stand out with respect to other relayers in the market?

We are making the global shared liquidity concept a reality with our Aqueduct network. This network incentivizes everyone in the ecosystem to share liquidity as far and wide as possible. No other relayer has this.We also will be a compliant trading venue for tokenized securities I don’t think any other relayers are doing this either.

What are the challenges you face as one of the pioneers in the decentralized industry?

Anyone that doesn’t answer this question with “liquidity” is wrong. Liquidity is the biggest problem with all decentralized exchange. We’re tackling it and making good progress, but it’ll take time.

Tell us about your team and what makes you special?

We’re unique in the 0x relayer space in that our team not only comes from a software engineering background, but we also have deep finance and business experience and connections. This helps us in many ways.

What are your challenges in acquiring, educating and retaining customers?

We have a couple of challenges here.

Liquidity begets liquidity — users will go wherever that liquidity is, so we have a bit of a starting problem. As I said before, we’re solving that, but it takes time.

We’re US-based, dealing in a business where the regulations may be a bit unclear. We’re doing everything we can to be as compliant as possible, but doing so may mean sacrificing taking an action that would otherwise bring us a large infusion of users. This is a sacrifice we’re willing to make to realize our long-term goals.

Do you plan to bring additional products to the market?

Absolutely. We currently have 3 products in the market: our ERC dEX relayer for token spot trading, our Aqueduct liquidity network, and our Market Maker Automation Toolkit. We know we’re going to be adding compliant security token spot trading, but we may also add products using other protocols. Some we’ve been seriously considering include dY/dX, b0x, and others.

How do you plan to offer liquidity?

We have over 80 members in our liquidity network, including large market makers like Hehmeyer Trading and other relayers like Bamboo Relay, Shark Relay, and Amadeus Relay.We are the only relayer that collects fees and uses those fees to incentivize liquidity providers. We do this through our Market Maker programs. We have two levels to this program, our institutional program and our Designated Market Maker program, which is intended to democratize the market making process. I recently published a blog on this and the benefits of signing up, with as little as $100 committed. We’ve had nearly 60 people sign up in the few days after that blog was published.

Have you guys closed any rounds of funding?

We have mostly bootstrapped to date, but are now about halfway through a seed round. Interested investors should reach out to [email protected].

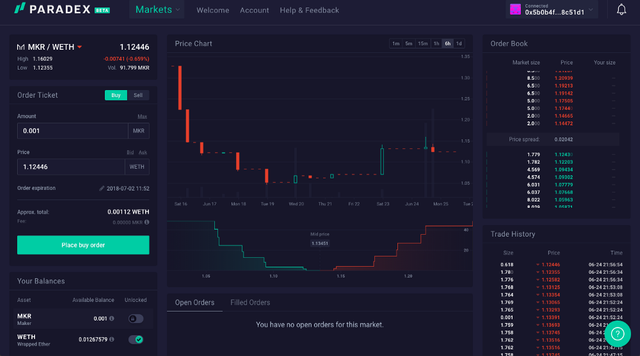

Paradex

Paradex offers a decent trading experience. You can begin by connecting your wallet. You need to select the token pair by click on the market button on the top bar. They have a limited number of tokens to trade.

Once you have selected the token at the price you want to buy/sell you can place the order by authorizing the Metamask wallet.

Paradex offers a decent trading experience. You can begin by connecting your wallet. You need to select the token pair by click on the market button on the top bar. They have a limited number of tokens to trade.

Once you have selected the token at the price you want to buy/sell you can place the order by authorizing the Metamask wallet.

Your order will be visible on the open order book until its filled. Our order on Paradex took almost two hours to fill.

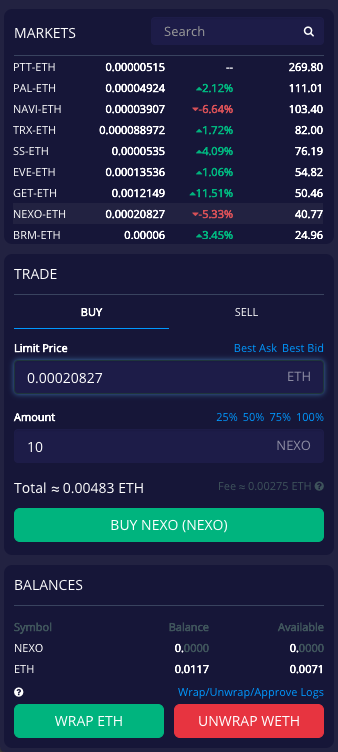

DDEX

Trading in DDEX is similar to trading with Radar Relay. Connect the MetaMask wallet, wrap ether and make an order. Once you make an order, it will be listed in the open order section. DDEX doesn’t provide time-limited orders like Radar Relay.

DDEX uses Hydro protocol as a network layer, that promises faster transactions and high liquidity. They also provide APIs to automate trading. Our order on DDEX took two to three hours to fill.

I also reached out to the DDEX team, they responded to my queries.

How do you plan to stand out with respect to other relayers in the market?

1. Execution, Hydro Protocol is one of a few shared liquidity protocol which has product live build on top of Ethereum main net and 0x Protocol.

2. Geographical location, DDEX is the only 0x Relayer in the Asia Pacific Region.

3. Mobile first, DDEX native app Beta is testing on both iOS and Android. Since crypto is 24/7, DEX with native wallet build in-app will have a better user experience than PC version DEX.

What are the challenges you face as one of the pioneers in the decentralized industry?

Limited Ethereum wallet users compare to other Million DAU app

Tell us about your team and what makes you special.

Hydro Protocol team is based in both Beijing and Seattle. Team members are from Microsoft, Palantir, Baidu, Google, Facebook, Bank of Americ, Alibaba, Classbox, Zhenfund. Talent from both tech world and financial service market.

The geographical location makes the team special. Since exchange is a segmented marker caused by culture barrier and regulation barrier.

What are your challenges in acquiring, educating and retaining customers?

The general adoption of DEX is really low. We need time to educate the market and create niche market compared to centralized exchange.

Do you plan to bring additional products to the market?

The mobile DDEX app will be the first DEX in the world to have its own wallet + DEX in one install.

How do you plan to offer liquidity

Our API document is easy to read and implement. Also, we work with several market making firm across the globe and have an in-house quant group.

Have you guys closed any rounds of funding?

Hydro Protocol raised a private sale round in Jan 2018 with 30 institutional investors participated in the round, including FBG, Inblockchain, Zhenfund, Danhua Capital, Garry Tan, Alexis Ohaninan, Nirvana Capital, Draper Dragon

Conclusion

It’s the early days of relayers, it is too early to conclude on the winner. As of now, Radar Relay offers a great trading experience. Liquidity is a common challenge every relayer face. Though dEX’s have taken measures to gain high liquidity, it would take time to see results.

This story is part of our “Deep Dive Into ERC20 Ecosystem” Series. The third part of the story will be published soon. In the next story, we will be explaining the future potential of 0x.

Votes Please 👏 , Thank You 😊.

We are also taking an initiative to bring people working in the crypto space closer. If you are a developer, designer, marketer, writer, trader, entrepreneur, etc in the crypto-space please fill this form. We will curate the list and share it with you, that can help you build your network.

Congratulations @febin! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!