Equitybase ICO - Securities Token Platform Ecosystem on the blockchain

5W1H concept

The Five W´s (sometimes referred to as Five Ws and How, 5W1H, or Six Ws) are questions whose answers are considered basic in information gathering or problem solving. I, therefore, choose to use this concept to explain the idea of upcoming ICO projects for your better understanding. Today, I'll introduce to you equitybase.

Disclaimer: The information on this article is for educational purposes only and is not investment advice. Please do your own research before making any investment decisions. I make no representations, warranties, or assurances as to the accuracy, currency or completeness of the content contained in this article or any sites linked to or from this article.

What is it?

Equitybase is a decentralized end-to-end platform built on Ethereum blockchain aiming at the real estate industry which allows investors to obtain the liquidity of a stock and, at the same time, the earnings of a private equity investment. It has an ecosystem for project assessment, credit valuation, liquidity event entirely on the blockchain. Moreover, equitybase allows fund managers to offer asset-backed investment opportunity directly to investors worldwide since there is no single central party to restrict the accessibility.

Why is it there?

Equitybase was born with a mission to solve the current investment model’s inefficiencies. Since it's a hybrid of the liquidity of a stock and earnings of a private equity investment, equitybase will address the problems in both fields:

Problem of the Private Equity Market:

Low Liquidity: Equity investments has long lock-in period ranging from 3-10 years, meaning your investments are dead money in that time since you can not easily convert them into cash even in emergency cases in the period.

Barrier of Entry. Commercial investment requires a huge amount to start, which mean ordinary salaryman would have zero chance to step in this market with his income.

Cost of Credit. Interest rate would varies by region and developers equity would be substantial

High Management Fees. Private equity management fees ranging from 2-4% per year

Problem of the Stock Market:

Low Return Rate. Stock market over the past 10 years has average of 7% return per year. In another report done by the Standard & Poor’s 500 index, from 2013-2017, stocks return about 10% annually, which is also not really high.

Funding Accessibility. Developers would be only be able to obtain funding domestically

How will it solve those problems?

As mentioned, the Equitybase Hybrid Market Investments Platform would offer an ecosystem with lots of features to solve those problems:

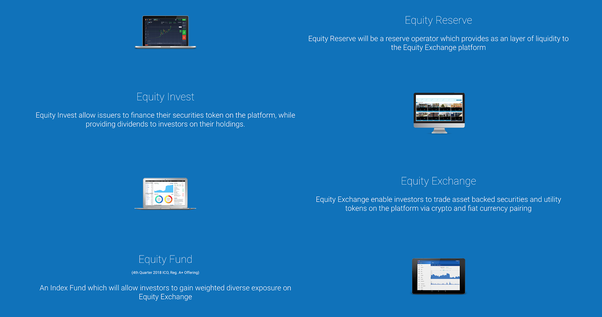

Equity Reserve. Equity Reserve will enact as a secondary reserve operator which provides an additional layer of liquidity to the Equity Exchange platform, it will be utilize as a reserve pool to continuous enable platform users to liquidate their holdings with guarantee buyback on the exchange.

Equity Invest. On Equity Invest, you can buy equity in companies that are raising up to $50M. For some offerings, investment limits apply depending on your income and net worth. You can sell securities on Equity Exchange immediately after the offering has ended. Investors would be able to track all project's financial figures such as earnings, payment history, withdraw dividends & gains and even project credit rating.

Equity Exchange. Equity Exchange enable investors to trade asset backed securities and utility tokens on the platform via crypto and fiat currency pairing.

And in the upcoming time, specifically in Q4 of 2018, they would introduce the Equity Fund - An Index Fund which will allow investors to gain weighted diverse exposure on Equity Exchange.

With those above, they provide investors and fund managers with a solution that is:

Worldwide Access. Developers around the world can promote their projects on the Equity Invest platform and raise sufficient capital with ease

Zero Fees Investment. BASE token holder will be able to utilize the platform without incurring any fees while obtaining dividends on Equity Fund

Dividends and Target Return. Commercial Real Estate Investment offer one of the highest return and dividends base on any asset class around the world.

No Minimum Investment. Investors can invest any amount of their choosing without minimum investment restriction

Credit Rating System. Investors can track performances and track record of developer

Liquid Investment. The Equity Exchange Platform offer the flexibility for investors to liquidate their asset holdings on any investment

By the fall of 2018, IOS and Android apps will be available to their platform users as well, with the full functionality of their website securely on mobile devices.

Who're behind the project?

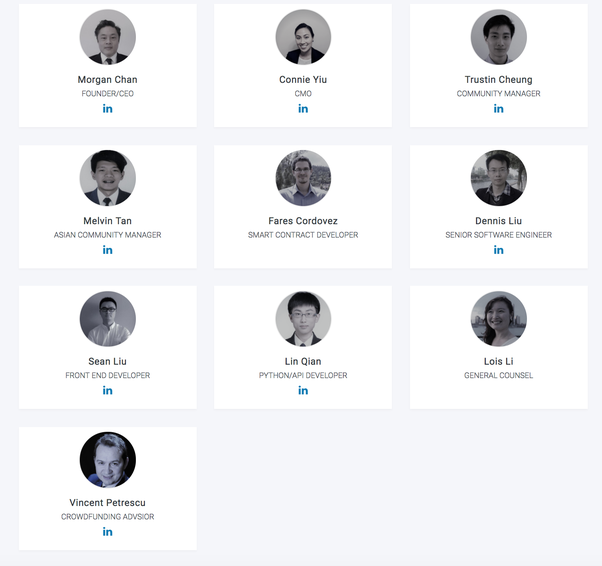

Team:

Equitybase consists a combination of a great team of experts and professionals and advisors, led by Morgan M. Chan as the CEO and the co-founder.

Advisors

Where do they aim at deploying the project

Investment Location: their main investment objectives are focus on super cities such as New York, Los Angeles and expand to other markets such as Hong Kong and London in near future. Each of these markets is benefiting from the following positive trends:

Consistent Growth Rate

Stabilize Value

High Demand

Minimum downside risk

Ease of capital events

Los Angeles & New York

London & Hong Kong

When does it happen + Token info

Token Symbol:BASE

ICO time: LIVE NOW 28/02/2018 - 22/05/2018 with initial discount of 30%, discount rate will be lower in increments of 5% weekly over the duration of the ICO sale.

Country of Origin: Hong Kong

Total Token Supply:360,000,000 BASE

Hard Cap:$50.4 Million

Token Price:$0.28

Minimum Purchase:None

Accepting:Ethereum (For Wire Transfer, Bitcoin, Litecoin and DASH, please contact them [email protected]

ERC20 Token:Yes

Individual Cap:None

Countries Allowed: Equitybase does not exclude persons from any nations from participating in their ICO. All participants are encouraged to check their respective country/region ICO regulation.

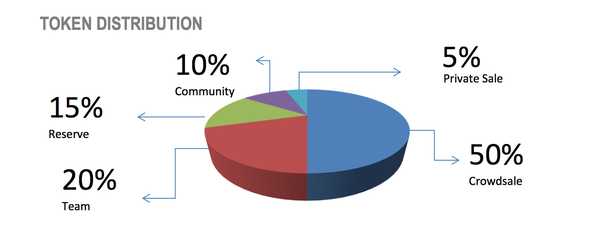

Token allocation:

180MM (50%) of BASE to be distributed in BASE token sale.

72MM (20%) of BASE to be locked in a multi-sig wallet and held by Equitybase for long term expenditures and network updates.

48MM (15%) of BASE will be utilize for reserve

36MM (10%) of BASE to be distributed for bounties and to the Base community including advisors, partners building on the equitybase platform.

18MM (5%) of BASE to be offer for private pre-sale

Proceeds Distribution

60%: Equity Reserve

40%: Operation includes platform development, legal, sales/marketing and administrative

For more information about Equitybase visit their whitepaper or website Equitybase.

Social media:

Twitter: Equitybase (@equitybaseCo) | Twitter

FB: equitybase

Telegram: Equitybase

Medium: Equitybase – Medium

Author’s info:

Bitcointalk username: dadumtuss123

Bitcointalk profile link: https://bitcointalk.org/index.ph...

Telegram username: @quanghuy96