The Ultimate Guide to REX Participation on EOS: The What, Why, How, and Where for the Average EOS Token-Holder. Buy & Sell REX in 3 Easy Steps.

If you want to get right to purchasing REX tokens and skip the information then scroll down to "Where Can I Use REX?".

When REX?

The final step to deploy REX is likely to be proposed as early as 29 April 2019 and approved within the week. This guide will tell you all you need to know to participate in REX safely and smartly.

What is REX?

REX is short for "Resource Exchange" and is a novel creation first officially proposed by Block.One on August 8, 2018. It is a marketplace created within the EOS blockchain that allows for the risk-free leasing of network resources (CPU & Network)

Why Do We Want REX?

REX was originally proposed at a time when EOS was experiencing a high degree of congestion which affected the ability for the average user to transact successfully on-chain. Just as important, large decentralized applications (dApps) were voicing concerns over the rising cost and increasing scarcity of resources required to run their dApp.

At network launch, all tokens were staked and around 46% of these tokens remain staked today. When one stakes their tokens one essentially lays a claim to a percentage of network resources whether a user uses those resources or not. EOS rate-limiting algorithms, which govern resource allocation, take this into account. When a user is staking but not using resources it essentially becomes an inefficient allocation of these scarce resources. In short, fewer resources for developers to access and at a higher cost. REX introduces a leasing market to allow for token-holders to stake their tokens for the same reasons they did before (e.g. security, voting), but relinquish their claim on resources out to those that need it (i.e. dApp devs). This creates a free-market to more efficiently allocate on-chain resources.

Why should token-holders care? Because REX will pay token-holders to care.

How Rex Works

As REX is a resource exchange system, it shares similarities with the Chintai platform. Specifically, the ability to borrow resources or lend available ones and receive a return. Contrary to Chintai, REX only allows 30 day loan terms but benefits from the ability to keep a user's votes and retain full custody of their EOS. REX returns are based on the demand for network resources, that can be supplemented by fees from name bids and ram trading.

The rex system introduces the REX token, a non-transferrable, non-tradable token which represents a claim to economic activity within the REX pool, essentially it is an internal accounting unit.

Users can acquire REX by lending their resources. This can be from their liquid EOS balance, or directly from their staked resources, so don't worry about unstaking prior to REX launch.

To curb market manipulation, purchased REX will be held in maturity buckets that cannot be sold until matured. These buckets mature at midnight (UTC time) 4 days after being bought. So if one buys REX on Monday 2pm UTC, they will mature on Friday at midnight UTC (~4.42 days). REX bought on the next day will go into a new bucket, allowing up to 4 buckets that mature on different days. A user can also consolidate different buckets into a new bucket that will start a new 4 day maturation process from the point of consolidation.

After REX is matured (~4days), it can be sold immediately, unless there is a liquidity crunch, i.e. not enough EOS tokens in the REX pool to cover the sale. As the REX value, relative to EOS, is likely to go up, a user is very unlikely to receive less EOS than they initially exchanged. Therefore, REX tokens can be retained to continuously accrue value as a result of the economic activity within the REX pool.

Once REX matures it is as liquid as unstaked EOS. A compromised active key could allow a malicious user to sell all one's REX and move the EOS tokens immediately. To address that, a savings feature into REX. Essentially, savings is a bucket that effectively never matures. One can move their maturing or matured REX into the savings bucket at any time. If ever removed, a minimum delay of the point of removal to midnight UTC that day + 4 days will be needed for the maturation process. This will allow some time for a user to use the owner keys to override any compromised keys and move the REX tokens back into savings.

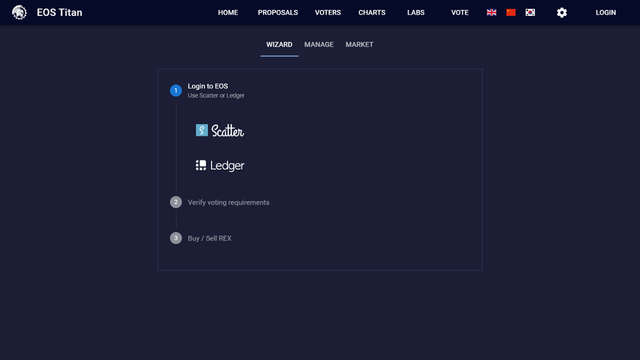

REX Participation Requirements & rexcoreproxy

To be eligible to buy REX, a user must be voting for at least 21 block producers or delegating their vote to a proxy. Users can quickly delegate that responsibility to rexcoreproxy; A proxy run by EOS New York and EOS Titan, two block producers that have been actively involved in EOS since before launch. For more information on rexcoreproxy visit the proxy portal here.

REX Pricing

The price of REX is affected by the demand of the resources and any additional system fees funneled to REX.

REX price = (Total Lent + Total Unlent) / Total REX

Users or dApps can borrow resources using the rex system. Fees paid for loans drive up the REX price as they go into the Total Unlent. The borrower only submits the payment and type of resource to the smart contract and receives delegated resources.

One can determine the exact payment required, to receive the desired amount of delegated resources using the following equation which is derived from Analysis of Bancor Equations Supporting REX

Loan Cost = Total Rent * Loan Amount / (Total Unlent --- Loan Amount)

Example of REX Price:

- Assume there is 100 EOS in REX pool and 100 REX tokens, then REX Price (0+100)/100 = 1 EOS

- A developer takes out a loan of 100 EOS worth of resources and pays a fee of 5 EOS tokens.

- Total lent will increase by 100, total unlent will decrease 100 plus the 5 EOS fee.

- New REX price is (100+5)/100 = 1.05 EOS

REX Strategy

There is a very low probability to receive less EOS upon selling REX tokens than the amount of EOS a user started with. So, the strategy is simple, the earlier a user stakes to REX the better. Remember, once a user has purchased REX tokens they will want to move all of their REX to their "REX savings" which is the same as staking EOS tokens for the sake of security (if the goal is long-term holding)

For a detailed list of REX Implementation actions and explanations, visit the EOSIO contracts github here.

Where Can I Buy & Sell REX?

We have reviewed nearly half a dozen REX interfaces and are happy to present our recommendations for the easiest and most intuitive of the bunch.

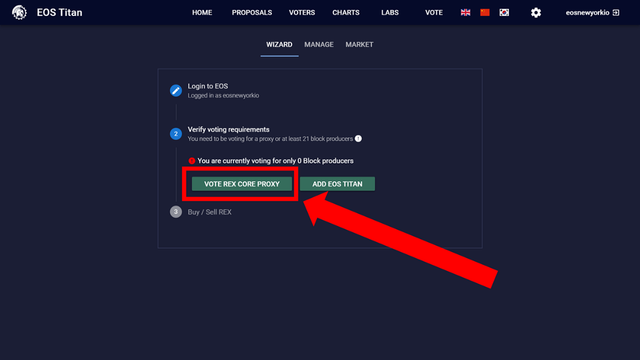

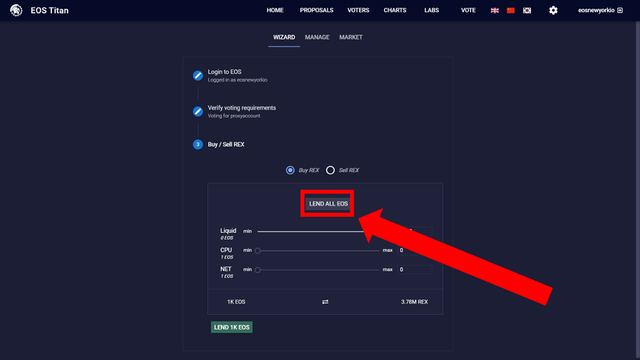

RECOMMENDED: EOS Titan REX in 3 Steps

Link Here: https://eostitan.com/rex

EOS Titan has created an intuitive and simple user interface for REX which will take less than 2 minutes to use and in only 3 easy steps. It leverages the Transit API to enable direct login using Scatter or Ledger on the desktop or through one's favourite mobile wallet. Visit [https://eostitan.com/rex].

Step 1: Login with the preferred method

Step 2: Confirm vote for proxy. We recommend rexcoreproxy managed by both EOS New York and EOS Titan. REX Core Proxy is focused on supporting all REX UI builders within EOS as well as general UI builders. To see the list of BPs the proxy is voting for, please visit here.

Step 3: Buy/Sell REX. Lend all EOS or the desired amount.

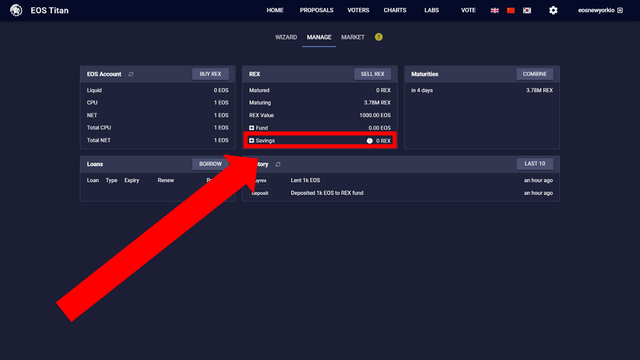

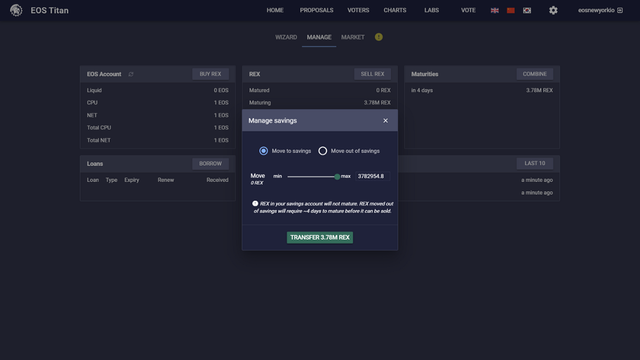

Moving to Savings: From here, users will want to move REX tokens they purchased into savings if they are not planning on selling at the end of the ~4 day maturation period. Click on the Manage tab and click on Savings in the *REX *table which is outlined below:

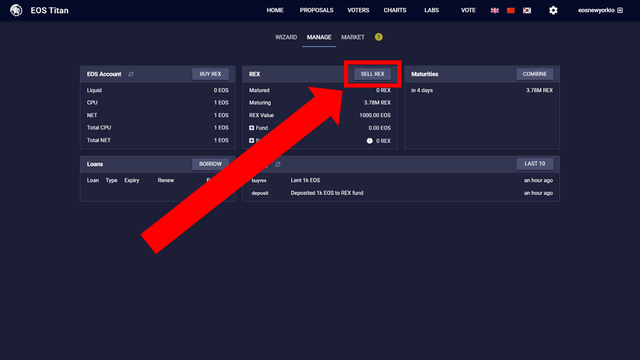

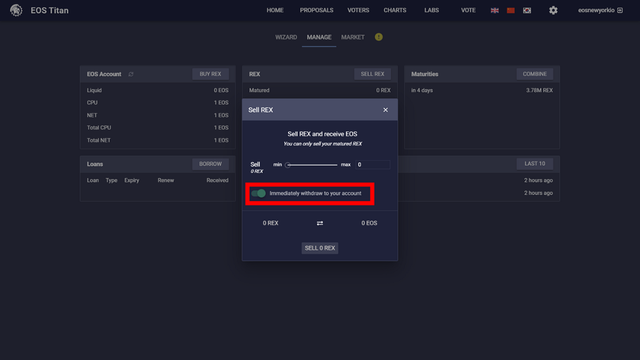

Selling REX (Once matured)

Once a user's REX has matured they are eligible to be sold. It's very easy to do this.

Step 1: Click Sell REX in the REX table

Step 2: Make sure the toggle for immediate withdrawal is checked and click Sell [Number] REX. This action sells REX tokens and moves the EOS from a user's *Fund *into their liquid EOS account balance. Done!

On the Manage tab users can:

- Buy/Sell REX

- View REX Maturities Status (Matures Fully In ~4 Days)

- Start New Loan/ Borrow EOS

- View Trading Charts/ Account balances

- Automate Loan Renewal

- Fund REX Savings

- View Action History

NOTE: Matured REX can show "0" when there may be maturities showing they expired days ago. This is because tables are only updated on next action in the smart contract. Performing a simple action such as depositing REX into savings will update all tables and correct any inaccuracies. (EOS Titan REX interface auto calculates the correct matured, maturing and savings, regardless of chain state. An update is bundled in a transaction if required.)

Other recommended REX interfaces

Most of all other REX user interfaces have the functionality available that the average token-holder would need. Once you understand the steps above, a user should be able to use every UI listed below.

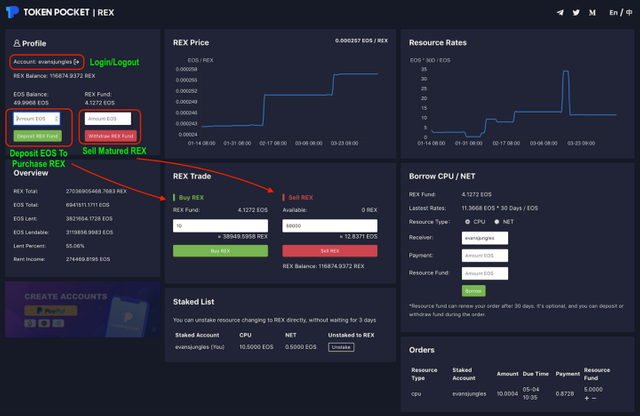

TokenPocket (Mobile & Desktop)

Link Here: https://rex.tokenpocket.pro/#/

TokenPocket is a leading mobile wallet across the world which comes highly recommended. TokenPocket also has a desktop interface which has integrated Transit API for easy login and is featured below. To access the mobile version, download their app from links on their website.

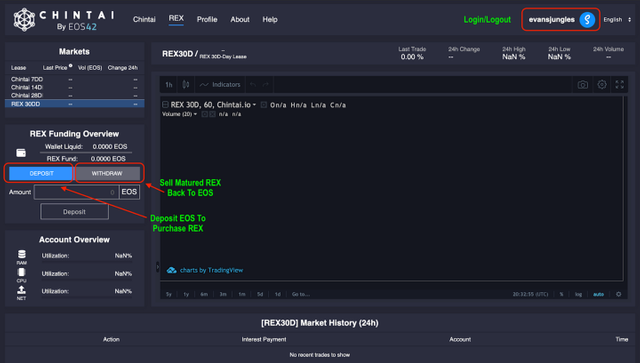

Chintai

Chintai Team, is to token leasing and resource leasing as Bancor is to token exchange and liquidity. Chintai's development is lead by EOS42.

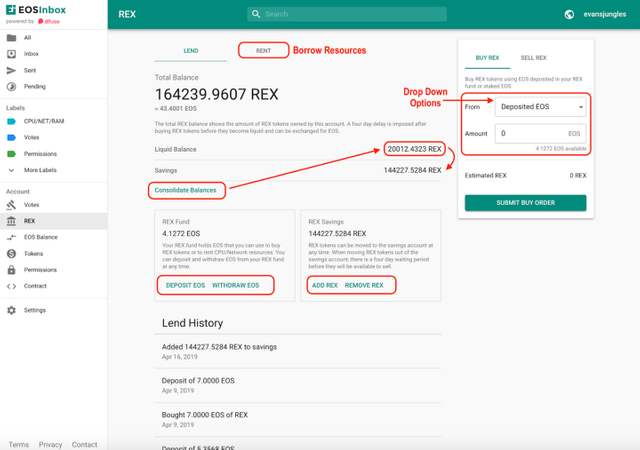

EOS Inbox

Link Here: https://eosinbox.io/

EOS Inbox takes a novel approach to the block explorer, designing it similarly to how one's e-mail interface looks.

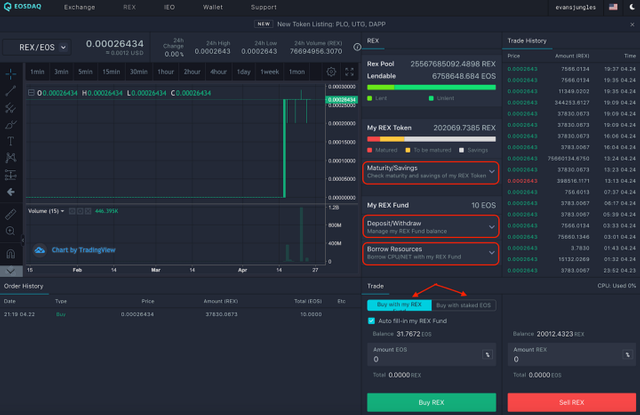

EOSDAQ

Link Here: https://eosdaq.com

EOSDAQ runs a decentralized exchange on EOS so their REX interface will look and feel quite similar to that.

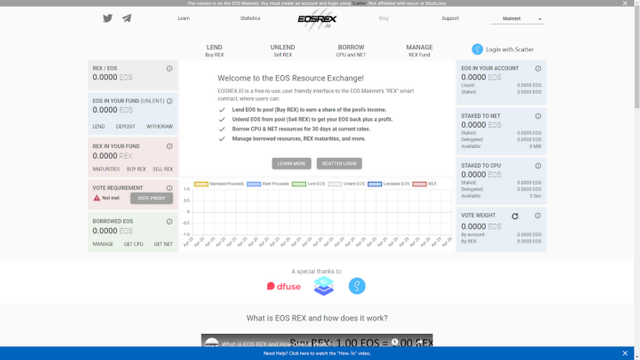

EOSREX.io

Link Here: https://eosrex.io/

EOSREX.IO has built a dedicated website to host their interface. It was built by EOS Lab and EOS Socal, the BP candidate.

REX will undoubtedly be a powerful tool which the EOS community can adopt to help lower the cost of development, increase token holder voting participation, and reward EOS token holders for their resource contribution. Stay tuned for our in-depth guide on interfacing with REX as a developer! Thank you to EOS Titan for contributing to this article.

EOS New York is a Top 21 Block Producer on the EOS Blockchain

Website | Twitter | Medium | STEEM | Meetup | Telegram | Weibo | Bihu

About 150.34$ has been spent to promote this content using Steemium

I look forward to it. I remember when I couldn't transact at all in EOS cuz of the CPU issues.

good

I just resteemed your post!

Why? @eosbpnews aggregates updates of active EOS BPs and conveniently serves them in one place!

This service is provided by @eosoceania. If you think we are doing useful work, consider supporting us with a vote :)

For any inquiries/issues please reach out on Telegram or Discord.

EOS is so complicated.

damn complicated

Congratulations @eosnewyork! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

https://steemit.com/life/@life-guide/sticking-to-these-things-will-help-you-get-out-of-the-bottom-of-your-life-and-become-strong

(Respected senior Steemians please do comment on it even if you are not going to upvote because I need your valuebale feedback)

How much eos need to stake for playing games? Thx

is this a game?

Follow back

Posted using Partiko Messaging