[Weekly Analysis]Capital is moving to main cryptocurrency, especially Bitcoin, to drive the price above $7,000.

Hi, MICA focuses on ICO advisory and cryptomarket research. We are devoted to delivering the best quality research reports to our readers. If you have any question or suggestion, please leave a comment below. We will be glad to offer our help!

1. The market is bear, but price variation decreases.

The performance of the cryptocurrency market is not positive in June, but the price variations are decreasing. According to 30 cc index, the weighted average price index consisting of the top 30 market capitalization, dropped from 7,500 to 5, 284, a roughly 29.5% decrease. A few events occurred in June and caused structural changes to the market, including Mt. GOX’s BTC and BCH transfer, EOS main net launch delay, EOS account frozen controversy, EOS crowd-sale account ETH liquidation and Bancor’s wallet hacked. A series of bad news makes the bear market worse in June.

In terms of trading volumes, MICA observes a huge amount of irregular trading volume in the market because of the innovative “Trading is mining pattern” launched by F COIN exchanges. This innovation was copied by other exchanges accordingly and it attracts many investors to transfer their crypto assets to trade for tokens. Though Coinmarketcap.com revised their statistical methods to exclude those exchanges with no transaction fees, the measure of price and volume analysis has been distorted. Overall, the inactive trading and low-price variation indicate we are currently in the range-bound market.

MICA found small cap cryptocurrencies outperform those big ones. In our experience, speculative capital would tend to move to small cap cryptocurrencies for higher returns. However, the decision to follow these capitals is risky because the bubbles don’t stand long at the most time. Aggressive investment strategies are highly unrecommended. The following is the event analysis for June and July:

A. June 4, BTC and BCH have been transferred from Mt. GOX Wallet address, triggering the bear market.

The liquidation of those Bitcoins owned by Mt. GOX exchanges poses a threat to the market. The trustee needs to sell the bitcoins and get fiat for the repayment of the debts. The trustee began with 170,000 BTC at very low cost and currently is possessing around 130,000 BTC and BCH. Each time he liquidates the bitcoins, the market would have dropped severely due to trustee’s 400M sell. Fortunately, the Tokyo District Court has ordered Mt GOX to begin compensating victims of its infamous 2014 hack, effectively stalling the exchange ‘spending bankruptcy. It means it will take a long time for Mt. GOX to proceed with the compensation. A period of peacetime can be expected in the market.

B. June 9, The delay of EOS Main Net Activation

EOS Main Net was supposed to launch on June 1. However, EOS Main Net was delayed to June 7 due to the high voting threshold, which requires more than 15% of the total token holders to vote the block producers. What makes it even worse is that the official website only released a command line interface for users. Though many community members made Graphic User Interface, some dishonest people tried to deceive users to give their private keys away by faking the voting interface.

C. July 2, EOS team transferred ETH from their crowd sale accounts and the market dropped accordingly.

After the launch of EOS Main Net, the transfer of ETH from EOS owner wallets continued and speeded up since July 2. Until July 11, there are only 3,837 ETH left in their accounts, which is not significant to the market.

D. July 9, Bancor’s wallet was compromised, causing the loss up to 23.5 million USD.

According to Bancor’s Twitter, one of the accounts for smart contract upgrade was compromised by the hackers. Around 24,984 ETH(~$ 12.5M), 230,000,000 NPXS(~$1M) and 3,200,000 BNT(~$10M) were stolen. The details of their security issue are still under investigation. It’s only Bancor’s wallet compromised instead of their decentralized exchanges. Bancor’s Twitter stated all users’ wallets are safe.

2. Performance ranking: Altcoins become speculative capital’s targets

Due to the bear market, speculative capital began to balloon those tokens with small market capitalization for higher returns. Therefore, we can observe the prices of certain cryptocurrencies rocketed, ranging from 40.78% to 227.88%.

3. Further analysis: Coins for June, F COIN & EOS

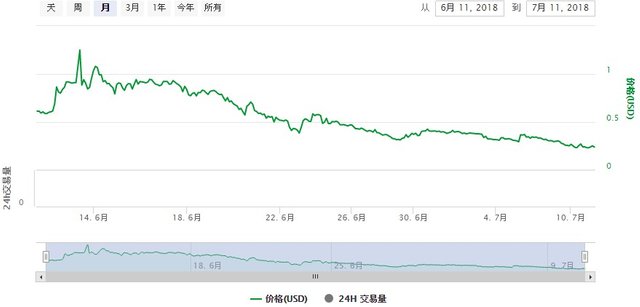

1. F COIN TOKEN

The F Coin exchange founded by former Huobi CTO Zhang Jian launched its innovative “trading is mining” mechanism, featuring 100% transaction fees back. Investors trade to get tokens distributed by F Coin team at zero cost and sell the tokens to get cash back. This type of mechanism required the exchanges to attract new investors. If so, the more new investors they bring, the more profits they can get. This model is very successful and popular. Many other exchanges also copy this model for wash trade to manipulate their own trading volumes.

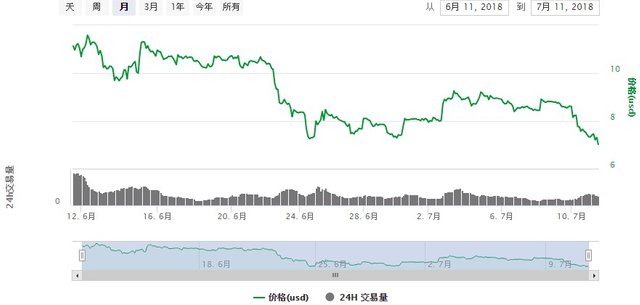

2. EOS Main Net Launch

EOS which totally raised 40B in its ICO is the most controversial currency in June. EOS Main Net was supposed to launch on June 1. However, EOS Main Net was delayed to June 7 due to the high voting threshold, which requires more than 15% of the total token holders to vote the block producers. What makes it even worse is that the official website only released a command line interface for users. Though many community members made Graphic User Interface, some dishonest people tried to deceive users to give their private keys away by faking the voting interface. After the activation of the Main Net, the network was suspended and freezes 7 accounts in violation of its own constitution and potential security issues. These problems trigger the market concerns toward the reliability of EOS and the price dropped accordingly.

On July 1, RAM in the EOS network cost about 0.11 EOS per kilobyte, a price around which the resource had long hovered. Then, over the course of two days, the price shot up in a nine-fold increase. Most have concluded that RAM is being bought up as a speculative scheme. If instead of being bought for its utility, RAM has become a commodity that is bought and sold for profit, it potentially won’t be available as a resource to develop DApp. Additionally, the price could be driven so high that EOS simply becomes too expensive to use. The founder of EOS, Daniel Larimer only claimed a three-step plan to solve this problem by increasing the supply instead of re-designing the mechanism. In June, the price of EOS plummeted from 15 USD to 8 USD. So far, we haven’t seen any real action taken by EOS teams.

4. Cryptocurrency Market Perspective

The trading volume in July was slightly low (excluding irregular trading activities), but pricing fluctuations of the big coins were slowly coming to stability. Altcoins took over the market and performed rather well in the past week. Price of ETH hovered between $450 and $500 and BTC was within the range of $6,000 to $6,500, however, the incident of Bancor being hacked could further drive down the market as lots of ETH were sold quickly.

As Ethereum will continuously release update versions in 2H 2018, ETH will gradually resume its values on blockchain application, people will start purchasing ETH again according to Ethereum’s updates and the implementation progress of a variety of ICOs.

Cryptocurrency market has progressively cooled down since the surge in 2H 2017, also, ICO investors have refrained from making irrational investments but starting to evaluate the fundamentals of ICOs in different aspects such as potentiality, the probability of project implementation, partnership, etc. before making investment decisions. Cryptocurrency and ICO investors have evolved and learned their lessons, and this phenomenon will set higher standards for teams seeking to raise funds via running ICO campaigns. These are the things to bear in mind.