Time to short Ethereum?

We are at a historic moment in cryptocurrency history. EOS is a couple of days away from completing it’s year long ICO. The ICO has managed to raise a record-breaking $4 Billion in Ether. With Ethereum’s market cap currently being at about $57 Billion, this represents the dubbed “Ethereum Killer” holding about 7% in value of the total market cap. Just imagine all this was dumped on to the market.

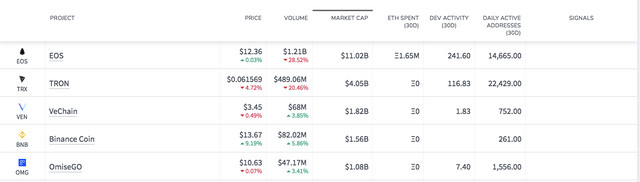

There has also been recent speculation that EOS has been selling large amounts of Ethereum on Bitfinex (1). Just approximately one week ago, Santiment, a data collecting & analysis site for cryptocurrencies, had shown that EOS had spent 1.1 million Ether. The definition of spent as per the site is that the Ether was transferred out of the wallet. This figure has hence increased to 1.65 million.

Generally, bitcoin & Ethereum move fairly closely in sync. When the market is moving upwards, Ethereum tends to slightly outperform bitcoin, & when the market is moving downward, Ethereum tends to slightly underperform Bitcoin. When a piece of significant news related to Ethereum gets released, it can have a big move in relation to bitcoin in either direction. Given that they tend to move sync, shorting Ethereum versus Bitcoin would be a potential way to position for if a large amount of Ether gets dumped on the market. Key risk would be some really positive news related to Ethereum hitting the headlines. EOS launch is scheduled for Saturday, June 2nd.

References:

(1) https://cointelegraph.com/news/ethereums-price-drop-possibly-due-to-large-eth-sell-off-by-eos-report-says

Important Disclaimer: This is not financial advice, entertainment purposes only

To give a bit more of context. Ethereum at its funding stage, raised 18 million, when the entire cryptocurrency market was 11 billion.

This amounts to 0.16% of the total market cap.

EOS raised 4 billion dollars, with the current market at 333 billion dollars, that gives makes it 1.2% of the total market cap.

This still makes EOS funding a magnitude larger than Ethereum, but not a completely unreasonable amount.

Ethereum conducted a crowdsale in Ethereum with 2,000 Ether being provided for one Bitcoin. When the crowdsale was completed, the amount of Bitcoin raised only represents a miniscule fraction of the Bitcoin market cap. EOS conducted it's ICO accepting Ether. At near the time of completion, the market of the generated funds represents around 7% of the total Ethereum market cap. It will be interesting to see what happens if/when EOS goes to sell this significant holding.