EOS-BTC Market Analysis - 14 June 2018

Friends and foes, welcome to this analysis of EOS-BTC.

I have analysed the daily chart of EOS with the best of my knowledge and i am posting the statistics here. Please note that i am learning TA and i am using this article as a log for my progress. This is not an investment advice. Invest your capital at your own risk.

So, without any further ado, let’s get started.

EOS has been moving into cycles (forming a symmetrical triangle) after a great crash from it’s new ATH of $23 which it created on 29 April 2018. Since the, it has been moving downwards with no significant move upwards. The outcome of this movement in the triangle can be either break upwards or break downwards. But at this moment, the break downwards looks more prominent.

I am using Heikin Ashi candles for this chart only just to show the trend. I am using Fibonacci Retracement tool to find Support and Resistance levels. Note that fibonacci is not set on actual values, they nearly set to the acutal value because i am not concerned with the actual targets, i am just concerned with the further trend.

This is the daily chart of EOS-BTC(Bitfinex):

The price has perfectly rebounded twice in the past, from 0.5 fibonacci level on 16 May and 24 May respectively. Now the price has moved back to the same support region since the last 2-3days. This is a critical level for EOS because if if doesn’t rebound from here, then it’s gonna fall further to 0.618 Fibonacci level, somewhere around 125k satoshi(0.00125000 BTC) which should act as a strong support then.

RSI + EMA

The EMA smoothed over RSI shows rising Bearish nature. Have a look at the chart below.

( I have learned this technique from @cryptomedication(One of the best.!).

WILLIAMS ALLIGATOR

The Williams alligator shows early signs of further downward movement.

Basically, The Alligator indicator uses three smoothed moving averages, set at five, eight, and 13 periods, which are all Fibonacci numbers. The initial smoothed average is calculated with a simple moving average (SMA), adding additional smoothed averages that slow down indicator turns.

Read the post below to know more : https://www.investopedia.com/articles/trading/072115/exploring-williams-alligator-indicator.asp

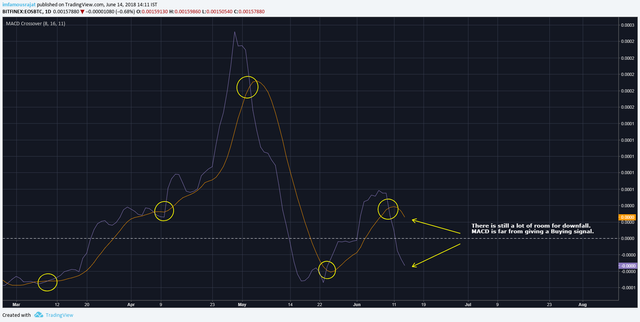

MACD

Moving average convergence divergence (MACD) is showing clear rising selling pressure with a lot of room for further downfall.

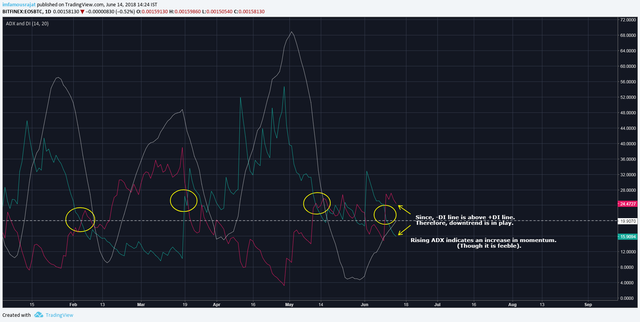

ADX AND DI

-DI just moved above +DI, few days back which shows bears are in control of power. Though the value of ADX is only 19.9(atm), but may rise(or maybe fall) anytime soon which supports the strentgh of down trend.

CONCLUSION:

I’ll leave it for you to decide. I am neither shorting nor longing at this moment, i am just sharing this for knowledge purposes only.

P.S: This is not an investment advice, and i am just learning. This is for my learning purpose only. Invest your capital at your own risk.

Those who wish to achieve greatness,

never seek for permissions.

They follow what their heart says,

and do what their mind states!

Good luck trading.!

Peace.

- The information contained in this article is for education purpose only and not financial advice. Do your own research before making any investment decisions.