EOSUnion BlockChain 101 | 11 Introduction to cryptocurrency Investment: Cryptocurrency Selection Guideline(Part 1) 区块链讲座第11期 区块链小白投资入门之【选币指南1】

Through the [Blockchain Lecture] 1-6, we walked into the world of blockchain and appreciated its fascination. Then we talked about the connection between blockchain and digital currency in class 7-10, so that everyone can understand the value of digital currency. I believe that many of you are eager to try and want to make some profits through digital currency investment.

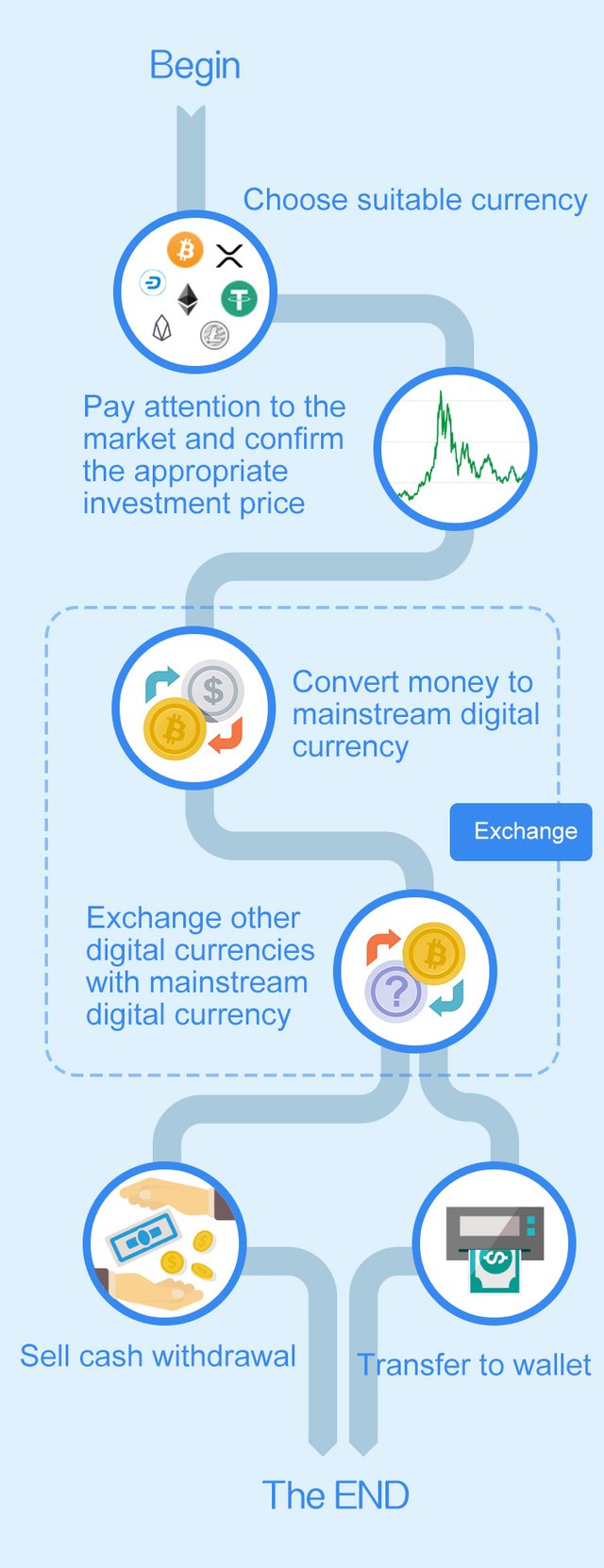

But I may have to remind you to be more careful about the investment, because you are still unclear about the last and the most crucial step, which is the digital currency investment process. This process, we can simply sum up as the following five steps (as shown on the picture below),i.e., [select currency] - [chooce a time] - [exchange digital currency with money] - [digital currency exchange] - [sell cash withdrawal / transfer to wallet]. So [blockchain lecture] will have several classes to discuss digital currency investment in detail, focusing on different topics like currency selection, market tools, exchanges, wallets, and today we will talk about currency selection first.

The selection of currency is the beginning of investment. As the saying goes, a good start is half the success. There is already a lot of digital currency for us to choose. But for new comers, we suggest not to look at it too much at once, but to give priority to mainstream digital currencies. So today we will briefly introduce the current main the TOP 10 digital currency, later we will introduce the other high-quality digital currency in the rankings.

NO.1 Bitcoin (BTC)

The concept of Bitcoin, originally proposed by Nakamoto in 2009, is an anonymized, global, decentralized encrypted digital currency.

The existence of these characteristics determines that law enforcement agencies can neither find the owner of Bitcoin nor blocking or freezing its bitcoin, making Bitcoin used by some black and gray industries as the first currency option, and the scale of these industries is huge.

At the same time, a large number of well-known venture capital companies, funds, and individuals have also entered the Bitcoin infrastructure with real money. Foreign countries include traditional financial giants such as Visa, Nasdaq, and Citigroup. Domestically, they include Kai-Fu Lee’s innovative factory and Xu Xiaoping’s. Real fund.

The entry of black and gray underground industry transactions and venture capital has become two strong support for Bitcoin. And with the development of Bitcoin, Bitcoin has received more recognition, so we don't have to worry about the risk of Bitcoin being worthless, because as long as the public's consensus on Bitcoin is still there, its value will not return to zero.

Bitcoin is actually the "gold" of the digital currency market. It is a conventional currency substitute and has a very large investment value in the long run.

NO.2 Ethereum (ETH)

Ethereum is an application development platform based on smart contracts and decentralized technology which enables developers to build and run decentralized applications. It can be used to program, decentralize, guarantee and trade anything: voting, domain names, financial exchanges, crowdfunding, corporate management, contracts and most agreements, intellectual property, and smart assets that benefit from hardware integration.

From the perspective of blockchain, Bitcoin is the representative product of Blockchain 1.0, then Ethereum can be said to be an upgraded version of the former, namely Blockchain 2.0, which applies blockchain technology to broader areas other than digital currency. The value of Ethereum may not be limited to a purely digital currency. The commercial profitability of smart contracts, Ethereum virtual machines and various decentralized applications (DAPP) on the chain has made the value of ETH have a rising space.

Its huge potential in commercial applications has attracted many industry giants to join the distributed application software development platform. For example, Microsoft, Samsung, IBM and other technology companies have adopted Ethereum technology for researching and developing blockchain projects.

Therefore, although Ethereum is currently inferior to Bitcoin in terms of network stability and market value, its application value in smart contracts cannot be underestimated. If you are optimistic about the future potential of Ethereum, you can choose to invest in this currency.

No.3 Ripple (XRP)

Like all bitcoin, Ripple (XRP) is a digital currency based on math and cryptography, but unlike Bitcoin, which has no real use,** XRP acts as a bridge currency in the Ripple system, acting as an intermediate product while exchanging between currencies.** Because in the Ripple system, it is difficult to transfer or withdraw funds across the gateway without converting them into Ripple (XRP); and Ripple coins can be freely circulated between any gateway.

What exactly is the "gateway" mentioned here?

The "gateway" is where the funds get in and out of the Ripple system. It acts like an intermediary through which people can inject or withdraw various currencies (whether national currency or bitcoin) into the Ripple system. In this case, even if two person are untrusted strangers to each other, as long as both of them trust the same gateway at the same time, the transfer between the two can be carried out. If the “gateway” is filled by a big bank or a large financial institution, then this chain of trust is easy to establish. Ripple can be used as an intermediary for cross-border settlement of assets that optimizes bank liquidity, and is used to solve the huge problems and challenges that plague international banks.

Therefore, the US, the UK, Japan and other countries have joined the Ripple network test, or have introduced it to cross-border payment operations. It is reported that more than 100 financial institutions are currently using Ripple's blockchain network.

From these perspectives, Ripple is likely to grow into a supernova coin that exceeds Bitcoin. (Yuan Fang, what do you think?)

NO.4 bit cash (BCH)

When Bitcoin was originally set, the block size was 32M. Considering the initial use of fewer people, in order to avoid waste of computing resources and ensure the safe operation of the Bitcoin system, Nakamoto will temporarily limit the block size to 1M. However, as bitcoin transactions increase, the transaction confirmation is unusually slow, and if you don't want to wait for a long time, you will have to pay a high transaction fee. In this case, the Bitcoin ABC program came up with a hard-forked system that launched Bitcoin Cash (BCH) based on the original bitcoin chain.

Therefore, BCH is actually a new competition coin that is branched out on the basis of the original BTC chain.

Compared with Bitcoin (BTC), the biggest feature of Bitcoin Cash (BCH) is to support large blocks. The size of the block determines the transaction capacity that can be processed. The BCH cancels the block size of 1M, which means that the transaction capacity of the BCH can be greatly increased, which perfectly solves the problem of bitcoin transaction congestion, and the transaction fee is also A large reduction has followed.

At the same time, the reduction in handling fees does not lead to a decrease in the income of miners, and the reduction in transaction fees can attract more people to participate. More transactions can make up for the decline in fees and can quickly expand the occupation of new markets. BCH will bring users a new experience with low transaction fees and fast confirmation.

NO.5 EOS

EOS can be understood as an Enterprise Operation System, a blockchain operating system designed for commercial distributed applications, designed to extend the performance of distributed applications.

Through a deeper understanding of EOS, EOS is quite valuable for investment.

First, it solves the problem of latency and data throughput through parallel chain and DPOS. EOS can process thousands of transactions per second, while bitcoin is about 7 per second and Ethereum is 30-40 per second. Therefore, trading in Bitcoin and Ethereum is very congested. If you want to be fast, you can only pay an expensive fee;

Secondly, developing DAPP on EOS is very simple. You don't need to write a lot of modules yourself, because EOS itself builds the underlying modules for developers, which provides a platform that greatly reduces the threshold for development;

Once again, as an ordinary investor, having EOS is equivalent to owning a property that can be used for rental (because EOS founder BM recently plans to launch an EOS resource leasing system) to earn money. As DAPP develops, with the increase in the number of users, the increase of EOS price will be unstoppable.

For an introduction to the digital currencies NO.6 - NO.10, please see the next class.

区块链小白投资入门之【选币指南】

我们通过【区块链讲座】1-6期带领大家走进区块链的世界,领略其迷人之处;紧接着在7-10期讲述区块链与数字货币的联系,让大家了解到数字货币的价值所在。相信看到这里的很多小伙伴都跃跃欲试,都想进入大热的数字货币投资中分一杯羹。

但我可能要给你们浇一盆冷水了,因为你们还有最后一步也是最关键的一步没有弄清楚,而这一步就是数字货币的投资流程。这一流程,我们可以简单归纳为【选币】-【选时】-【法币兑换数字货币】-【数字货币间的兑换】-【卖出提现/转出钱包】以下五个步骤(如下图),所以【区块链讲座】接下来将围绕选币、行情工具、交易所、钱包分几期给大家做足功课,而今天这一期我们先讲选币。

选币是投资的开始,俗话说,好的开始是成功的一半,目前已经有非常丰富的数字货币供我们选择。但对于新手,我们建议不要一下子就看太多,而是优先关注主流数字货币,所以我们今天主要简单介绍目前TOP10的主流数字货币,后期也会对排行榜上优质的数字货币进行跟进和介绍。

NO.1 比特币(BTC)

比特币的概念最初由中本聪在2009年提出,是一种具有匿名性、全球性、去中心化的加密数字货币。

它的这些特性的存在,决定了执法部门既无法查到比特币的所有者,也无法查封冻结比特币,从而使得比特币被一些黑色和灰色产业当成第一货币选项使用,并且这些产业规模是巨大的。

与此同时,大量著名风投公司、基金、个人也用真金白银入局比特币基础设施建设,国外包括Visa、纳斯达克、花旗等传统金融巨头,国内则包括李开复的创新工厂和徐小平的真格基金。

黑灰色的地下产业交易和风投资金的入局成为比特币两大强有力的支撑。而且随着比特币的发展,比特币收到的认可会愈加广泛,所以我们不用担心比特币价格清零的风险,因为只要公众对比特币的共识还在,它的价值就不会归零。

比特币其实就是数字货币市场的“黄金”,是一种常规货币替代物,从长期看是具有非常大的投资价值的。

NO.2 以太坊(ETH)

以太坊(Ethereum)一个基于智能合约以及去中心化技术的应用开发平台,使开发人员可以建立并运行分布式应用程序。它可以用来编程、分散、担保和交易任何事物:投票、域名、金融交易所、众筹、公司管理、合同和大部分的协议、知识产权,还有得益于硬件集成的智能资产。

从区块链的角度来说,比特币是区块链1.0的代表产品,那么以太坊可以说是前者的升级版本,即区块链2.0,将区块链技术应用于数字货币以外的领域之中。以太坊的价值或许已经不仅局限于一种单纯的数字货币,智能合约、以太坊虚拟机和链上各种分布式应用(DAPP)的商业盈利性都令ETH的价值具有不断上升的空间。

它在商业应用上的这种巨大潜力,吸引了多个行业的巨头纷纷加入到这个分布式应用软件开发平台,例如微软、三星、IBM 等科技企业都采用了以太坊技术进行区块链项目的研发。

所以,尽管以太坊目前在网络稳定和币值方面不如比特币,但它在智能合约方面的应用价值不容小觑,如果看好以太坊的未来潜力,你可以选择投资这一币种。

NO.3 瑞波币(XRP)

瑞波币(XRP)和比特币一样都是基于数学和密码学的数字货币,但是与比特币没有真正的用途不同,XRP在Ripple系统中起着桥梁货币的功能,它充当各类货币之间兑换的中间品。因为在Ripple系统内,不兑换成瑞波币(XRP)的话,就很难跨网关转账或提现;而瑞波币则可以在任意网关之间自由流通。

那这里提到的“网关”到底是什么?

“网关”是资金进出Ripple系统的进出口。它像一个中介,人们可以通过这个中介将各类货币(不论是各国法币,还是比特币等虚拟货币)注入或抽离Ripple系统。这样的话,即使两个人互相是无信任的陌生人,只要他们两个人同时都信任同一个网关,这两人之间的转账就可以进行。如果“网关”是由大银行或大金融机构充任,那么这个信任链是很容易建立起来的,瑞波币完全可以作为优化银行流动性的机构跨境结算资产,用来解决困扰国际银行支付的巨大挑战。

因此,美国、英国、日本等国家纷纷加入Ripple 网络的测试中,或将其引入跨境支付作业。据悉,目前已有超过 100 家金融机构正在使用 Ripple 的区块链网络。

从这些方面看,瑞波币完全可能成长为一个超过比特币的超新星币种。(元芳你怎么看?)

NO.4 比特现金(BCC)

比特币最初设定时区块大小是32M,考虑到初期使用人数较少,为了避免计算资源浪费和保证比特币系统的安全运行,中本聪临时将区块大小限制1M。但是,随着比特币交易的增多,交易确认异常缓慢,如果你不想长时间等待,就需要支付高额的交易费用。在这个情况下,Bitcoin ABC方案拿出了一套硬分叉的体系,基于比特币的原链推出“比特币现金”(BCH)。

所以,BCC实际上是在BTC原链的基础上分叉出来的一种新的竞争币。

与比特币(BTC)相比,比特币现金(BCH)最大的特点就是支持大区块。区块的大小决定着可处理的交易容量,BCC取消了区块大小1M的限制,这就意味着BCH可处理的交易容量大大增加,完美的解决了比特币交易拥堵的问题,而且交易费也随之出现大幅度的降低。

与此同时,手续费的降低并不没有导致矿工的收入减少,而且交易手续费降低可以吸引更多的人参与到进来,更多的交易可以弥补手续费的下降,可以迅速扩大占领新的市场。BCH将带给用户一种交易费低廉,确认速度快的新体验。

NO.5 柚子(EOS)

EOS可以理解为Enterprise Operation System,即为商用分布式应用设计的一款区块链操作系统,旨在实现分布式应用的性能扩展。

通过对EOS更深入的了解,EOS是相当有投资价值的。

首先,它通过并行链和DPOS的方式解决了延迟和数据吞吐量的难题,EOS是每秒可以上千级别的处理量,而比特币每秒7笔左右,以太坊是每秒30-40笔,所以在比特币和以太坊交易都是十分拥堵的,如果你想快,只能支付昂贵的手续费;

其次EOS上开发DAPP是很简单的,不需要自己写很多的模块,因为本身EOS就为开发者搭建了底层模块,其提供一个平台,大大降低了开发的门槛;

再次,做为一个普通投资者,拥有了EOS就相当于拥有了房产,可以用来出租(因为EOS创始人BM最近打算推出一个EOS资源租赁体系),赚取资金,当随着DAPP的开发,用户量的增加,EOS的价格上涨将势不可当。

欲知NO.6 - NO.10的五种数字货币的介绍,请看下期分解。

Some other articles we wrote

EOSUnion Blockchain 101| Distinguish the issuance methods ICO, IFO, IPO, I*O... https://steemit.com/eos/@eosunion/eosunion-blockchain-101-or-distinguish-the-issuance-methods-ico-ifo-ipo-i-o-94-or-ico

FIBOS| The recent strong performance of EOS price is actually because of this "sidechain"? https://steemit.com/eos/@eosunion/fibos-or-the-recent-strong-performance-of-eos-price-is-actually-because-of-this-sidechain-eos

EOSUnion Blockchain 101|09 Why is digital currency valuable? https://steemit.com/eos/@eosunion/eosunion-blockchain-101-or-09-why-is-digital-currency-valuable

EOSUnion| Understand "Ricardian Contract" in 5 minutes https://steemit.com/eos/@eosunion/eosunion-or-understand-ricardian-contract-in-5-minutes-5

EOSUnion BlockChain 101 | Token and Token economy https://steemit.com/eos/@eosunion/eosunion-blockchain-101-or-token-and-token-economy

EOS inflates 5% per year, 1/5 as BP reward, and where is the remaining 4/5? https://steemit.com/eos/@eosunion/eos-inflats-5-per-year-1-5-as-bp-reward-and-where-is-the-remaining-4-5

EOSUnion| Understand EOS resource allocation logic with 3 pictures https://steemit.com/eos/@eosunion/eosunion-or-understand-eos-resource-allocation-logic-with-3-pictures

The Global EOS Eco Summit held successfully! https://steemit.com/eos/@eosunion/the-global-eos-eco-summit-held-successfully

Follow us

WeChat: eosunion

Steemit: https://steemit.com/@eosunion

Telegram Channel: https://t.me/EOSUnionChannel

Telegram Chat: https://t.me/EOS_Union

Email: [email protected]

Twitter: eos_UNION

@eosunion, I gave you a vote!

If you follow me, I will also follow you in return!

Enjoy some !popcorn courtesy of @nextgencrypto!

Coins mentioned in post: