Investment Language 101 Series: TERM OF THE DAY: -- What Is: ' Dividend ' | E.202 | Trading Candle Cheat Sheet Incl. Each Episode.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Dividend ' ?

--

A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, paid to a class of its shareholders. Dividends can be issued as cash payments, as shares of stock, or other property.

--

Breaking Down...

' Dividend ' :

--

The board of directors can choose to issue dividends over various timeframes and payout rates. Dividends are typically monthly or quarterly. It is also common for a company to issue special dividends either individually or simultaneously with a scheduled dividend.

Investors often view the company’s dividend by its dividend yield which measures the dividend in terms of a percent of the current market price. The dividend rate can also be quoted in terms of the dollar amount each share receives (dividends per share, or DPS).

A company's net profits are an important factor in determining a dividend. Net profits can be allocated to shareholders via a dividend, or kept within the company as retained earnings. A company may also choose to use net profits to repurchase their own shares in the open market in a share buyback. Dividends and share buybacks do not change the fundamental value of a company's shares. Dividend payments must be approved by the shareholders and are managed by the board of directors.

Companies That Issue Dividends

Start-ups and other high-growth companies such as those in the technology or biotechnology sectors rarely offer dividends. These companies often report losses in their early years and any profits are usually reinvested to help sustain higher-than-average growth and expansion. Larger, established companies with more predictable profits are often the best dividend payers. These companies tend to issue regular dividends as they seek to maximize shareholder wealth in ways aside from supernormal growth.

Companies in the following sectors and industries have among the highest historical dividend yields: basic materials, oil and gas, banks and financial, healthcare and pharmaceuticals, and utilities. Companies structured as master limited partnerships (MLPs) and real estate investment trusts (REITs) are also top dividend payers since their designations require specified distributions to shareholders.

Arguments for Issuing Dividends

The bird-in-hand argument for dividend policy claims that investors are less certain of receiving future growth and capital gains from the reinvested retained earnings than they are of receiving current (and therefore certain) dividend payments. The main argument is that investors place a higher value on a dollar of current dividends that they are certain to receive than on a dollar of expected capital gains, even if they are theoretically equivalent.

If a company has a long history of past dividend payments, reducing or eliminating the dividend amount may signal to investors that the company could be in trouble. For example, GE, one of the U.S. market’s largest industrials, announced a financial plan that included decreasing its dividend by approximately 50% on November 13, 2017. The stock fell -7.26% following the announcement. Alternatively, an unexpected increase in the dividend rate might be a positive signal to the market.

Dividend Payout Policies

A company that issues dividends may choose the amount to pay out using a number of methods.

Stable dividend policy: Even if corporate earnings are in flux, stable dividend policy focuses on maintaining a steady dividend payout.

Target payout ratio: A stable dividend policy could target a long-run dividend-to-earnings ratio. The goal is to pay a stated percentage of earnings, but the share payout is given in a nominal dollar amount that adjusts to its target as the earnings baseline changes.

Constant payout ratio: A company pays out a specific percentage of its earnings each year as dividends, and the amount of those dividends therefore vary directly with earnings.

Residual dividend model: Dividends are based on earnings less funds the firm retains to finance the equity portion of its capital budget and any residual profits are then paid out to shareholders.

Dividend Irrelevance

Economists Merton Miller and Franco Modigliani argued that a company's dividend policy is irrelevant, and it has no effect on the price of a firm's stock or its cost of capital. Assume, for example, that you are a stockholder of a firm and you don't like its dividend policy. If the firm's cash dividend is too big, you can just take the excess cash received and use it to buy more of the firm's stock.

If the cash dividend you received was too small, you can just sell a little bit of your existing stock in the firm to get the cash flow you want. In either case, the combination of the value of your investment in the firm and your cash in hand will be exactly the same. When they conclude that dividends are irrelevant, they mean that investors don't care about the firm's dividend policy since they can create their own synthetically. It should be noted that the dividend irrelevance theory holds only in a perfect world with no taxes, no brokerage costs, and infinitely divisible shares.

Investing in Dividend Paying Investments

Investors seeking dividend investments have a number of options including stocks, mutual funds, ETFs and more. The dividend discount model, or Gordon growth model, can be helpful in choosing stock investments. These techniques rely on anticipated future dividend streams to value shares.

Taxes may also be a consideration. In many countries, the income from dividends is treated at a more favorable tax rate than ordinary income. Investors seeking tax-advantaged cash flows may look to dividend-paying stocks in order to take advantage of potentially favorable taxation. The clientele effect suggests especially those investors and owners in high marginal tax brackets will choose dividend-paying stocks.

Similar to stocks, mutual funds and ETFs pay out interest and dividend income received from their portfolio holdings as dividends to fund shareholders. In addition, realized capital gains from the portfolio's trading activities are generally paid out (capital gains distribution) as a year-end dividend.

Total return is an important performance metric to follow for dividend investors as it factors in the value of the dividend in its performance calculations. Dividend investors also typically have the option to reinvest dividends paid which helps to increase the total return of the investment.

Your Friend in Liberty, Barry.

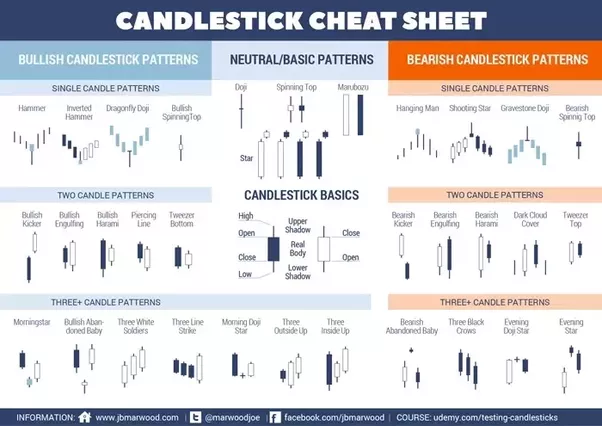

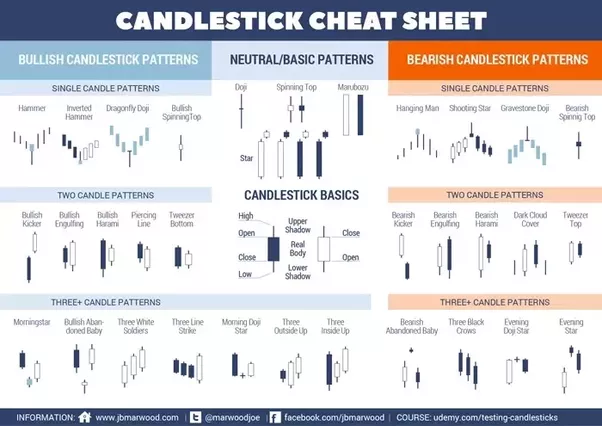

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Dividend ' ?

--

A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, paid to a class of its shareholders. Dividends can be issued as cash payments, as shares of stock, or other property.

--

Breaking Down...

' Dividend ' :

--

The board of directors can choose to issue dividends over various timeframes and payout rates. Dividends are typically monthly or quarterly. It is also common for a company to issue special dividends either individually or simultaneously with a scheduled dividend.

Investors often view the company’s dividend by its dividend yield which measures the dividend in terms of a percent of the current market price. The dividend rate can also be quoted in terms of the dollar amount each share receives (dividends per share, or DPS).

A company's net profits are an important factor in determining a dividend. Net profits can be allocated to shareholders via a dividend, or kept within the company as retained earnings. A company may also choose to use net profits to repurchase their own shares in the open market in a share buyback. Dividends and share buybacks do not change the fundamental value of a company's shares. Dividend payments must be approved by the shareholders and are managed by the board of directors.

Companies That Issue Dividends

Start-ups and other high-growth companies such as those in the technology or biotechnology sectors rarely offer dividends. These companies often report losses in their early years and any profits are usually reinvested to help sustain higher-than-average growth and expansion. Larger, established companies with more predictable profits are often the best dividend payers. These companies tend to issue regular dividends as they seek to maximize shareholder wealth in ways aside from supernormal growth.

Companies in the following sectors and industries have among the highest historical dividend yields: basic materials, oil and gas, banks and financial, healthcare and pharmaceuticals, and utilities. Companies structured as master limited partnerships (MLPs) and real estate investment trusts (REITs) are also top dividend payers since their designations require specified distributions to shareholders.

Arguments for Issuing Dividends

The bird-in-hand argument for dividend policy claims that investors are less certain of receiving future growth and capital gains from the reinvested retained earnings than they are of receiving current (and therefore certain) dividend payments. The main argument is that investors place a higher value on a dollar of current dividends that they are certain to receive than on a dollar of expected capital gains, even if they are theoretically equivalent.

If a company has a long history of past dividend payments, reducing or eliminating the dividend amount may signal to investors that the company could be in trouble. For example, GE, one of the U.S. market’s largest industrials, announced a financial plan that included decreasing its dividend by approximately 50% on November 13, 2017. The stock fell -7.26% following the announcement. Alternatively, an unexpected increase in the dividend rate might be a positive signal to the market.

Dividend Payout Policies

A company that issues dividends may choose the amount to pay out using a number of methods.

Stable dividend policy: Even if corporate earnings are in flux, stable dividend policy focuses on maintaining a steady dividend payout.

Target payout ratio: A stable dividend policy could target a long-run dividend-to-earnings ratio. The goal is to pay a stated percentage of earnings, but the share payout is given in a nominal dollar amount that adjusts to its target as the earnings baseline changes.

Constant payout ratio: A company pays out a specific percentage of its earnings each year as dividends, and the amount of those dividends therefore vary directly with earnings.

Residual dividend model: Dividends are based on earnings less funds the firm retains to finance the equity portion of its capital budget and any residual profits are then paid out to shareholders.

Dividend Irrelevance

Economists Merton Miller and Franco Modigliani argued that a company's dividend policy is irrelevant, and it has no effect on the price of a firm's stock or its cost of capital. Assume, for example, that you are a stockholder of a firm and you don't like its dividend policy. If the firm's cash dividend is too big, you can just take the excess cash received and use it to buy more of the firm's stock.

If the cash dividend you received was too small, you can just sell a little bit of your existing stock in the firm to get the cash flow you want. In either case, the combination of the value of your investment in the firm and your cash in hand will be exactly the same. When they conclude that dividends are irrelevant, they mean that investors don't care about the firm's dividend policy since they can create their own synthetically. It should be noted that the dividend irrelevance theory holds only in a perfect world with no taxes, no brokerage costs, and infinitely divisible shares.

Investing in Dividend Paying Investments

Investors seeking dividend investments have a number of options including stocks, mutual funds, ETFs and more. The dividend discount model, or Gordon growth model, can be helpful in choosing stock investments. These techniques rely on anticipated future dividend streams to value shares.

Taxes may also be a consideration. In many countries, the income from dividends is treated at a more favorable tax rate than ordinary income. Investors seeking tax-advantaged cash flows may look to dividend-paying stocks in order to take advantage of potentially favorable taxation. The clientele effect suggests especially those investors and owners in high marginal tax brackets will choose dividend-paying stocks.

Similar to stocks, mutual funds and ETFs pay out interest and dividend income received from their portfolio holdings as dividends to fund shareholders. In addition, realized capital gains from the portfolio's trading activities are generally paid out (capital gains distribution) as a year-end dividend.

Total return is an important performance metric to follow for dividend investors as it factors in the value of the dividend in its performance calculations. Dividend investors also typically have the option to reinvest dividends paid which helps to increase the total return of the investment.

Your Friend in Liberty, Barry.

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

Still one of the best series going, period.

This user is on the @buildawhale blacklist for one or more of the following reasons: