A Primer on EOS, why it grew 320% overnight and why it isn't done yet!

Maybe you missed it. I almost did — in fact despite carefully tracking ICOs this summer I almost let this sleeping giant slip through my fingers.

Unlike some of my other posts, I can’t even tell you that it was my research that helped me uncover this find. Rather, I just happened to be awake at the right moment when a Kraken blog post landed in my inbox.

Kraken isn’t my normal stomping ground for trades, but I follow their updates quite carefully.

Unlike many exchanges Kraken has been selective in which trade pairs they add to the exchange — and as someone who was previously a director at a crypto exchange and had to make these decisions, I know how hard it can be to make the right picks. But, Kraken has always done a great job in including mostly winners (although I’m still skeptical about Melon). So when I saw they added an asset I hadn’t heard of I realized there was something I missed.

What is EOS?

EOS is the latest project by experienced blockchain entrepreneur Dan Larimer.

Dan was the creator of BitShares, STEEM (+ The SteemIt platform) and BitUSD three projects with a combined market cap of $886M and he is now the CTO of the company block.one who is building the EOS platform.

So what exactly is EOS?

In their own words EOS “is software that introduces a blockchain architecture designed to enable vertical and horizontal scaling of decentralized applications.”

What does that mean?

Right now, there are hundreds of major companies, banks and governments looking to build enterprise level applications on the blockchain, and leverage the smart-contract technology of Ether.

The problem is, as we’ve seen with the rise of ICOs this season, these technologies don’t scale well. The goal is to change that by creating a system designed for enterprise level adoption, that allows large corporations to build DAPPS (Decentralized Applications).

Can’t Bitcoin and Ethereum handle enterprise DAPPS?

Short answer: No.

Longer answer: Not yet and not on the current infrastructure.

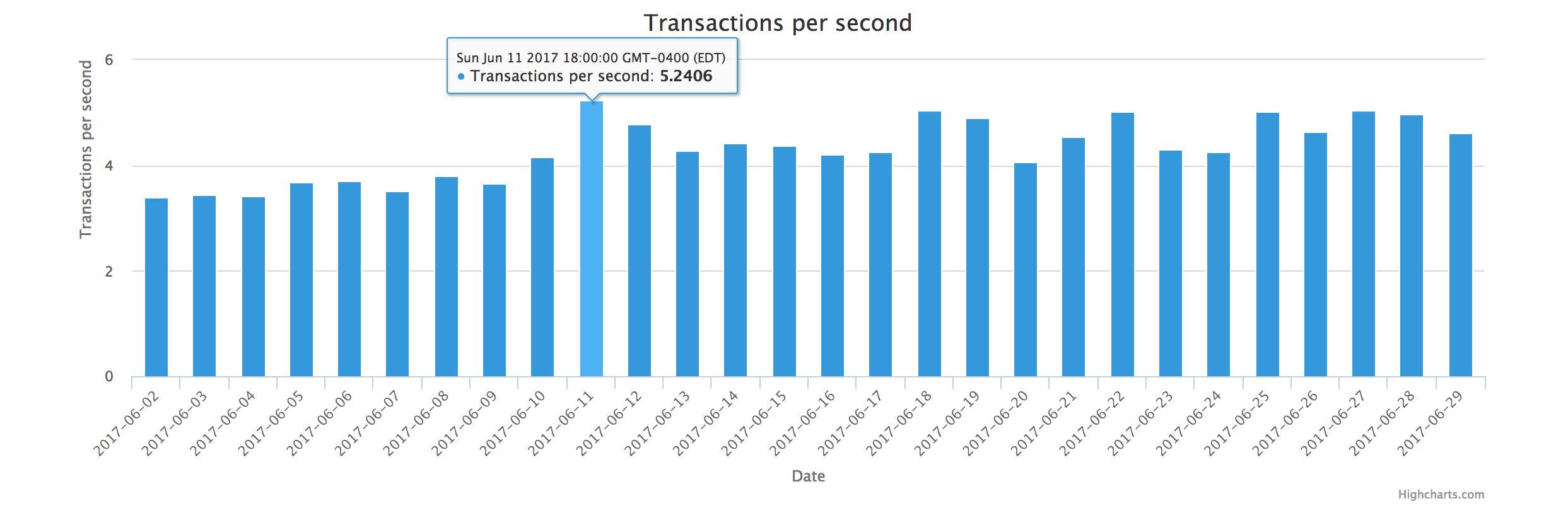

On June 11th 2017 the Ethereum network was hammered with traffic and pumping out 5.2 transactions a second. Which seems like a huge success! However, taking into consideration that on June 20th during the status ICO the Ethereum network was bumping out 5.04 transactions per second and that some users were waiting hours for Ether to send, it turns out the network can handle a pretty small volume.

While for cryptocurrency 5.2 transactions per second is a huge milestone, it fails in comparison to the number of transactions that someone would need to host an enterprise level solution on the blockchain.

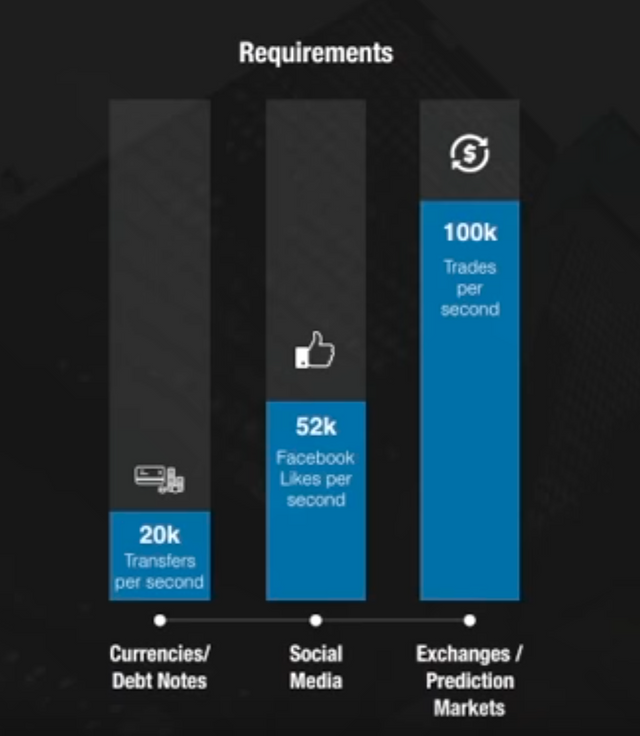

In Dan’s EOS presentation at Consensus 2017 he highlighted the number of transactions per second of a few consumer services.

Before we even get to being able to run stable financial markets on the blockchain, we’d have to break through barriers to even be able to support the transaction volume of social networks.

Facebook alone pumps out 52,000 likes per second. Not posts, not messages, JUST likes.

That means in order for Facebook to run just one component of their system on blockchain technology would require a platform like Ethereum to be 10,000x more efficient than it currently is.

Isn’t this just a node/miner problem? Can’t we solve this with more Engineers?

The speed of the network isn’t simply a function of miners, nodes or hashing power. It comes back to the fundamental way in which a blockchain functions.

The over simplified version is that on a current blockchain information is processed in a sequential fashion in the order of each block, and without implementations of modified structures like the Falcon Network the sending of this information doesn’t start until the full block is complete.

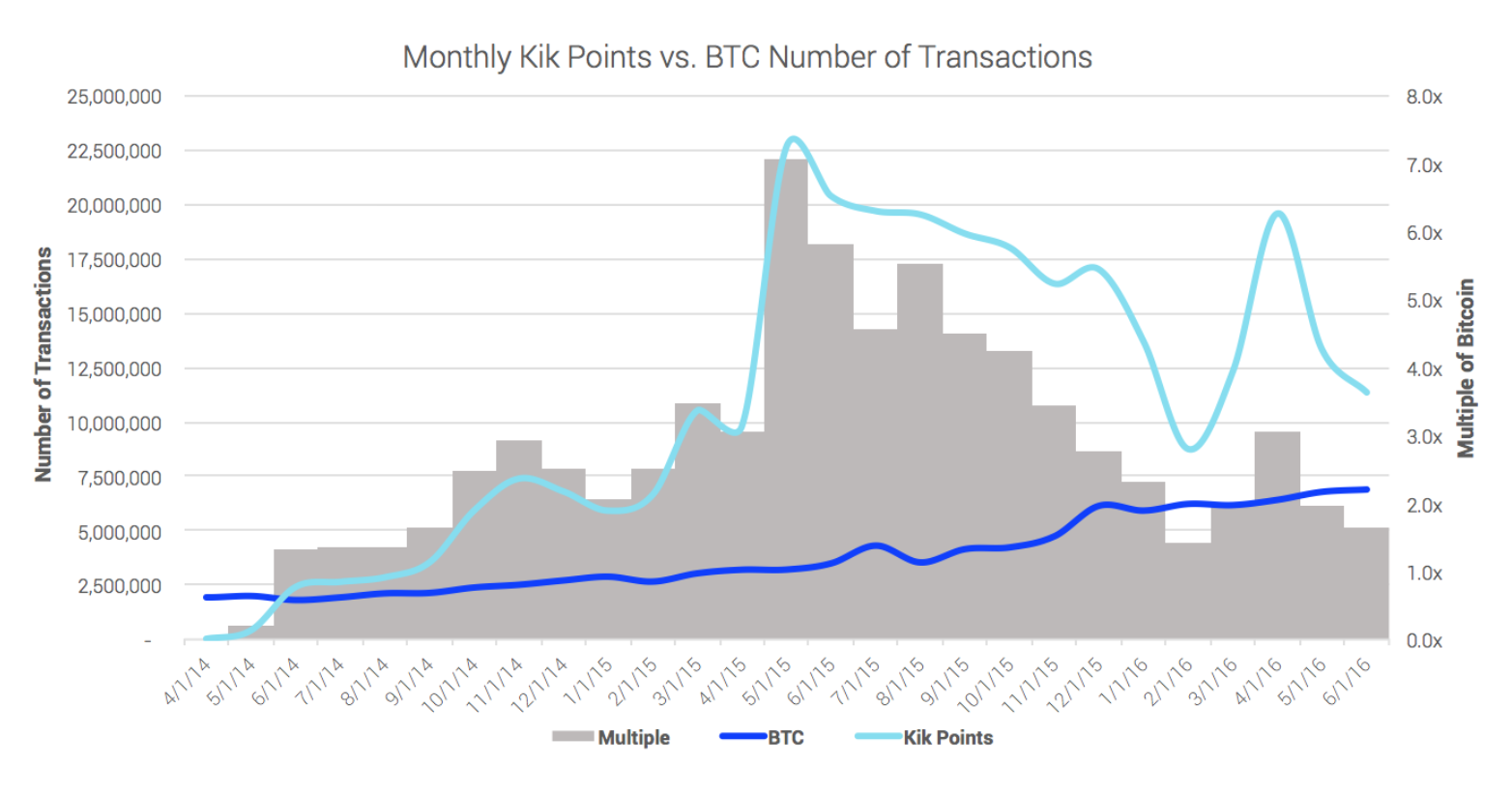

Even modified implementations have their limits. Take for example, the Kik’s upcoming implementation of “Kin” — despite being a $1bn unicorn startup with significant engineering resources, Kik announced that Kin would need to implement “a hybrid on-chain and off-chain solution” to keep up with the transaction volume.

A few years ago in the early planning stages of Kin, Kik launched an experiment called “Kik Points” allowing users to earn a traditional currency in the app. They monitored the number of transactions they were seeing and compared it to the Bitcoin blockchain:

At their high-point they were seeing 7x the number of transactions that the Bitcoin network was, and Kik has only continued to grow over the past 3.5 years.

So, What is the Solution?

That brings us back to EOS. EOS has the goal of creating essentially a developer friendly operating system that allows both private and public blockchains to, among other things, process information in parallel across multiple cores rather than restricting it as a single thread.

EOS also introduces a few other concepts to make blockchains more accessible to the enterprise client:

- Separation of read and write actions for sake of speed.

- The ability to communicate asynchronously between public and private blockchains.

- The ability to manage user accounts with different permission levels.

- Account names instead of long addresses.

- The ability to fix bugs and role back changes with super-majority consensus instead of needing a hard-fork.

These features rely on a change of infrastructure referred to as “Delegated Proof of Stake”

Some cryptocurrency hardknocks argue that this ultimately makes a blockchain ‘less decentralized’ and while that’s true it’s important to realize that companies like VISA and IBM who are spending hundreds of millions of dollars on this technology were never going to adopt a fully public blockchain anyway.

So what’s the value of the Tokens

Ultimately the goal of EOS is to act a a simplified operating system for large businesses to adopt blockchains, and after the crowd sale ends on July 3rd 2018 there will be consensus vote among token holders to create a blockchain.

As long as enough holders vote for the creation of a public blockchain that follows the EOS.IO infrastructure then the tokens will be able to be bought by businesses in order to build and use their private blockchains via the EOS platform.

And, so while there may be risks in the future of this token, the team behind it has a wealth of experience in delivering products and is tackling some of the biggest challenges in the blockchain space. If they manage to deliver then EOS will likely change the landscape of blockchain tech forever.

If the coin manages to beat out the market values of projects like Bitcoin or Ethereum then it would be worth an estimated value of over $35 a coin one day. That's why I think this little token isn't nearly done growing yet!

Price is too high. ICO only got started.

Great article...I am trying to wrap my head around this... Can you recommend an article which explains how the eos tokens would be valuable? It sounds to me a bit like a business just buys an eos token like an anchor and then just uses its private blockchain... a bit like sidechains or something like that?

I would love to know more about that, but would like to understand why the eos tokens would have to be bought...

They give you a percentage share of the blockchain's storage and computing power. The number of tokens you own determines your access to the network.

Ok, so this is the same like in Steem... But if you run your private chain would you need many of them?

Does this article means death to other cryptos like Bitcoin, Ethereum and etc. because EOS is faster ?

I found the white paper... so will give this one a read... looks interesting... :)

Since the EOS token is not in any way connected to any future EOS blockchain, nor will it be, the number of tokens you own will only indicate how much money you'll have lost.

Yeah so basically the tokens they issue will all get to vote on July 4th 2018 to try and form a formal blockchain. If it implements the guidelines of the EOS.IO system it will create a public blockchain that follows that standard and companies would need to use those tokens to make applications on that blockchain (at least that's what I understand).

While they can also create their own private blockchains based off of EOS I imagine some of them will want to interact with a public blockchain which would need to be this EOS token one.

In summary, what I gather from the whitepaper is the goal is to have the current tokens become a key component of the platform, they just don't want to promise that for legal reasons incase someone gobbles up enough tokens to out vote them.

What I read in the whitepaper is this statement:

PLEASE NOTE: CRYPTOGRAPHIC TOKENS REFERRED TO IN THIS WHITE PAPER REFER TO CRYPTOGRAPHIC TOKENS ON A LAUNCHED BLOCKCHAIN THAT ADOPTS THE EOS.IO SOFTWARE. THEY DO NOT REFER TO THE ERC-20 COMPATIBLE TOKENS BEING DISTRIBUTED ON THE ETHEREUM BLOCKCHAIN IN CONNECTION WITH THE EOS TOKEN DISTRIBUTION.

What I understand is that any new blockchain using the EOS,io software will be equipped with a new token, with a name of choice. This new token will be key to the functioning of this new blockchain. The EOS token we bought a few weeks ago, has no relation to any blockchain using the EOS.io software, nor is it intended to be so. It is a coin without use or function.

This post reflects also on EOS. This is another view: https://steemit.com/eos/@jerrybanfield/best-time-to-buy-eos-or-any-new-cryptocurrency

I have posted today an article that shows that the value of the EOS token is absolutely ZERO. Since businesses do not have to be buy EOS tokens to use the EOS blockchain open source software, and since the EOS tokens are in no way connected to an EOS blockchain, nor is it the intention of the developers to make it connected, it is a token without function, and without a team to give it a function. It is useless

EOS is really interesting. Thanks for the great post. Dan the creator has made Steemit/Bitshares and so far they are doing good so I think he will do a great job in this project too.

So you're saying Kraken is the reason for the pump? I'm going to have to disagree and say that it was all the US investors that "couldn't get in the ICO", because of the "regulations scare".

I realize many ignore that entirely and it's just a formality, but you have a lot of people out there that will follow that quite literally.

I don't think Kraken was the reason for the pump - I think there are a lot more factors at play, but I agree US investors who didn't want to touch the ICO are likely a major component of that.

Heck yeah!!

Thanks for this good article as ever. I've just started following you. People might also like the one I posted on criteria for choosing what to put in your long term crypto portfolio. https://steemit.com/crypto-news/@katythompson/5-criteria-for-choosing-a-winning-long-term-crypto-portfolio

This is such a great post - clearly explaining the technical advantage of EOS - which I am convinced of! I do think it will get to the same value as ETH within 2 years ;-)

Also worth bearing in mind is the exceptionally clever way they are raising money - they are now already the best funded blockchain platform and will continue to be so, as they will most likely raise between $1 to $3 billion over the course of this year.

If any readers would like to understand more about the structure of the ICO year long token offering for EOS and why and how it will raise so much money and why having so much money will make it even more likely to be a serious competitor to Ethereum please see my various posts on this on my blog @willstephens .

Have a beautiful day y'all,

Will

Agreed Will! The ICO deployment is a fascinating aspect, it means that people who invested early have a vested interest in driving the price up each day. It'll be interesting to see how it all plays out.

Just buy it, but it drop... I feel very sad on it.

I'm making the crypto world friendly and accessible for everybody by explaining acronyms and terms related to cryptocurrency. Here I found:

Please upvote for visibility. If there are any missing terms here you want to be added to the database, please comment, so I'll become better.

I'm trying to come up with a good one-line definition of EOS.IO that isn't too technical such as "EOS.io is open source software that will do parallel blockchain processing enabling a virtually unlimited number of transactions per second. "