Micro lending sites - Kiva.org - the discerning lender perspective.

Based on the screen grabs @sme did yesterday, we could see that there were some very interesting details available for those who dig deeper.

Basically Kiva.org gives a very limited amount of information to lenders who just want to quickly make a few clicks and be done.

To more discerning lenders there is plenty of information to do your shopping around on.

For instance, Yesterday @sme gave the example of the group from Uganda that would end up paying what is very close to the equivalent of 50% interest on their loan. This is one of the high cases.

High interest rares are typically given to lenders in Africa because that is where access to financial services is possibly the worst and lending is very difficult to come by.

On Kiva you will be able to find people and projects to lend to that are charged 0% interest all the way up to well over 50%.

My personal preference is not to lend where interest rates are excessively high as that is just more likely to be counter productive and lead borrowers into a debt trap.

Also, due to the fact that the borrower has often been lent the money before you even loan it out, means, that in actual fact, you are actually part of a crowdlending initiative for the Field Partner rather than directly contributing to the person whose story you just read.

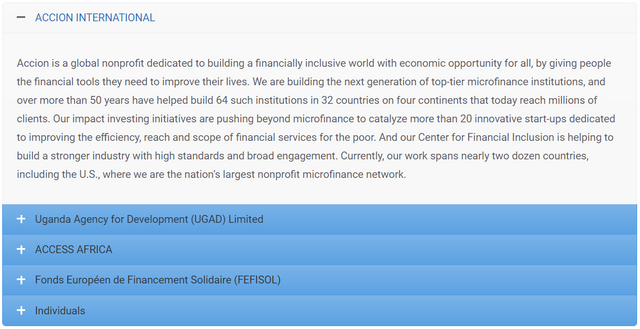

I therefore like to scrutinize the Field Partner more closely than the story.

So looking at yesterday example on can see that it is actually a bank.

Then going to their web site you are even able to get an idea of their shareholders.

Based on this evaluation it is quite easy for me to see that this is not really the type of loan I want to be making, because I don't really like banks and secondly, it looks to me, that at these interest rates, there seems to be some profiting off the poorest of the poor going on.

The point is:

There is enough information on kiva.com to allow the discerning lender to pick their type of project to fund.

I understand that there's definitely going to be higher administrative costs on small loans in certain countries, however 50% does seem pretty crazy. At 50%, a loan probably isn't the best idea as the person doesn't really understand how it works.

This project has been going on for a long time. Kudos to all those involved.

Yes Bro

this is informative...but i getting loans from a financial institution is like cutting a pound of flesh from your body... they make it difficult for you to pay back

It sure can be

This content is very useful. Though this may sound good to many , I'm one that would run from this. 50% APR is RIDICULOUS another bad product for people who've may had made some financial mistakes in the past. Not my cup-o-tea

I wasN't aware of these pitfalls. I did some microlending through MyC4 But they shut down.

You recommend kaya?

check out @sme they are doing more detailed coverage

Thanks @gavvet.

Wow Just Amazing. Thousand of Borrowers' profile set up on site, and 487 Borrowers are listed from my country. Amazing. Many lenders working some of them are working direct without any field assistance. Sounds Really great to me. Thanks for such a kind post buddy. Love you.

kiva is a great site in my opinion. It's been around for a very long time and they do very very good work.

Agreed, but I don't just click on loan without checking deeper...

Guys, check their silicon valley competitor zidisha.org, it is direct competitor with much lower rates, because they use AI

To be poor and live a hard life is close to slavery. To be poor and buried in high interest debt is one step closer to slavery. -World Travel Pro

.....How philosophical of me, ha ha :)

On a lighter note, I hear these lower interest micro loans to poor communities in Africa are really sparking economic activity and making life better for these people. Great post bringing attention to how those with means can help out.

And on an appreciative note:)

Thank you for taking a notice and a liking to my informative travel blog. It's really made a difference for me here on steemit, and it's greatly appreciated.

Thank you! -Dan "World Travel Pro"

These fuckers are criminals at 50% APR! Like all lenders they rely on people with low credit ratings so they can charge more interest to mitigate the risk.

I applied for a loan with Zopa, they offered me a rate of 7%, I went back and adjusted my income at 5k more and the interest was then slashed to 3%!

The rich always get the best rates or even free banking...

Makes sense though. Default rate on debt must be very high.

What's the guarantees you'll ever get your money back?

None