The Good Old Days of International Money Transfer, Good Old Repression

![[resized]22003991445_fa6e2c06aa_c.png](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmcL5xuxvGf3h2axHBMHGDE3e36uGwwurRVXkjapnL2Sfo/[resized]22003991445_fa6e2c06aa_c.png)

Take it from me, I lived for four years as a digital nomad and never in my life I felt as free as when I did that. To be constantly on the move and not fixed somewhere was, by far, the happiest period of my life.

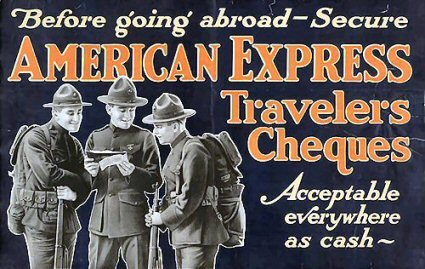

While I was living like that I had to deal with the old world’s alternatives to overseas money wiring, read Amex’s Travellers Checks, Money Gram, and Western Union.

Traveler’s checks might have been a thing in the very slow world of the second half of the 20th century, but they were worthless when I used them in the early 2000s.

I doubt that those things were of any use at all outside of America. Because in Europe the only way to exchange them was in an Amex office in an important city, no one, not even forex traders would take them.

The Amex office in Asia just reserved their rights to buy some from me, and I ended up getting rid of them selling them for much less than they were worth to a forex exchanger.

This was in the beginning when I didn’t know about the broad topic of electronic funds transfers which included bank transfers.

This first time around, in the early 2000s, I didn’t have big problems, the only decision my banker had to make was sending it by either Western Union or Moneygram. Most of the time it was through Moneygram, due to lower transaction fees.

Since my banker deposited the money, until I could cash it out, the average waiting time was three days, for a North America to South Asia transfer.

Same South Asian Place, Nine Years Later

But when I needed again to make use of international funds transfers, it happened at the same time I began crawling my baby steps on the crypto world.

I was on the road again. That time I was decided not to use wire services anymore. I wanted to learn how to receive transfers and payments overseas but doing it through cryptos or banks, but not by WU or similars anymore.

There weren’t crypto exchanges in the place I was going back then in early 2013. I fell back to plan-b, which was to use banks, in my case it was HSBC.

I didn’t like what I learned about bank-based international money transfers. To do it you have to have a bank account. And even with one, it wasn’t, by any means, an easy or cheap thing to do.

Generally, not any bank will transfer money to any other bank. With some of the banks, a country’s branch won’t transfer to another country’s branch. Very restrictive and playing by the old world rules.

Already by late 2012 I was interested and researching ways to use cryptos for overseas electronic funds transfers.

There weren’t many cryptocurrencies back then in 2012, and even if it didn’t seem complicated, for me it looked too much in its initial stages.

My first contact with cryptocurrencies was with Bitcoin and Dogecoin back then. Still, I didn’t adopt any of those two.

I paid the price of not being an earlyvangelist of cryptos because when I went overseas, receiving money from another country, in that place, had become nigh-impossible by conventional channels.

But, like I said, cryptos were just starting in 2013 and there wasn’t even a lot of online crypto exchanges, what to say of a brick and mortar crypto exchanger. Maybe there were some in NYC, but not where I was going.

Pertaining wires, in 2013, when I returned there after a long time, I can’t remember right now, but I think either the transaction fees were extremely unfair, or either one (or maybe both) of the two companies had left.

The Systems of The Old World Were Corruption-Fuelled

![[resized] no-corruption-4650589_640 (1).png](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmZEtUjCK5j26VVWUY8hFRvsDbrt1dfgKmkBoqK6wU4Ujd/[resized]%20no-corruption-4650589_640%20(1).png)

To face the fact that in that particular place it wasn’t as easy as before to perform electronic funds transfers was an indicator that things had changed. It had a lot to do with why I decided not to work there.

In a long list of disadvantages, the change in the money wires service market of the town weighted in.

That tipped the scales towards aborting my plans. It just wasn’t worth the suffering to try to stay there and work illegally.

What to say of working with all the paperwork in order? I was warned by more than one person to be prepared to have an additional amount, 20% of the startup capital, on top of it to be given away as “desk-jokey grease.”

The 20% backsheesh could make or break a startup there. Those that didn’t pay were tired around for years in bureaucratic limbo.

The place was corrupted and revenue dispensing services had quitted. That was a red flag I saw right then and there. What could have been the start of an expat business was just a five-month-long life lesson.

This was early 2013, there weren’t as many choices as of now, and I was too green an entrepreneur to be able to find ways to do business without feeling I was cut from the rest of the world and submitting to the local (socialist/restrictive) reality.

The “Pandemic” is The Old World’s Smacks of Drowning

![[resized]49790376433_b34710350b_c.png](https://steemitimages.com/640x0/https://cdn.steemitimages.com/DQmeuwuCcQqryKnASGV2qRfoQC4r2Phu9S3fXdvXWrwDWnh/[resized]49790376433_b34710350b_c.png)

In the department of moving money around the world without giving explanations to nobody or to, at least, do it discreetly, the system was dealt a disabling blow with the rise of crypto-currency culture.

A thing like the coronavirus is one in a series of effects, big and small that we will see as a consequence of the death of the old way of doing things as opposed to a new dawn of freedom.

I’m not saying that nCoV-19 was something staged and something that somebody has spread on purpose to enslave the world. I don’t know if such a thing was what transpired.

I’m just saying that it is an expression of the unhealthy and reactionary backlash of the spirit of the old world. A system that can’t stand something as liberating and empowering as cryptocurrencies coupled with other world-belittling improvements over the past, like social media and such.

I urge you to incorporate into your life an active interest in the law and as many law-related skills and studies as you can. We need a solid base in that department to change the world and shape it for freedom.

Image Attributions

Tim Welch

Becker1999

Don O’Brien

Cryptogames

Zelandia

Copy Content © Martin Wensley 2020