Understanding the markets - Some basic knowledge

Hello friends!

While I am not really interested in talking about financial matters and I am also totally against giving any investment advice ( and so should you unless you are a certified financial analyst ), I feel compelled to share some of my thoughts, insights and resources regarding how markets in general work in order to give you a better understanding and also help some of you to take more careful and thoughftul decisions when it comes to your investment choices.

It is one of the saddest things in the world to see people losing their hard earned money, savings and pensions just because a charlatan came over and convinced them that investing on X or Y stock/commodity/coin is a good idea or because he made them feel like they have a proper understanding of the markets just because he is an expert in technical analysis and showed them a bunch of indicators.

Disclaimer: I will not provide any investment advice and this post is offered only for educative purposes. I will cover some pretty basic stuff without going into much detail and in the end I will also share some resources. The views presented here are my personal views and someone might very well have a different opinion, in which case I ask for a thoughtful discussion in the comment section afterwards.

Prologue

Since the rise of Bitcoin and the cryptocurrencies lots of new people around the world entered the field of investment and that of speculation although with minimal and more than often, a wrong understanding on how the markets work. The legacy financial system had a pretty high entry barrier, something which dettered the masses from investing but also protected them from losing their funds.

This has changed with the introduction of cryptocurrencies and new exchanges and today, literally in minutes, you can invest virtually in any market even with minimal funds. This provides us with some good opportunities but also includes some serious risks. Nowadays you can find all sorts of people from all ages, investing in all sorts of stuff and this new market has been dubbed as the millenial market.

In this post my goal is to provide you with the definitions on some basic market concepts and also share some resources that will help you acquire a better knowledge on how markets work in general.

So, the first thing I would like to talk about is the market itself.

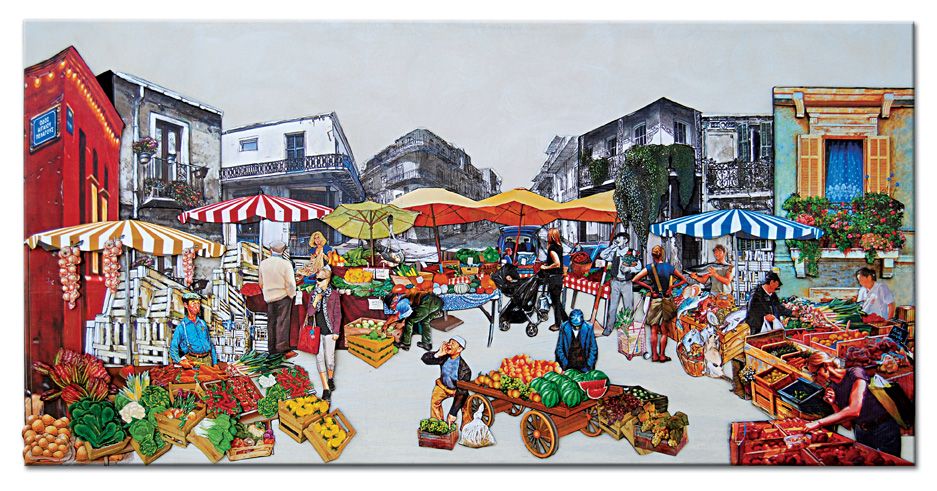

The market

In its most simple definition a market is simply the place where people gather to buy and sell their goods. The people who gather to buy and sell are also called market participants ( among other agents who are also considered as such but do not directly participate in the exchange of goods such as enforcers, regulators, facilitators etc).

According to the Oxford Dictionary a market is defined as:

- A regular gathering of people for the purchase and sale of provisions, livestock, and other commodities.

- An area or arena in which commercial dealings are conducted.

This is quite simple to understand. Nowadays markets exist both in the physical and the digital space.

Examples of physical markets are:

- A flea market.

- The supermarket.

- A car dealership.

- An auction house.

Examples of markets in the digital space are:

- Amazon.

- E-bay.

- Online real estate platforms.

- Online Exchanges. ( Coinbase, Bittrex etc. )

While all these markets differ significantly in their purposes and structure, the basic premises remain the same. People gather in them to exchange goods and that is all.

Let's delve now into some more basic concepts.

Market participants - The Ask and the Bid price - The spread price

As I said earlier, in a market the most common type of market participants are the buyers and the sellers of goods.

Let's assume that I am a buyer and I want to visit the local market in order to buy some potatoes. When I go to the market, I have a maximum price which I am willing to pay for a fixed amount of potatoes.

Assuming I want to buy a kilo of potatoes, I am willing to pay no more than 0.90 euros per kilo ( which is also the median price for a kilo of potatoes as of now in Greece).

This is what is called my bid price and in this case my bid price is 0.90 euros per kilo of potatoes.

The bid price is the maximum price a buyer is willing to pay for a specific amount of goods.

Wandering around the market I find someone who is selling potatoes. I stop in the stall and check for the price. On it there is a small tablet where the price 0.90euros/per kilo is written. This indicates that the seller of potatoes is willing to get paid no less than 0.90 euros per kilo for his potatoes.

This is what is called his ask price and in this case his ask price is 0.90 euros per kilo of potatoes.

The ask price is the minimum price a seller is willing to receive for a specific amount of goods.

Back in our case, since my bid price is the same as the ask price of the seller of potatoes we are able to make the exchange. I give him 0.90 euros and he gives me 1 kilo of potatoes. In this case, the 0.90 cents is what is known as the current market price.

Let's consider now that the price I'm willing to pay for a kilo of potatoes is again 0.90 but the price the seller has set is 1 euro per kilo. In this case, it is obvious that I cannot buy the potatoes because I am willing to pay less than what the other person is willing to receive for his goods.

Here, unless I decide to pay him 0.10 euros more or he decides to receive 0.10 euros less, the exchange cannot be completed.

The amount 0.10 in this case is called the spread and it is the difference between the maximum price I am willing to pay and the minimum price he is willing to receive.

The difference between the bid and the ask price is called the spread.

So far, I covered what are perhaps the most basic concepts. What is the market, who are the basic market participants, what is the ask and the bid price and what is the spread price.

Next up is Volume.

Volume

In every active market buyers and sellers meet and conduct exchanges. The number of the transacted goods ( or their dollar based value as seen in Coinmarketcap) in a given period of time in a specific market is called the volume of the market. For example in the stock market, a single stock is usually traded thousands or even million times per day. Whenever a buyer and a seller meet and make an exchange, the number of the shares that they have traded between them, is added to the cumulative total volume of the day. As of today the stock of Amazon has traded roughly 3.79 million times which roughly means that 3.79 million shares have simply changed hands.

Here is the definition of volume from Investopedia:

Volume is the number of shares or contracts traded in a security or an entire market during a given period of time. For every buyer, there is a seller, and each transaction contributes to the count of total volume. That is, when buyers and sellers agree to make a transaction at a certain price, it is considered one transaction. If only five transactions occur in a day, the volume for the day is five.

Volume as an indicator for market activity.

One of the most common and serious mistakes I see people do when studying the relative move of a price of a given asset is the following.

Whenever a big move occurs in the price of an asset people are often lulled by this change into thinking that there are many people ( market participants ) in this market and that the big change actually implies market activity. This is simply wrong for the fact that it is not the change of the price that indicates if a market is active or not but the cumulative total volume traded. I'll give a short example.

Let's assume that company X has issued 1.000.000 million shares. For reasons of simplicity, let's also assume that all of these stocks can be traded but they are not all currently inside the market. Let's assume that only 100 of those stocks are actually in the market while the rest 999.900 can enter the market with a time delay of two hours. Now, market participants trade this 100 stocks and a price is created, but this price is not representative for the simple reason that there is no volume traded to that market compared with the total existent stocks. Whatever change occurs in the price of the asset that is tied with those 100 shares is not reflecting true market activity, thus also a more representative price. As more buyers and sellers enter the market, total volume increases and now these 100 stocks are only a fraction of the volume traded. If we could somehow put tags on these stocks, just in order to know which stocks they are, the impact they would have in the first 2 hours of trading would be absolute. After 2 hours though, the impact of these 100 stocks on the price would be near zero as the price would now be dictated by far larger orders. This is a general rule of thumb.

The lesson from this is this. While a change in price most certainly has an impact, whether it is accompanied by low or high volume, changes in price accompanied with high volume have more significance than price changes with low volume.

According again to Investopedia:

Volume is an important indicator in technical analysis as it is used to measure the relative worth of a market move. If the markets make a strong price movement, then the strength of that movement depends on the volume for that period. The higher the volume during the price move, the more significant the move.

Next, in this presentation I'd like to talk a little about Market liquidity.

Market liquidity

According to Wikipedia, Market liquidity is defined as:

... a market's ability to purchase or sell an asset without causing drastic change in the asset's price. Equivalently, an asset's market liquidity (or simply "an asset's liquidity") describes the asset's ability to sell quickly without having to reduce its price to a significant degree. Liquidity is about how big the trade-off is between the speed of the sale and the price it can be sold for.

Market liquidity is a very important factor when it comes to trading and exchanges. If you have an asset and you want to sell it quickly and at a good price, then you need to find a liquid market. As noted above, the smaller the trade-off between the speed of sale and the price and it can be sold, the more liquid the market and vice-versa.

You can easily check if a market is liquid by the presence of a large number of buyers and sellers. In case they buyers and sellers also trasact in big volume, this is even better for the overall market liquidity.

Before entering a specific market to buy or sell an asset, it is of outmost importance to check if the market you are willing to participate is liquid or if there are other liquid markets that you can quickly transfer your assets there and make your exchange. You do not want to get caught in an illiquid market with few buyers and sellers and low volume since this could seriously hurt your investment.

Risk exposure

By far the most serious thing one has to consider, before everything else, is the amount of risk exposure that one has.

Risk exposure is simply defined as the potential for loss that can occur from a trade or an investment. If I decide to buy some stocks or cryptos with my own money ( and not on margin) then the amount I decide to invest is my risk exposure.

Before anything else, one should make sure to have a perfect sense of how much his risk exposure is. I cannot stress more the importance of this. Before potential rewards, before anything else, ALWAYS KNOW YOUR RISK EXPOSURE! This will save you your health, your relationship, your dog, your bank account, your car, your house and pretty much everything else.

The general rules of thumb here are the following:

1. Don't invest more than you can afford.

2. Always know your risk exposure.

When it comes to the first rule, I think this is quite obvious. If your income is 1000$ per month, and you have a family, expenses etc. then it is totally unwise to downright foolish to take 80% of your income and throw it in the markets. Regardless of the potential reward or the certainty you have that your investment or trade will pay off this is a very bad move.

As a matter of fact, in case you do such a bad trade or investment and it does pay off, this is far worse than losing your money since now you also have a false sense of confirmation and this can lead to complacency and make you repeat the mistake. However next time, you might not be so lucky and certainly it will hurt more. Repeat this several times and in the end you will end bankrupt.

The second rule is what I already stressed. Knowing your risk exposure is easy when you deal with stocks and cryptos ( and you buy them with your own money). Simply, the amount that you have invested from your wallet is your risk exposure and you should always keep a good track of it. Sometimes things do not go as desired and a stop in action is required in order to contemplate of what went wrong and if we are willing to take these risks again. You definetly need to track this figure all the time and keep it updated as this compared to you returns will give you a crude indication of your record so far. If you see that in a year you have lost most of your capital and this starts to hurt your wallet, sit back and relax. If you followed the first rule you wouldn't care much after all, as this in the end would only be an expensive lesson that in the process made you a lot wiser. Keep your numbers updated and always look at them!

When it comes to other investment vehicles such as futures and similar things ( such as short selling ), the risk exposure is not easy to calculate ( or even possible to). Here I plead complete ignorance and I would advise you to be extremely cautious if you ever decide to deal with these things. Just don't if you are not absolutely sure of what you are doing! In my knowledge, luckily most exchanges in the cryptocurrency space don't offer these kind of instruments and I don't know if this is good or not but it is certainly good in the sense that it protects those with minimal knowledge from taking very bad decisions.

Investing vs trading

Investing and trading are very important to understand before you decide to do any of these two. These two methods differ singificantly and one should make sure to understand both of these concepts. There are fundamental differences between these two approaches and understanding these differences will help you create your own strategy on how to deal with the markets.

While both traders and investors participate in the markets, their goals, scope of involvement and ultimately their actions differ significantly. Let's discuss a little more about investing and trading.

Investing

An investor is someone who aims at building wealth over a period of time. Investors typically look at the markets and invest their funds in assets with a long term perspective. Whenever an investor chooses an asset, he does so with the goal of maximising his potential returns by holding this asset over a long period of time ( years or even decades ). An investor might look for several things in an asset that he wishes to invest. Some investors look for potential growth of the underlying company or utility represented by the asset, others look for assets that provide them with dividends, others invest in promising projects and technologies with the hope that these will gain value in time and others seek for well established companies or projects that offer them a better sense of security( see blue chips). Regardless of the strategy of the investor, what is common to most is their commitment to the asset they choose to be involved in. An investor is not so interested in the short term fluctuations of the price of an asset as he is looking the larger picture and is in for the long run.

Usually, an investor will also reinvest a portion of their profits to further bolster his position in the market. Most investors do not follow technical indicators to base their decisions and if they do so, it is mostly done in a complementary way. Short term market trends do not seem to affect the overal attitude of the investor although big moves might have an impact on investor sentiment. An investor will most look at the fundamental indicators such as the profitability of the company, their debt, their balance sheet etc.

Summarising, the investor is in for the long run and his goal is to ultimately increase his position and is not so interested in short term profits.

Trading

Image source

As opposed to the investor who is in for the long run, a trader is someone who is actively participating in the markets daily, weekly or monthly and tries to get a return in these timeframes. A trader is not interested in holding an asset for an extended period of time and his goal is to maximise his profits by buying assets and securities at a low price and selling them at a higher price, usually as soon as the price reaches a predetermined level. Traders, as well as investors, use predetermined entry and exit points when looking at an asset and based on these points they base their strategy. This is done so in order to minimize risk exposure and also have a better control over their position and most importantly, their sentiment.

Traders are more usually looking at technical indicators in order to base their assumptions but also things such as the news and they are generally more sensitive to changes in price than investors. While an investor will be more tolerant if he sees the price of one of his assets drop by -10%, a trader ( always depending in his method ) might look for an exit quickly as this price change affects his overal strategy.

Bottom line is: Traders look for quicker profits than investors and are much more sensitive to changes in prices than the latter.

If you want to learn more about the differences of investing and trading I would suggest looking at this post in Investopedia, ''What is the difference between investing and trading?''.

Some personal advice and useful resources

If you finally consider that investing is your niche I would first advice you to work on your sentiment. Your sentiment and psychology will have a huge effect on whatever you choose to do. If you have decided your goals, your limits and your current level of knowledge you will have a much better control over your emotions and you will make conscious choices rather than impulsive ones. I believe this to be crucial also for your health. Whether it is a big win or a big loss, a sober mind and a temperant spirit will help you make the right choices and contemplate in the correct context.

Simply, take a step back, reflect and work on yourself. Try to understand what is the bias or the attitude that drives you to have these emotions and study it. Every one of us has his strengths and weaknesses and to have a good knowledge of ourselves is crucial for pretty much every aspect of our lives, not only investments!

Here is a list of useful resources that will further help you in your goal to broaden your knowledge and acquire a proper understanding of what the markets are and also help you make educated choices.

Some sites for general investment knowledge:

- Investopedia - A treasure trove of knowledge and definitions for pretty much every aspect of the markets. Consider starting your journey here if you have minimal knowledge in investments.

- TradingView - An excellent site with price charts that also let you set notifications and tinker around with the charts.

- Trade2Win - Another treasure trove of knowledge. Trade2Win is a forum dedicated to investments and trading where you can also find reviews of just about anything and lots and lots of tutorials. An excellent place to be for new and experienced investors/traders alike.

- Khan Academy - An educative platform with lectures, courses and tests ranging from nuclear physics, to chemistry and history. An amazing place to further educate yourself!

Books:

- The entire bibliography of Nassim Nicholas Taleb. Nicholas Taleb is an erudite philosopher and professor who was also a successful futures trader and is notable for his work in a variety of subjects such as decision making under uncertainty, antifragility ( he created the term ), criticisms on mainstream economic theory and much, much more . Personally, I consider his books as a must read! Also make sure to check his Facebook page and his personal web-page for amazing conversations and insights alike.

- The Misbehavior of Markets: A Fractal View of Financial Turbulence - A fantastic book by mathematician, polymath and inventor of fractal Geometry, Benoit Mandelbrot. In this book, Mandelbrot delves deep into the chaotic financial world and gives his insights on market behavior by challenging mainstream assumptions and making us wonder on how much do we really know in the end. Another must read!

- The Grapes of Wrath - A book by American novelist and writter John Steinbeck that describes life in the American Mid-west during the Great Depression. While some may wonder about this book, I totally suggest reading it as it will give you a neccesary sense of humility. A classic and a must read regardless!

- Reminiscences of a Stock Operator - A fantastic biography of perhaps the greatest speculator ever existed, Jesse Livermore. Once you have a basic knowledge on market concepts and investments, seriously consider reading this book as it is a nice literary read on the life of Jesse Livermore and it will certainly help you understand the bigger image in the world of speculation.

YouTube channels:

- Crash Course - An awesome youtube channel with hundreds of educational videos from the Green brothers. In here you can find series dedicated to history, philosophy, science and many, many more. Totally recommended!

- Jordan B Peterson - Jordan Peterson is a clinical phychologist and professor of psychology with many interesting ideas and insights on human biases, beliefs, myths etc as well as an extensive bibliography on matters of psychology. I have recently discovered him and I am watching him closely. What I mostly admire in him is his simple yet deep reasoning and his ability control his emotions and logic under stress. A very interesting person.

Great post. I would like to see how big money manipulate the markets.

This is a nice subject actually. Market manipulation has always been around in markets and we can also see that in crypto space too, especially through vehicles such as Ripple and Tether. Big institutional money moves through these two vehicles and one should always keep on eye on them.

I would like to see how they actually do it. Idea for a post I guess. :)

Kalispera.. diavazontas to post soy nomiza gia mia stigmi oti imoun sti doylia... einai para poli wraio to athro soy..

Σε ευχαριστώ Νίκο! Πιστεύω ότι υπάρχει αρκετός κόσμος σήμερα με ελλιπή γνώση στο θέμα των αγορών ενώ ταυτόχρονα αναλαμβάνει και μεγάλα ρίσκα. Γενικά ο καθένας θα πρέπει να γνωρίζει όσο το δυνατόν περισσότερα γίνεται αν αποφασίσει να κάνει μία οποιαδήποτε επένδυση και να μην επαναπάυεται ποτέ στην γνώση που έχει.

sangat membantu

your post @theodorelib is very good and very useful for visitors and readers ... continue to work

Thank you for you good words @abiumi!

I will do my best!

Also, welcome to Steemit :)

Thank my friend... Follow me @abiumi

This type of comment is considered spam. Many of your previous comments have also been identified as spam. The style of commenting your practicing diminishes the overall quality and authenticity of this platform. @steemflagrewards