Poolz DeFi : Introducing a decentralized layer-3 swapping protocol.

Cryptocurrencies have been a prominent topic in the financial market for many years now. Since its inception, cryptocurrencies have created strong developments that also become a part of everyday life. Even though there aren’t too many people using cryptocurrencies today, there are a number of large establishments accepting cryptocurrencies for payments.

Currently, Defi has also created a great attraction for this market, and on the basis of building projects on Defi. And to be able to connect innovators with investors, through decentralized swaps and an interactive user interface to easily manage pre-listing liquid auctions.

Cryptocurrencies act as a medium of exchange over the Internet, using encryption of functions to carry out transactions themselves. The core of cryptocurrencies is Blockchain technology. This technology helps electricity money do decentralization, transparency and immutability. The trend of the future is digital, so digital currencies are also very important, believe it or not, the crypto community continues to make waves and attract enthusiasts around the world. And cryptocurrencies are still very new, so there are few correlated assets that drive price changes.

They are designed in a decentralized, unregulated, unregulated form, so data issuance, exchange rate changes and political volatility do not affect them as much as fiat currencies often. And to completely disrupt and decentralize liquidity auctions, the project was built with a vision to facilitate greater interoperability through cross-chain interactions, thus further enhancing DeFi adoption and value.

What is Poolz?

Poolz is Pool Trade liquidity, the pool will be there to make initial phase liquidity arrangements for existing tokens and cross-chain token trading. A startup that is ready to build up their DeFi token liquidity can easily use the Poolz stage. Poolz will provide everyone with a safe haven to explore. The DeFi venture has attracted a lot of foothold since its inception due to its accumulation of liquidity. This is a contract with a Concentrated trading stage but by the DEX has not reached its normal possibilities due to certain constraints in the framework. The original case of this limiting element includes market share liquidity and initial financing. Poolz Trade has stepped up to collect accounts for both startups and offers reliable air from which to start to increase startup reserves and expand liquidity.

Poolz will offer a decentralized crypto market that will help new companies to understand their fantasies and aspirations. Business visionaries, organizations will access fair-minded liquidity that will help their creative thinking come to the real world. Poolz will make liquidity pools accessible in the pre-posting period of a business and furthermore for existing crypto resources. This is a great setup in the crypto space.

Poolz Features

- Swap Cross Chains

- Hashed Time Lockdown Contract (HTLC)

- Token Lockout / Vesting Period

- Combustion Mechanism

- Governance & Betting

- Direct Selling Bundles (OTC Offers)

- Time Locked Collection (TLP)

Poolz is a Decentralized Layer-3 exchange protocol, based on the DeFi infrastructure. Navigating long-term business opportunities and market coverage for layer-3 exchange protocols.

Poolz is based on the DAO convention on the Ethereum blockchain. The Decentralized Self-Governing Association arrangement suggests the network takes a dynamic function in the administration and decision-making stage. Community groups make the best choices in stage administration.

Poolz has a token named POZ token. Poolz Token (POZ): This is the Poolz Trading local badge, which is basically used for administration, business progress, and token usage on the poolz network. It is also a client for improvements in the Poolz organization. it is a token that depends on the Ethereum network, the ERC20 token. POZ token capacity as fuel in the Poolz environment.

Here are the most specific use cases of products from Poolz:

Liquidity Bootstrapping: Innovators can leverage the Poolz platform to launch token auctions, thus generating liquidity for their DEX listing. Although the platform is the most relevant for early-stage projects, it can be similarly used by any blockchain-based project.

OTC Trading: Strengthening widespread DeFi adoption, the Poolz platform can also be used as a marketplace for wide-ranging crypto OTC trading.

Yield Generation: Investors can participate in auctions hosted on the Poolz platform, thus generating passive yield from their ETH and DAI holdings by providing liquidity to auctioning projects.

Non-Fungible Token Bid Auction: NFT-based projects can launch dynamic ratio auctions on the Poolz platform, thus diversifying the options for liquidity providers.

Clearly defining who uses the day from the beginning will help Poolz define its goals and focus on developing the next product. I also think that Poolz will get strong support from users because we are in desperate need of a product that Poolz is aiming for.

Poolz also gives users very useful features:

Customizable pool options ensuring relevance for wide-ranging blockchain-based projects and use cases, alongside multi-chain integrations and support. Poolz is built with the long-term aim of enabling a unified interface with cross-chain interactions and other functionalities. A fully decentralized, non-custodial, and trustless ecosystem with robust, Solidity-based smart contracts. An interactive, intuitive, and responsive UI, coded in React for a smooth and seamless user experience. Moreover, Poolz integrates Web3 libraries to access continuous feedback from on-chain data, thus implementing necessary UI upgrades for optimum consistency. Unit testing of smart contracts and network code using Ganache, ensuring optimal bug-resistance and security. Continual and multi-level incentivization mechanisms, facilitating recurrent gains for investors, liquidity providers, and yield farmers. Due to Poolz’s optimized network and contract architecture, innovators require substantially lesser gas fee for registering their pools, as compared to existing market standards

An Overview of the Poolz ecosytem operations

Poolz is built as a DAO protocol on ethereum, and the premise of the Poolz operations and governance is that, the community gets to decides how governance and operations will evolve, going forward. So even though our team get to set the initial operations, the community still gets to decide how it eventually evolves.

Please note that, this overview is not an exhaustive representation of the overall Poolz operations. That will be available in the litepaper. What is captured here is a brief summary of the its operation:

Poolz (POZ) token: this is an ERC-2O token, since Poolz is deployed on Ethereum. It will be used for incentivization, to pay for developmental cost goin forward and governance requirements. Also, POZ holders get to be discounted with pool entry and simply for being holders of POZ, so you get to earn more POZ for having POZ.

Pool Type: there will be two pool types on Poolz, which is the direct sales pool (DSP), where the tokens are received by the investor, imediately after a swap, and the time-lock pools (TLP), where the pools have a lock-in-period, before the tokens are released to the investors.

Poolz Market Players: There are two categories of players in the market, which are the liquidity providers (LP), technically the market makers, and those in need of the liquidity or Pool creators.

Pool rule makers: every pool on Poolz come with basic rules and the pool creators, which are usually the project owners, for new tokens, get to set the rules. The parameters for this rule includes choices like: relevant blockchain protocol and wallet for the swap, pool type, pool duration (in the case of a timelock pool,) available token for the pool or auction, the swapping ratio and several others.

Planned Improvements: as an eventual milestone in the poolz functional agenda, there will be a cross-chain token transfer implementation, at a later stage of its developmental roadmap. This will allow for non-ethereum tokens to be swapped by the poolz protocol.

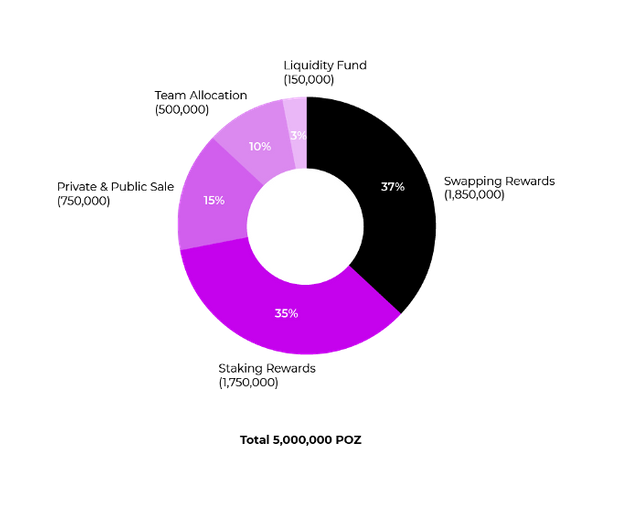

Poolz (POZ) Token:

About Poolz (POZ) Token: POZ Token is the standard ERC-20 method. As a native Poolz property, POZ will be used to promote, manage, further project development, and burn tokens on the Poolz network.

- Token Name: PoolzDefi Token

- Ticker: POZ

- Type: ERC20

- Initial Supply: 750,000

- Total Supply: 5,000,000

- Seed Sale: 240,000 POZ, at 0.455 USD (avg. price). 25% TGE, then 25% quarterly.

- Private Sale: 360,000 POZ, at 1 USD, with a capping of 2500 USD per person. 20% released on the day of sale and 20% after a month from the sale day. The remaining 60% is released as equal monthly vestings of 20%, for 3 months.

- Auction Pools: 150,000 POZ to be auctioned at 1.6 USD.

- Uniswap Listing Price: TBD.

Conclusion

This is the standard format of declaring Poolz DeFi pools closed. Here, the predefined tokens are issued and the duration of the pool is complete. However, if there are some left-over tokens, they will be returned to the wallet of the PO while the investors will receive their swapped tokens via the Time-Locked Pools (TLP).

The $16 billion Decentralized Finance (DeFi) industry by market capitalization can as well move to $20 billion because the opportunities presented by Poolz DeFi have strong fundamentals to position the DeFi industry for more market capitalization opportunities.

For more information PoolzDefi :

Website: https://poolzdefi.com/

Medium: https://medium.com/@Poolz

Twitter: https://twitter.com/Poolz__

Telegram: https://t.me/PoolzOfficialCommunity

Telegram Announcements: https://t.me/Poolz_Announcements

Github: https://github.com/PoolzAdmin/Poolz

cryptojozz

0x6AaB8a727a208e4f6783acA2BDD88CB36b18eFfc