Economic Collapse Indicator - FED shows Interbank Lending Tanks!

When it comes to the economy, and the news that we are fed by the mainstream media, we always hear the news a little bit too late to be of any benefit to us.

In 2008, the Fed chief was still publicly optimistic about the economy a day before the meltdown of AIG, Lehman etc. And this was while they were telling Congress that not bailing out the banks would be the end of America and likely martial law.

It is not a matter of timing, and getting the news feed to the networks too late. It is a case of outright lying, the background reality of the severity of the sub-prime loan was deliberately withheld from the public.

So, we, the public, must look behind the curtain at inside indicators rather than the rosy news reports and Dow Jones average numbers.

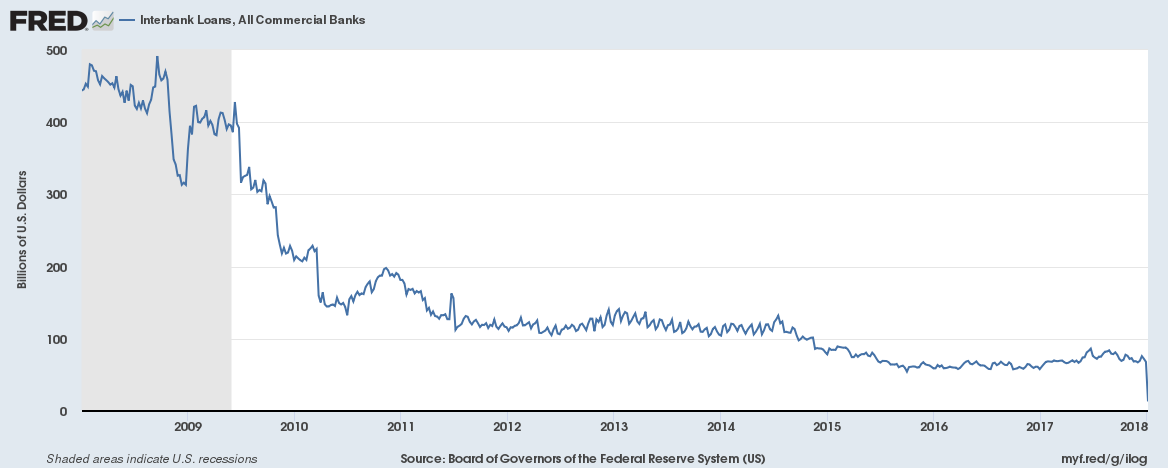

One such indicator, that you will never see on primetime TV or in the newspaper headlines, is the Interbank lending rate. In a nutchell, this is the activity of banks lending to each other, to put their short term and overnight funds to work earning interest. It is also, a great indicator of the confidence that banks have in each other. This chart and data comes directly from the St. Louis Federal Reserve bank. These are their numbers, not mine.

Just prior to the meltdown in 2008, the Interbank lending rate was hovering around $500 billion (the high in September was $491b) As you can see, this lending activity stalled out by Christmas to $313b, down 36%. This lack of internal bank confidence foreshadowed the crisis to come, that we would publicly learn about after the fact.

You can see the plunge in the last quarter of 2008 of the graph.

For some reason that I won't speculate on, the data is delayed, such that the most recent data is from early January 2018. However, there is an alarming steep drop that shows a lack of confidence again, by banks, in the stability of their own industry. On the graph below, also from the Fed, we see that Interbank lending was stable until around Christmas 2017, at a level of about $60 billion. By January, 2018, this rate had dropped a whopping 78% to a level of only $13 billion.

.png)

This lack of confidence from behind the curtain, within the banking industry, looks similar but more severe than that in 2008. Of course, the media only tells us fragrant rosy positive news about the economy, until it changes, surprising everyone (except maybe the insiders who saw it coming)

I'd suggest that this Fed data is telling us that the economy, and certainly the stock/equities markets, are not in a healthy happy place.

Integrate this into an even bigger picture ;-) https://steemit.com/news/@rakim/the-russian-alternative-to-the-swift-system-what-is-it

Congratulations @truthpointer! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!