Possible way of serious manipulation!

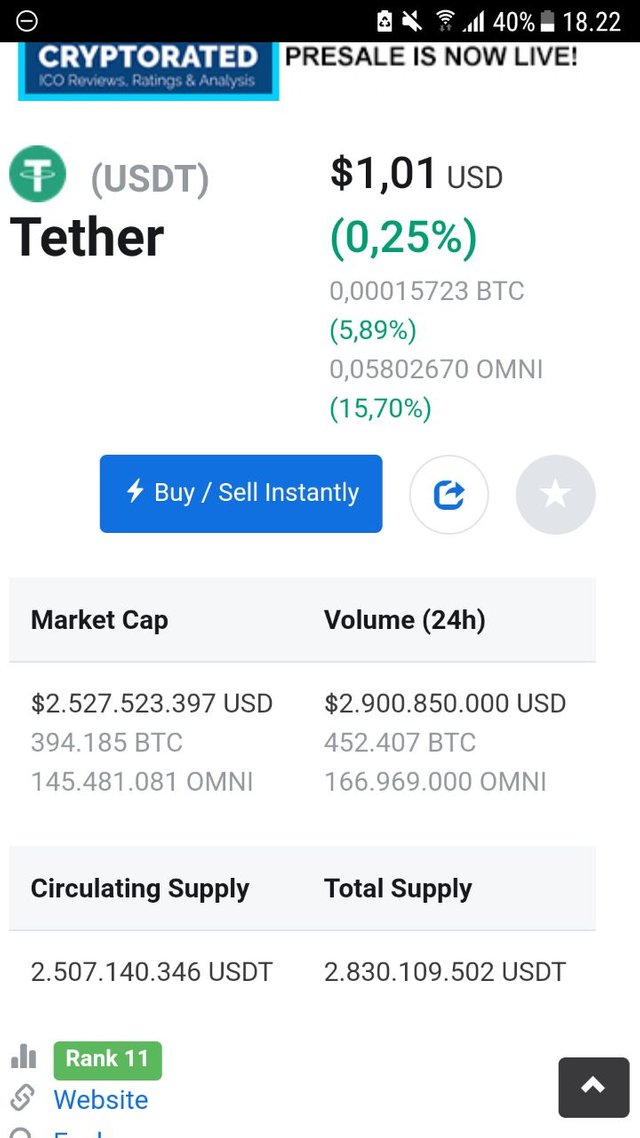

The 66-page document, which researchers Amin Shams and John M. Griffin released, accuses Tether Ltd. from manipulation. It has the same name Tether (USDT) on the neck, Stable cognac. Tether is covered by the US dollar, which also comes from the USDT. It is allegedly included in a ratio of 1: 1, meaning that the company has the same USDT tok as USD. Researchers Shams and Griffin, however, found that they did not really have to.

The 66-page document, which researchers Amin Shams and John M. Griffin released, accuses Tether Ltd. from manipulation. It has the same name Tether (USDT) on the neck, Stable cognac. Tether is covered by the US dollar, which also comes from the USDT. It is allegedly included in a ratio of 1: 1, meaning that the company has the same USDT tok as USD. Researchers Shams and Griffin, however, found that they did not really have to.

According to their statement, most of the time at the end of the month when a large amount of USDT was issued is a major pressure on the BTC. This suggests that Tether also publishes some USDT "tokens" that are not, as they claim, covered by a dollar. The result is a negative pressure on BTC's price and hence its decline. At the end of the month, BTC put the reserve into the reserve and could talk again that USDT is a stable wood, covered in USD in a 1: 1 ratio.

USDT as responsible for the BTC rocket rise in December

According to a report from Texas University researchers, cryptomeni prices are being manipulated as follows. Tether, or USDT is issued by Tether Ltd. after 200 million tokens, which are then transferred to Bitfinex. As soon as the BTC price drops thereafter, Bitfinex is using the BitTorrent BitTorrent BitTorrent Algorithm to help coordinate the purchase of Bitcoin with USDT, which puts Bitcoin's price on the upside. The study also declares Chainalaysis as trusted.

"We find that Tether has a significant impact on cryptomania. Tether appears to be used not only to stabilize but also to manipulate Bitcoin prices, "the researchers wrote.

They add that less than 1% of the time associated with Tether transactions is 50% associated with BTC growth and 64% with growth of alcohoins.

Tether, however, blamed researchers for handling the BTC at the end of last year, when its price rose to $ 20,000. And not only Tether, but also the Bitfinex cryptobus, which had to deal with the transaction. And it's not the first time Tether has been charged with unfair action. At the end of last year, the US Securities and Exchange Commission received a summons. However, it is not clear how the company's investigation has continued.

conclusion

Transparency and decentralization, thus exempting governments and institutions. These are some of the main cryptomenias pillars Bitcoin pioneers. However, Tether's current allegation of untrustworthy manipulation of the BTC price, unfortunately, carries in the carat those who accuse cryptomes of being used to fund unfair activities, and that in fact it is much more manipulable than ordinary fiat. Worse, Griffin and Shams are also starting to get involved with mainstream media. Hopefully, this case will not imply any limiting regulations or similar steps that would punish the entire industry before the culprit himself.

God bless you. https://steemit.com/@biblegateway