Yesterday’s Perfect Recession Warning May Be Failing You

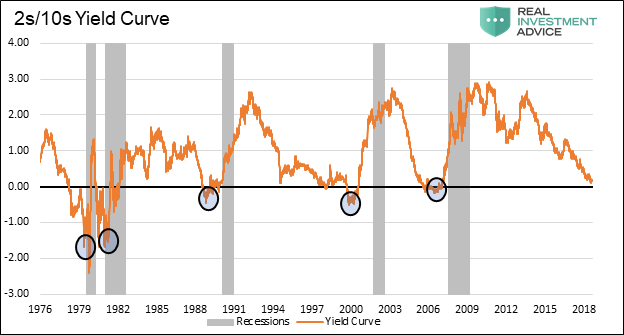

An inverted yield curve is one of the more predictable indicators of recession.

It is not as clear as it seems. When the curve inverts, the incentive to lend longer term is diminished. The steepness of the curve also tells a large part of the story.

Many are watching the yield curve, something that might not happen. While recession still could be in the cards, the perfect recession warning might not be ideal in this instance.

Click on image to read full story.

You got a 50.10% upvote from @joeparys! Thank you for your support of our services. To continue your support, please follow and delegate Steem power to @joeparys for daily steem and steem dollar payouts!

About 96.95$ has been spent to promote this content.

Thanks for using @edensgarden!

You got a 54.53% upvote from @emperorofnaps courtesy of @steemium!

Want to promote your posts too? Send 0.05+ SBD or STEEM to @emperorofnaps to receive a share of a full upvote every 2.4 hours...Then go relax and take a nap!

This post has received a 44.32 % upvote from @boomerang.

It looks to me from that chart it’s a fore teller of recession. I wonder what some other signs are. Is the stock mark in irrational exuberance levels? Here in Australia we have low interest rates and still our housing bubble is bursting.