induced inflation in Venezuela. Causes

There is no economic theory to explain the sudden and disproportionate change in price levels since 2012 in Venezuela.

The economy of Venezuela is oriented towards exports. Venezuela's main economic activity is the exploitation and refining of oil for export, extraction and refining is the responsibility of the state-owned company Petróleos de Venezuela (PDVSA).

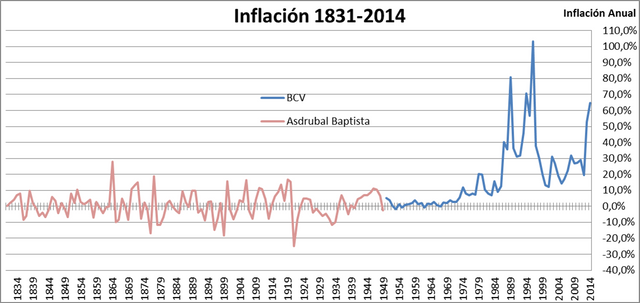

From the 1950s to the early 1980s the Venezuelan economy experienced a steady growth that attracted many immigrants. During the fall of oil prices in the 1980s the economy contracted, and inflation soared to peaks of 84% in 1989 and 99% in 1996.

From 1999 to 2006, inflation levels remained relatively constant. The largest price increases were registered in 2002 and 2003 as a result of the decrease in production levels of 9% and 8% respectively, a fall that was the result of the sabotage of the oil industry and the employer's strike. Inflation in those years amounted to 22.4% and 31.1%.

However, starting in 2006, there have been increases in prices that are not proportional to the variations in production. During 2007, inflation was 18.7%, but was accompanied by an increase in production of 9%. Likewise, in 2010, inflation was 29%, and production, although it fell, only did so at 1%. This phenomenon becomes more inexplicable from the year 2012 in which prices increased 20.1% while the economy grew 6%; in 2013 inflation was higher (34.7%) and GDP increased 1%.

During 2014 and 2015, inflation levels were higher, and although production fell in those years, proportionally, there is no relationship between prices and production levels: in 2014 inflation was 53.4% and in 2015 it was 180 , 9%, both much higher than in 2002 and 2003. However, the fall in production in 2014 and 2015 was lower than in 2002 and 2003 (-4% and -6%). Additionally, in absolute terms and per capita, production levels for 2014 and 2015 are relatively high when compared with 2002 and 2003.

This increase in prices observed since 2012 does not bear any relation to the behavior of production. It is not the fall in gross domestic product that is explaining disproportionate inflation since 2012.

In the framework of this economic war, inflation will not stop even if production levels increase. We do not mean by this that there is no need to produce, it is very important to produce, especially because the unemployment rate decreases and more households would receive income. What we are trying to say is that prices will continue to climb until their real cause is stopped. They will continue to climb, as long as the illegal exchange rate continues to be manipulated.

The emission of "inorganic" money is not the cause of inflation either

Scholars of the economy insist on affirming that the cause of inflation in Venezuela, especially in recent years is the emission of "organic" money. The argument is the following: the State, to fulfill its commitments of expenses and investments, among them the increase of the wages of the employees and workers of the public sector and the payment of the pensions to the elderly, increases the amount of money that circulates in the economy. Since this money, according to scholars, has no support in the real economy, its expansion leads to an increase in prices.

In this regard it is necessary to make several precisions. Certainly, both the monetary base and monetary liquidity have increased in recent years. However, given the induced increases in prices, whose original cause is the manipulation of the exchange rate in the illegal market (dolartoday), the State has been forced to expand monetary liquidity in order to respond, in the first place, to the greater requirements of bills and coins (when prices increase disproportionately, transactions made in cash will require more paper money: if we bought a pie in the corner at Bs. 1000.00 and increased to Bs. 2000.00 , we need twice as much cash to pay in cash).

Second, to meet the goals established in the plans and budgets of public expenditure, the State, before the induced increase in prices if it has seen the need to request additional credits, for example, for the acquisition of medicines that now They have a higher price and which can not be covered with the expense budget. In this scenario of very rapid escalation of prices, which although induced, is real, the State is forced to expand the amount of money to cover the expenses that allow achieving the goals of the government.

Third, the State, faced with the induced increases in prices that mainly affect the working class, and with the objective of containing the induced deterioration of purchasing power and maintaining the purchasing power of households, is obliged to adjust wages including those of employees and workers in the public sector, which in turn requires the request for additional credits and the expansion of monetary liquidity.

In other words, the expansion of monetary liquidity is not the cause of inflation in Venezuela, it is the response to inflation that is arising, previously and for different reasons, in this case, by the manipulation of the illegal exchange rate. Empirically, we observe that increases in monetary liquidity are subsequent to increases in prices.

We highlight in the graph the years 1989, 1996 and 1999, in which the amount of money that circulated in the economy (monetary liquidity) increased after the inflationary peaks. Additionally, how to support the claim that the expansion of monetary liquidity is the cause of inflation, if for example between 2002 and 2009 there were significant increases in the working capital in the economy, but nevertheless the price levels remained relatively constants The same occurred between the years 2010 and 2012.

With all certainty we affirm that it is not the impression of "inorganic" money that is generating inflation and we do it with the following argument based on the monetarist theory itself and on empirical evidence for the Venezuelan case. The theory states that by expanding the amount of money circulating in the economy, economic agents, in this case consumers, having more money, and given a marginal propensity to consume, will increase their demand and in that case, when Demand increases and there is a fixed supply, there will be pressure on prices.

In other words, for prices to increase as a consequence of the increase in the amount of money, it is necessary that in real markets, this increase in liquidity is reflected in an increase in aggregate demand. Which has not happened in Venezuela. The aggregate demand since 2012 and until 2015, not only has not increased in the same proportion as monetary liquidity has, but also has decreased 15%.

It can be seen that since 2012, the increases in monetary liquidity did not lead to increases in global demand, and therefore, the aforementioned condition that prices increase as a result of the increase in demand, in turn consequence of the greater amount of money in circulation, is not fulfilled, at least since 2012.

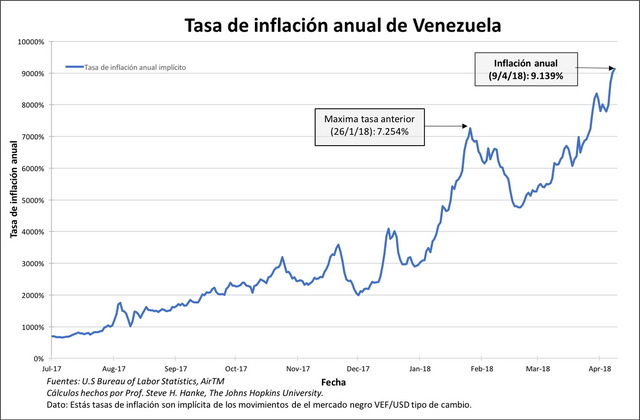

In just two months, Venezuelan inflation, the highest in the world, accelerated its dizzying pace, going from 4,966% annually at the end of February to over 13,000% in April.

the National Assembly of Venezuela, announced the scandalous figure of hyperinflation, which according to estimates will close at almost 100,000%.

The deputy Ángel Alvarado pointed out that the projected inflation by the end of 2018 is 904,453%, which will turn the South American country into the nation with the highest inflation in the history of the region. "Venezuela is rising in the ranking of the largest hyperinflation in the history of mankind," said the deputy.

Recommendations:

-Allocation of foreign currency to national and transnational companies

-Strict supervision and penalization of any overbilling attempt.

-Assign the currencies based on the invoicing, prior control of the international reference prices, transferring the payment directly to the suppliers, this with the objective of avoiding the exchange speculation between the currencies assigned by the State and those that are traded in the section of individuals.

-Create an integrated system that allows monitoring and control of the use of the State's currencies from the moment of allocation to its final destination, through the customs and tax system.

-Make public said system, as well as the allocation lists of currencies, in order to exercise the public and social control of the use of the currencies that, although administered by the State, are of all Venezuelans

-Exchange rate for the valuation of assets, profits and repatriation of dividends

- Given that one of the arguments of the transnational corporations is the difficulty to acquire the currencies for the repatriation of their dividends, it is proposed to create a section in the exchange system in which they can freely buy and sell their currencies

Congratulations @casifitnessvzla! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP