Implications of the Current Crisis for the Economy of the Future

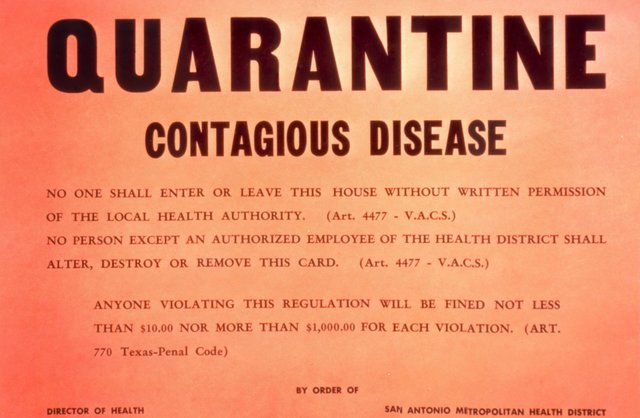

I have it on good word from a firefighter who is a member of the local virus-response task force that lockdowns will not be for 14 days – they will be much, much longer.

Everyone will be prevented from going anywhere other than the pharmacy, grocery store, doctor's office, or gas station.

If that's the case, you can forget about the markets finding any "bottom." If economic activity stops, markets will have to be shut down in order to prevent them from going to zero. It's already happened in The Philippines.

Gold and silver are either sold out or selling for insane premiums. People appear to be losing faith in fiat, central banks, and governments.

Bitcoin tanked along with everything else initially because of institutions that had gotten involved and had to scramble for liquidity. Yet now BTC is beginning to look like an appealing option, and might soon be the only option left.

Financial Restrictions Coming Soon

While my firefighter friend mentioned that no one will like the physical restrictions that will soon be placed on their freedom to move and act, he may not have been aware of the coming financial restrictions.

Some of these include NIRP, a ban on cash, and a market shutdown (note that I'm speculating here, but these are all very real possibilities, and two out of the three are already happening in places outside the USA).

Negative Interest Rates

It seems obvious now that the implementation of negative interest rate policy (NIRP) by The Federal Reserve is a near-certainty. Many people, some of them much wealthier and more intelligent than myself, have made this same assertion, e.g., Grant Cardone in a recent Instagram video.

Central banks have already blown their bazookas. It hasn’t done much, and it’s not going to.

A weak economy has been papered over with easy money for more than a decade. That wasn’t so hard to accomplish. But during that whole time, things were at least functioning.

Now, nothing is happening. There’s nothing to paper over. As I said in my last post, this isn’t a house of cards. It’s an imaginary table with no cards on it (obviously, since a fake table can’t hold cards).

Zero interest means that money and time (i.e., the amount of human life that it takes to earn money, at least for those of us who don’t have the privilege of our own central bank printing press, or are not in close enough proximity to it to benefit via the Cantillon Effect) have no value. Negative interest means that time has negative value. Think of it like a soft version of slow-motion slavery.

Your money will be slowly taken from you whether you like it or not.

But wait, can’t you just take that money out of the bank or other financial institution where it sits? Won’t that be an option?

Ban on Cash

In order to prevent a run on the banks in light of NIRP, cash will have to be banned.

There’s not much to say on this point. The war on cash has been heating up for years, and an estimated 90% of people now make most or all of their purchases with payment methods other than cash.

It’s unclear how people will pay for hookers and blow without cold hard cash, though. This could be a serious problem, as some countries, including Italy, have added things like prostitution and drugs to calculations of their gross domestic product (GDP).

[That’s not a joke, by the way. According to a 2014 article from Business Insider and many other sources, it’s true. See here: https://www.businessinsider.com/drugs-prostitutes-add-to-italy-gdp-2014-10?op=1]

Market Shutdown

In The Philippines, financial markets have been shut down.

Period, end of story.

They didn’t stop at just banning short-selling like some nation-states have begun doing. The entire market is closed until further notice.

I believe this will be the case worldwide soon. Jim Rickards, in his 2017 book The Death of Money, spoke of this exact thing happening during the next financial crisis. According to Rickards, those in power have been planning for this moment for years now. They know that flooding the system with liquidity won’t work as it did twelve years ago. Shutting the system down will be the only way.

We don’t need to get into all the “conspiracy” talk of the specific event triggering the current meltdown or speculate on its origins, intentions, or ultimate outcomes. That’s not our main concern here.

The fact of the matter is that this crisis has been a long time in the making, and it’s naïve to expect that the wealthiest and most powerful people in the world were somehow unaware of that.

Since at least 2014, statements issued by large financial entities such as the IMF and BIS have contained veiled verbiage warning of the eventuality of the kind of scenario the world now finds itself in. I don’t have time to include specific examples, but they can be found in Rickard’s book, for those interested.

Is This the End?

For the most part, many people seem to have an optimistic view of current events.

“It’ll be over before you know it and everything will go back to normal,” for example.

But is reality that simple?

If most of the global economy has to be shut down, even for a month or two, how long will it take to recover? How will people cope with losing their jobs and any savings they may have had? Will helicopter money provided by governments suffice? (hint: it's unlikely that "we the people" will see a bailout anywhere near as large as what the banks received in 2008. Are we not also too big to fail, even if these circumstances are different? Keep in mind, the 2008 crisis was one of the banks' own making. This time, the average person has nothing to do with the cause, and yet they will, in all likelihood, only receive a small bailout). What about all the businesses that will have to shut down, some of which will never be able to open their doors again?

The chain-reaction already set into motion is too complex to comprehend in its entirety. But it’s not hard to see that the results will be catastrophic at best.

Like Gerald Celente of the Trends journal, I believe the greatest depression has begun – the greatest depression in the history of humankind. It will make “the great depression” of the 1930s look like happy days.

There may be no coming back from what happens next. Things will return to normal, as they always do, but our definition of "normal" will be much different than it has been to date.

Thanks for reading! Follow me on these platforms, too!

https://www.clippings.me/bdncontent

https://bnibley.blogspot.com

https://medium.com/@brian.nibley

https://www.tremr.com/Brian-Dean-Nibley

https://steemit.com/@bdncontent

https://www.minds.com/BrianDNibley

https://www.blockdelta.io/members/bdncontent/

https://www.instagram.com/bdncontent/

https://twitter.com/BDNcontent

https://linkedin.com/in/freelance-cryptocurrency-writer

https://www.pinterest.com/BDNcontent/

https://facebook.com/BDNcontent/

https://blockchain.news/Profile?userId=563cdd05-584d-4cc0-ad03-bd488404900e

https://www.amazon.com/s?i=digital-text&rh=p_27%3ABrian+Nibley&s=relevancerank&text=Brian+Nibley&ref=dp_byline_sr_ebooks_1

Bitcoin tips:

3N5DgpE3xBFTJ6GD4eiDZsX8cLG2UuP1zB