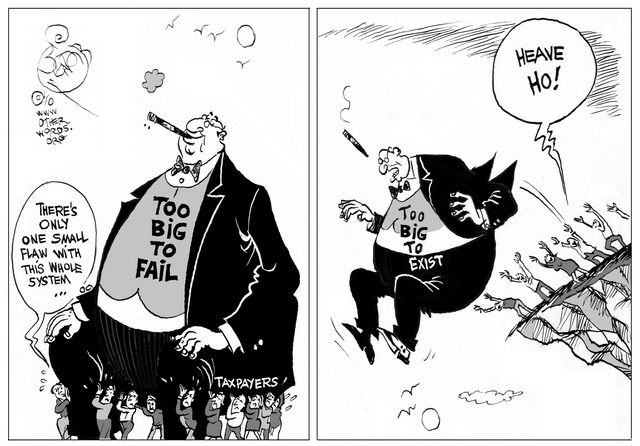

The Stock Market is Literally Too Big to Fail

A couple of months ago I had a discussion about the US Stock Markets with someone in person (yeah, I'm old fashioned apparently), and we both concluded that the US stock market is too big to fail.

This thesis has proven correct so far, not because its a 50/50 coin flip, but because of the amount of desperate effort being put into keeping the stock market from tumbling. For all intents and purposes, the crash happened in December 2018, but the central banks of the world, including the Federal Reserve set about to keep the expansion going.

This expansion isn't an organic expansion, as we've learned in recent months that retail investors are net zero investors in the stock market since 2008, with a large majority of the stock market action being stock buy-backs, which were made illegal after the 1929 crash because they are a form of racketeering, yet someone had the bright idea to make it legal again, because who doesn't like another great depression, right? Of course, tariffs were the icing on the cake in the 1930's, and the catalyst that triggered the crash, but Trump is a genius, right?

Looking at the indices, we can see that a new trend line has been established in a panic move. Thanks to Gregory Mannarino (@marketreport) we know by their own admission that the Fed have at least one trading desk, and I can't imagine anyone insane enough to have caught the falling knives this week but someone with bottomless pockets (literally).

It's a move of desperation, and an attempt to retcon the past few weeks out of existence and reshape the story before a panic. Of course, this brings up some interesting points:

Is there even anyone in these markets anymore outside of the corporate stock buy-back racket? I mean, aside from day traders, is their any cognition present or is it just dumb money and would-be criminals?

And yes, it is a racket because corporations selling and buying back their own stocks in an infinite loop to push valuations higher and get bigger bonuses and dividends, while execs and higher ups get to sell at top dollar should be illegal, but it's not, and anyone in north America who still has two nickels to rub together is going to pay for it through inflation, loss of dollar purchasing power, housing crashes, industry crashes, unions striking and freezing up what little water was left, and speaking of water this doesn't even cover the wheat shortage crisis around the world, or the US agricultural seed shortages for next years crops after this years massive flooding and crop failures in the US and Canada.

As I said: too big to fail. However, the bigger they are, the harder they fall. I'm a tall person, I speak from experience lol.

I can't give advice to people, nor would I expect anyone to follow it because no single person should be your source of information, but if you have money sitting in a fund that is high risk... may whatever god you believe in have mercy on you, because the stock market is an illusion, like the emperor who has no clothes.

I'm not fooled by this new trend line being established, and neither should you. If you ever decide to get into precious metals and you live in the US, I would highly recommend sticking with coins. There is a good video by Lynette Zang that was uploaded recently on youtube discussing gold and silver confiscation laws in the US, and her information and insights are worth their weight in gold.

Thank you for reading. Stay safe and keep your head up, always.