All Systems 'Go' For Growth Despite Trade Wars

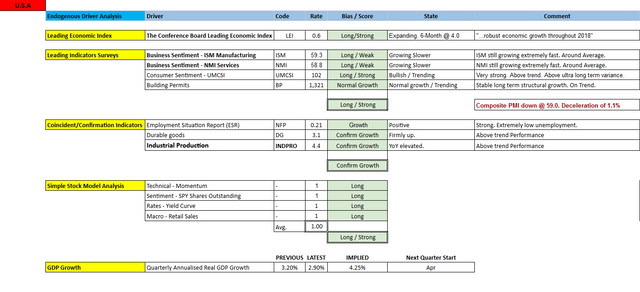

Leading economic indicators reported as of 5th April 2018 show strong growth potential in the United States economy for the short/medium term. All major leading indicators currently show growth supported by a positive reading of the Conference Board leading index. All coincident/confirmation indicators confirm growth. All indicators in the 'Simple Stock Model' analysis currently confirms growth. Implied GDP growth currently sits at a healthy 4.25%. Official Q4 GDP revised up at 2.9%.

This months release from the Conference Board commented on the savage downturn in stock markets and its apparent lack of effect on the economic landscape, it would appear that any fear or uncertainty that was expected to be transferred into business conditions has been over-hyped with the latest release stating:

The LEI points to robust economic growth throughout 2018. Its six-month growth rate has not been this high since the first quarter of 2011.

While stock market volatility appeared to have little effect, Trump's new tariffs have caused volatility of a different kind. The best description on current materials volatility came from construction services.

The unbelievable amount of market volatility in construction-related materials ... continues. Accurate, long-term planning has become incredibly difficult, as distributors that historically held costs for at least 30 days are now, in some cases, committing to only seven days, as prices can change drastically in that time.

And more from machinery manufacturing.

Much concern in the industry regarding the steel and aluminum tariffs recently [imposed]. This is causing panic buying, driving the near-term prices higher and [leading to] inventory shortages for non-contract customers.

Aside from these industry specific worries, consumer confidence is at extremely high levels, unemployment is at extremely low levels and industrial production (an important leading indicator to the SP500) is growing very strongly to propel us into May.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.