Expect Lower Returns in the Stock Market

Disclosure: I am not a professional analyst. The opinions expressed in this article are my own and is not investment advice.

Written on October 15, 2017

On October 13, 2017, the average return for the S&P 500 was at 7.30%. Deduct an average rate of ~2% from inflation, and the real rate of return drops to 5.30% if the stock doesn’t include dividends.

Basic returns (excluding shorts) are based on the concept of buying low and selling high; however, in the current market conditions, stock prices tends to be overpriced—October 13, S&P 500 PE Ratio: estimated 25.46—which makes it very difficult to follow such a basic concept; therefore, explaining the low returns. Returns will continue to drop while risk continues to grow in the market due to the Federal Reserve stopping its uses of Quantitative Easing.

Quantitative Easing

Quantitative easing, a monetary policy in which the Federal Reserve purchases securities from the bank at lower interest rates to increase the money supply in the economy. The policy was enacted to counteract the Housing Market crash from 2007 to 2008. By having lower interest rates, companies and banks are able to fund more projects by utilizing debt.

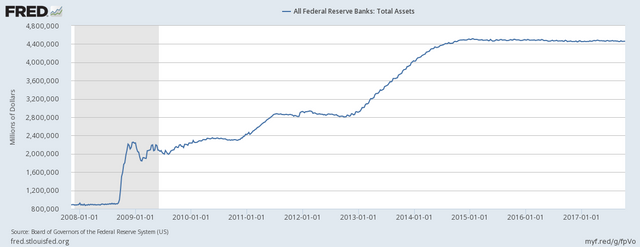

At the beginning of 2008, the value of total assets on the Federal Reserve’s Balance sheet was near $900 billion dollars. By November, 2008 the total amount of assets more than doubled to $2.2 trillion dollars to help provide liquidity and stimulation in the economy. By 2014, the total amount of assets doubled to $4.4 trillion dollars in total assets and remains stable at the current level. By stopping Quantitative Easing, the Federal Reserve allows room for interest rates to rise which will cause lower returns in the market.

Expect Lower Returns with Higher Interest Rates

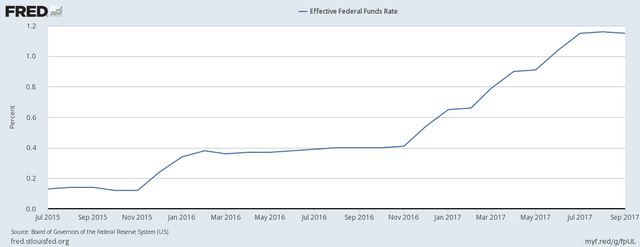

The Federal Reserve has been raising interest rates since 2015. There are many reasons on why low interest rates can be detrimental to the economy. One reason, is that lowering the interest rate is supposed to act as a stimulant for the economy during a drop in the market—slowdowns, bear market , and depression—however, the U.S. economy cannot decrease interest rates if it is already near 0%; unless they want to follow in Japan and Europe footsteps of having negative interest rates. The chart below shows the Federal Reserve attempts at increasing interest rates.

Results of an increase in interest rates:

- There will be less borrowing in the economy due to higher interest rates

- More incentives for residents to save, which will decrease the money velocity

a. A self-reinforcing cycle if the market slows down - Increase in the value of the dollar if inflationary rate remains consistent

a. Difficult for foreign countries to purchase U.S. products

b. Spurs foreign consumption

It is essential for the economy to increase interest rates, even though it will cause a momentary downturn in the economy.

Higher interest rates will provide a great buffer during the next bear market.

Closing:

The current market of higher premiums for lower returns while maintaining high risks is a very unclear venture. There are perks in holding money; however, safety sacrifices opportunity costs.

Alternatives:

- Personal Growth

a. Reduce personal costs/expenses

b. Put time & money in education - Decrease loans/debts

a. Paying off debts, guarantees a return by having lower interest payments

i. Returns not as obvious nor as exciting as exciting as stock returns

ii. 0% returns are better than say 5% (arbitrary number) in interest payments

Congratulations @value.investor! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP