We may not be "Due" for economic collapse

Often I hear the idea that we are overdue, timewise, for an economic correction. While there probably is some merit to this, maybe time is not the deciding factor. Magnitude of growth could be a better indicator. (All of my libertarian friends are going to cringe) This idea could suggest that we may still have a long way to go before we see another correction.

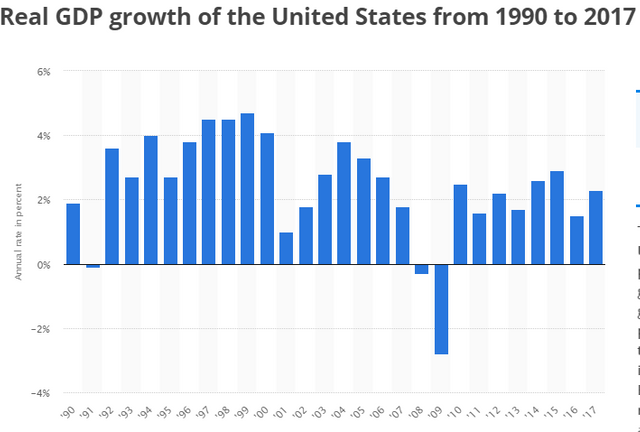

From ’91 to the dot com bust in ’01, The US had a cumulative real GDP growth of ~35%. In ’01, our GDP growth didn’t even drop below 0%. Since the beginning of our most recent recovery, starting in ’10, US’s GDP growth has totaled ~18%. Basically, half of our previous growth run. To be conservative, I didn’t even add post ’01 growth to the first span of time.

A few side notes:

None of this accounts for the acceleration of growth in the size of government, which distorts GDP upward in it’s accounting, usually stunts competition, and necessarily pulls production out of the economy.

None of this accounts for the inane interest rate policy over the past decade.

With all of the volatility in the equity markets we have seen lately, it’s anyone’s guess.

Thoughts?