Building Wealth; Market Cycles... And You Can Too!

I've always had the knack for business. When I was younger, I'd visit my various neighborhood friend's houses to find parents willing to pay me for my yard work services year round. Often times, the invitations of those friends to play and have fun were stonewalled by my desire to work and make money. In the later years, those more mischievous, I found myself growing and manufacturing plants and chemicals for profit with a great deal of success. When I finally got in some serious trouble, I found myself locked in a cell for an extended stay. Many years later, I'm still finding new ways to make money, but I've learned to play by the rules of the new world, while keeping myself out of trouble. Many hours, perhaps hundreds of hours of my time have been spent learning the habits of the rich, those 1% of individuals who we hear about accumulating a majority of the world's assets, while the rest of the population in most of the world struggles with accumulating enough food to feed their children.

My intention is to show you some of the tools that the rich use to invest their money that multiplies their wealth over time. You can use these same tools to multiply your personal wealth and secure your financial future, that of your children and grandchildren.

Assets and Liabilities...

I own a house, a car, a boat, 2 businesses that are thriving and a cat. How many assets did you count? Well, if I own 2 businesses that are thriving, those are the only assets I see. This is because out of all of that 'stuff', those are the only two things that are providing me with income. If my house were a rental property that I own and it were generating income, then that would be included in my asset column. Since I live in my house, and I pay a mortgage and property taxes on them, it is NOT an asset. It is a liability. If you haven't caught on yet, simply put, an asset is something that puts money into your pocket and a liability is something that takes money out. Although it's the liabilities that we truly enjoy, like large houses, fast cars, trophy wives and expensive scotch, it's the assets like productive businesses, real estate, stock market investments and commodities that make people truly wealthy.

The 3 (4) Major Asset Classes...

There are 4-ish asset classes. The reason I say "ish" is because I've already mentioned that assets are things that put money into your pocket and one of these 'asset classes' don't quite apply. They are Stocks and Bonds (and other cash denominated assets alike), Real Estate (which could be commercial, farm land, residential, rental etc.), Businesses and Commodities. All of these asset classes have the potential to create cash flow, except for commodities, which is why it doesn't traditionally apply as an asset class. Commodities like Gold and Silver can be used as both an inflation hedge, or a long term investment, but one that doesn't create passive cash flow income. The wealthy become wealthier by accumulating assets in these four categories, the smart ones by taking advantage of market cycles.

Market cycles... and you can too!

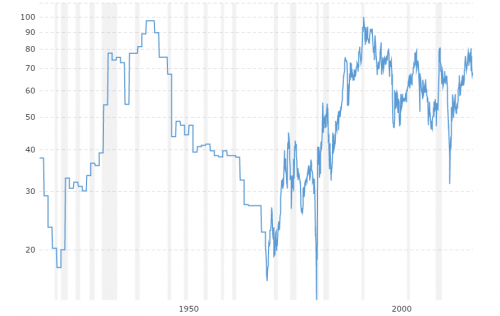

Market cycles are the movements of asset valuations from overvalued to undervalued back to overvalued constantly repeating. I know, confusing opener there. Let me give you a visual representation.

The chart above is the historical valuations of the Dow Jones Industrial Average (DOW) VS Gold. In January 1980, if you owned 1OZ of Gold, you could used the proceeds of selling it to buy 1 share of the DOW. If you'd held your stock market holdings until August of 1999, you could have traded in those stocks for 42 ounces of gold. That's a 42 times profit in just under 20 years by using market cycles to your advantage.

You can see that in the Silver VS Gold Ratio Chart that there are violent swings even in the precious metals sector. If you'd have started with one ounce of gold in December of 1979, the proceeds of selling that ounce of gold for silver would have bought you 14 ounces, but if you'd held that ounce of gold until January of 1991, the proceeds from selling your gold for silver would have given you 100 ounces of silver. Trading silver back in again for gold in February of 1998 would have doubled your previous holdings. The principal here is to find out when something is historically undervalued and trade it for an asset that is overvalued. Your gains are made when you purchase the asset at a discount.

The ultra rich use these same principals to trade between asset classes, building long term wealth. When the real estate bubble popped in 2008, buy signals were flown. Investors starting picking up real estate at rock bottom prices, expanding their portfolios of commercial, rental properties and farmland.

Dollar as a measuring stick...

You can't use the dollar to judge the true value of another asset, because even if the price of something is increasing, the value may be dropping. I'll give an example. I have a basketball and a soccer ball, both of which I bought for $5 last year. This year, the price of soccer balls went to $15, while the price of basketballs only jumped to $7. Both of the balls are rising in price, but the basketball is dropping in value in comparison to the soccer ball. This is because even though they both rose in price, soccer balls rose in price at twice the speed. If I sold my soccer ball, I could buy twice as many basketballs now. The reason that the prices rose in both balls is because of something called inflation. When we print more currency, or there is more revolving credit denominated in the U.S. dollar, then there becomes an excess amount of money buying the same amount of goods in circulation. Simple supply and demand principals. When something becomes more common, yet the demand ceases to increase, the value of that thing goes down. In contrast, when something is rare yet the demand is high, the value of that thing is much higher. The dollar is in a constant trend of increasing supply, yet the demand for the dollar remains stagnant, thus decreasing the value through inflation.

Cash... A medium of exchange, not a store of wealth...

The biggest mistake one can make financially is believing that if they save a large amount of money that they are set for life. This is completely untrue, even for a cash holding billionaire. Purchasing power is stolen from the dollar by diluting its value via the unrelenting printing press. We've already covered supply and demand fundamentals on this subject, so I won't bore you with a repeat paragraph, however I will say that the way to preserve your wealth is by buying assets that can not be diluted to outrun demand. I am talking about the commodity 'asset class'. Gold, Silver, Platinum, Palladium, Rhodium, Copper, Lumber, Wheat, Sesame Seeds, Coffee, it doesn't matter. The generally accepted definition of a commodity is a raw material such as the aforementioned that can be bought and sold, or used as a store of value. Generally speaking, you cannot inflate these items into devaluation, however most agricultural products have a shelf life that makes them unsuitable for long term storage of wealth. Since Gold and Silver have an indefinite shelf life and have a large storage of wealth in a compact area, these are generally the mediums used to preserve your wealth and hedge yourself against inflation. In my humblest of opinions, silver is the better investment by far. We mine Silver at 10 times the pace by weight that we mine gold at, yet there is 1/10th the amount of above ground silver than gold. This is because silver is used industrially and consumed to be lost forever in the junk yard, while a majority of gold is hoarded. There will come a day, I surmise, that the market will realize that silver is rarer and in much higher demand than gold, and when that day comes, silver will outbid the price of gold by a significant margin.

Interesting stuff! What do you think is in a bubble right now? and What do you see doing well over the next few years?

In my opinion, it's the stock market that's in a bubble currently. If you look at the DOW historically it is in a constant upward trend. The price of the DOW in points is supposed to be a reflection of economic growth, but the injection of inflated dollars hides the fact that we have had no true growth and that we are headed into another recession. The DOW in points has been skyrocketing and even hit 18,500+ a couple weeks back. Additionally, through the federal income tax alone we can't even sustain the interest payments we owe to the fed, which is why we are seeing low and maybe soon, negative interest rates. The only way to keep up payments at a positive interest rate now is to either inflate the currency further, or increase taxes. Both 'solutions' of which will be disastrous to our economy. IMO, I would park your wealth in commodities. Namely Gold & Silver. Or crop producing land, which has actually outperformed Gold & Silver this century.

I have a friend at work that is convinced the stock market is going to crash. My theory is since the fed keeps inflating our dollars away the stock market will just continue to go up over time. I'm about 50% stocks, 20% REIT and the rest in Bitcoin. I'm not sure I have the guts to pull out of the stock market with the constant gains over time.

The way you find out if you're making true gains is not by looking at the dollar value of your holdings, but looking at your shares purchasing power in comparison to other assets like Gold, Real Estate, a gallon of milk etc. The gains made in the stock market over the last 20 years have been completely inflationary. The price of stocks are going up, yes, but the price isn't out-running inflation.

The market is kind of like those credit cards that give you cash back. They give some customers cash back, but at what cost? Great news though, investment skills transfer just fine to crypto.. Crypto is just another set of markets anyway. My advice, don't put up with the fraud, find the guts somewhere. I took baby steps but I didn't waste any time doing it.

Agreed. My advice is just to do your diligent research and whatever you decide to do, stay out of the dollar long term.