The economics of a deflationary currency

Recently you might’ve heard about “inflation”, but what on earth is “deflation”? This article will explain that and explore why Bitcoin might be a better monetary unit than the ones existing today.

Recently you might’ve heard about “inflation”, but what on earth is “deflation”? This article will explain that and explore why Bitcoin might be a better monetary unit than the ones existing today.

Inflation

First let’s dive into inflation. Inflation happens when a currency is devalued, or depreciated. This means that one’s currency, the asset used to purchase various “things” such as goods or services has experienced a decrease in value. For example: Today you can go into a store and buy a basket of various fruits. The total comes down to $4. The next day, after your $ (USD) has experienced inflation, you will go in and buy the same basket of various fruits, but this time you spent $5. When this is applied to a bigger scale, it has much more implications for a whole economy, than it does for you as a single consumer.

First of all, inflation occurs when APL (Average Price Level) experiences a sustained increase.

Let’s assume that unemployment is low. Firms in this case would have to “bid up” (increase) their wages in order to employ the remainder of the population. For a firm, its wages are its highest “expenditure” when producing goods, so an increase in wages would cause firms to pay more money to produce the same amount of goods as before.

This means that the price of your goods will go up (so the APL will increase), or that the value of your monetary unit will go down (either way this means inflation), as companies are trying to maintain their level of profits.

After a while of steadily increasing the price of goods, firms will start to lay off some of its workers, increasing unemployment and decreasing inflation.

The trade-off

This is known as the inflation-unemployment trade-off. When there is high inflation, the central bank will decide to raise interest rates (the rates at which people have to pay back money borrowed), making people and companies less likely to borrow money.

This will decrease the overall demand for goods and services in an economy, as people will save more money. This fall in overall demand leads to lower inflation, however, since a fall in overall demand also means a fall in Real GDP, firms will employ less workers in order to “cut their losses”, leading to lower inflation, but higher unemployment.

Why should I care?

You definitely should care. The Federal Reserve, which prints the US Dollar, is (probably) constantly printing money in order to give to the US Central Bank, in exchange for debt. As the pool of money in an economy increases, the value of the amount of money you hold in your bank account will decrease over time. The amount of money you now hold, relative to the total amount of money in that economy is lower. This is caused by inflation, as your purchasing power has gone down.

In order to combat this inflation, the interest rates will be set higher by the Central Bank, and firms will start firing people, creating unemployment!

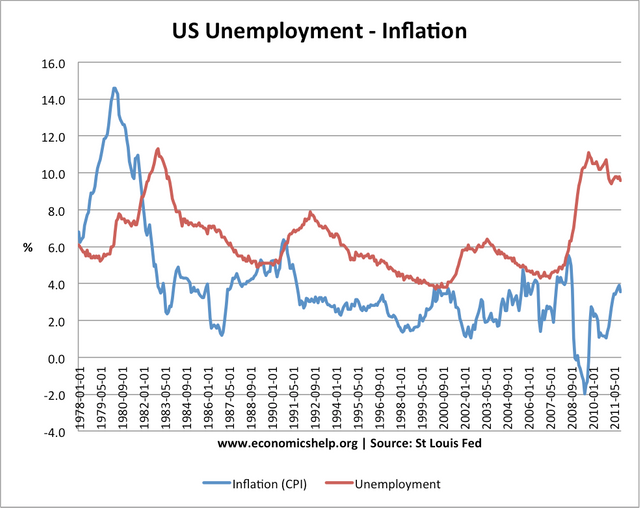

Here you can see for yourself the inverse relationship between Inflation and Unemployment in the US.

The solution? Bitcoin

Created by Satoshi Nakamoto in 2009, and having only ever supplied 21M of them, Bitcoin will never experience inflation due to “printing”.

Instead it will experience the exact opposite; deflation.

As the pool of existing Bitcoin gets mined, and as more people buy Bitcoin, we should see its value appreciate over the next years. Currently, there are 16 million Bitcoins in circulation, with 5 million left to mine.

But why does its value increase?

In the same way as the USD and all other currencies pegged to it decrease in value due to printing, as explained before, due to the total pool of money in the economy having increased.

In Bitcoin’s case, as the total pool of Bitcoin decreases since it is being mined, the worth of what is left un-mined will increase. Having and holding onto bitcoin still is profitable! Even though we are constantly reaching a new ATH (all-time high), and this is due to the amount of BTC left to be mined.

What happens when all the coins are mined?

You might be wondering.

This, I cannot say with certainty, Satoshi Nakamoto has not disclosed any information on what would happen afterwards, and we can only speculate on this matter.

Currently, miners make profit from the transaction fees gained. They use very powerful hardware such as GPUs and CPUs to solve some very hard mathematics, which is why we call it “mining”. The hardware is doing the “physical labour”. After having solved these mathematical problems, transactions are able to go through and be registered on the blockchain. Due to their efforts, the miners are awarded a small fee, which is how they are able to make money.

So when all coins are mined, how will miners be able to even make profits? Will there even be any miners left to help transactions process?

At first the answer seems simple: no, miners will simply just vanish as Bitcoin mining will become unprofitable due to electricity costs outweighing the transaction fees gained.

One solution to this might just be increasing transaction fees, in order to keep miners interested in giving their processing power so that we, as users of Bitcoin can process our transactions.

As mentioned before, this is something which yet has to be established, and there is nothing but speculation out there as of now. However, if we are capable of creating things such as cryptocurrencies, digital ledgers and even the internet, this should be nothing but a pebble in Bitcoin’s path to global adoption.