The Laffer Curve

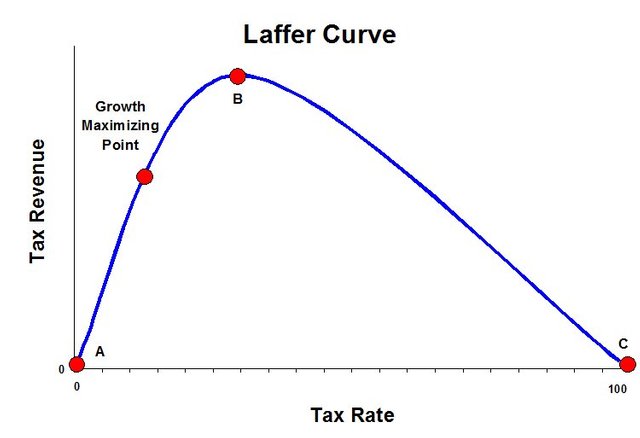

When talking about taxation one thing that can't be avoided is the LafferCurve. The Laffer Curve supposes that income rates have elasticity in relation to taxes and as the rate of taxation increases, the rate of economic activity decreases. This claim obviously has some merit, because if taxes were 99%, most people probably would not bother putting in overtime and would probably use as many sick and vacation days as they possibly could, while if the tax rate were 5% less people would be inclined to work more hours and vacation less because work would be more financially rewarding.

This curve also pre-supposes that there is an ideal tax rate that maximizes revenue, and any higher tax rate will result in decreased revenue. I won't pretend to know or have any clue what that ideal tax rate is, because obviously it would change every month depending on the varying preferences of each of hundreds of millions of individuals in the market. However it should be noted that when politicians talk about increasing taxes, they are concurrently talking about decreasing economic activity. Higher taxes makes working more expensive, and as things get more expensive people are less apt to do it.

Taxes also siphon money out of the economy, and that money when pulled out of the economy cannot be spent by private individuals in transactions. Every transaction has a job attached to it. Even when the rich buy a yacht, there are hundreds of jobs centered around the construction, assembly, delivery, sale, financing, maintenance, and operation of that yacht. When taxes are higher, there are many purchases that are not made, and less work for people within that economy.

Taxes impoverish anyone who has a job, and simultaneously ensure that less jobs are created for those who don't. High taxes necessitate the creation of a dependent class, and all but ensure that there are more poor people which can be pointed to as a reason for high taxes. The more people who work, and the more money they make, the less they need government. The government will never labor to make itself obsolete, so make sure you're aware of the falsehoods. No economy ever got rich by raising taxes.