Zynga Poker - an Analogy to Money Printing?

I've been playing online poker for eight years. And the strangest games I have played in that time have been on Zynga Poker. What became apparent to me was that the structure of the Zynga Poker was an analogy to real world monetary policy. The end result of which could be an indicator of real world results.

What is Zynga Poker?

Zynga is a free app on the facebook platform where players play with 'play money' chips. Each new account gets 20000 chips. I'll notate these chips as Z$(Zynga Dollars) from now on. You play with these Z$ and you win and lose like a regular poker game. If you bust the Z$20k your account gets replenished the following day with another Z$20K. Chips with no monetary value, or so it seems on the surface. However within the game structure, you can buy Z$ for real currency from Zynga.

Inevitably, when you can get chips for free but assign a value to them it creates a black market value. Although it violates the terms of service of Zynga, players exchange chips for a currency transfer either on paypal, western union payment and more recently on bitcoin for a lower rate offered than Zynga. I had come across phenomenon via my brother who had spent one of his summer holidays from university playing Zynga Poker and making $3000. At that point, I had been playing online poker for two years and had never come across this. So I decided to give it a shot.

Bizarrely for about a year these games were more profitable than my regular game and you didn't need to be of a good standard to beat them. It was easy money. Frustrating at times because of the suckouts and bad play not making any sense(it was play money afterall) but easy money none the less.

There were pitfalls however. You had to continually transfer Z$ around to evade when Zynga decided to periodically shut down accounts suspected of transferring chips. Once accounts got shut down, the Z$ got confiscated. There were also the usual dealings of internet. You had to be cautious of who you dealt with and there was always a threat of accounts getting hacked. I recall a story of an account with Z$35b being hacked which at the time had a value of ~$14k. But it was worth the risk after these were 'play money' chips.

The Z$ Money Supply

When a new account gets created, Z$20k gets created out of thin air. When a player makes an in app purchase of chips, that amount of Z$ gets created out of thin air. The end result is the Z$ money supply constantly increases when more accounts join and more chips are bought. The supply decreases when Zynga decide to confiscate Z$ out of the ecosystem.

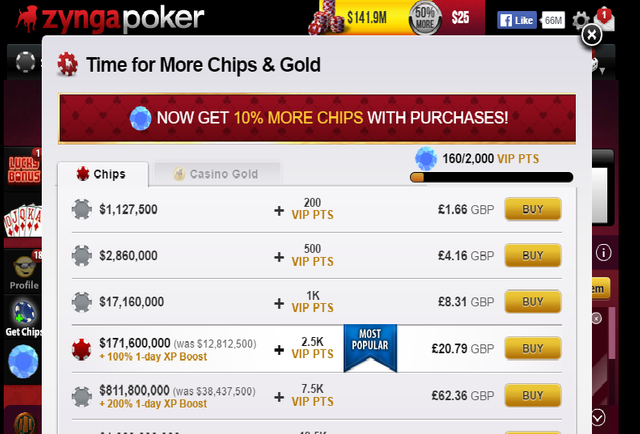

Purchasing Z$ from Zynga - the price of which have been decreasing

The sum effect of this is that as more Z$ are created, the value to which they're compared to decreases. In this case dollars, pounds, euros, etc. As there are more Z$ in circulation when compared to currencies, the value decreases. What I noticed that when Zynga confiscated Z$, the value of these in dollars actually went up for a short while.

In dollar terms, I used to routinely sell Z$1b for $600 dollars in 2010. At times of periodic account shutdowns the price went up to $900 per Z$1b. A price spike as a direct result of a destruction in the supply of Z$. But the net effect over the years would be that the supply of Z$ increases. I could be never sure how how many chips were created into existence but it was reflected in the price I could sell at. I wasn't playing full time on Zynga by 2012 but the price went to around $250 per Z$1b. I recently checked with a buyer of mine that the black market rate has gone down to $30 per Z$1b as of September 2016. The black market value has gone down a staggering 95% in six years.

So How is This an Analogy to Money Printing?

Consider, in the real world central banks globally have been engaging in a program called quantitative easing. This program is a house and mirrors scheme of in effect 'printing money' to deal with the financial crisis of 2008. Allied with the fact that fractional reserve banking exists(the ability for commercial banks to lend more money than in deposits) which creates money out of the thin air as result.

The analogy is this. Central banks are Zynga. Depositors in banks are players buying chips in the app. Everytime a new account opens, Z$20k is freshly printed from the central bank Zynga. Each time the account gets busted it is replenished with another Z$20k printed from the central bank Zynga. When a player decides to buy chips in the app, he acts like a depositor at a bank. In this case Zynga acts like a commercial bank by creating Z$ after a deposit from a customer. If the Zynga analogy holds for the real world then the results of for the value of the currency being printed would be devastating.

As I have seen the value of Z$ decrease 95% by the same methods against currencies(I get the irony of comparing Z$ to currencies themselves that are being printed!) why can't it be the case for currencies like the dollar to devalue considerably against constants that don't change drastically in supply? I'm talking more specifically about Gold, Silver and Bitcoin but it could be anything. If the currencies get compared to constants that don't change in supply and they're being printed, they have to devalue according to the Zynga Poker analogy.

I've taken my personal experience of the devaluation of the Z$ as a warning shot of what could come for currencies around the world.

Great observation.

You capture the premise of my thesis: https://thewealthofchips.wordpress.com/

Poker has evolved with the same limitations of our global financial system. I propose then that a solution to the latter would be applicable to the former. Ideal poker.

Very nice article/insight!

Thank you for your kind words. Yes, I agree. Games and their rules are a great way to look at related problems.

I shall certainly check out your thesis, it will definitely pertain to my interests.

It's quite natural that our games should evolve to mirror our social problems!

100% agree with this article. I play poker too, and the mindset of poker player mirrors exactly how its like in the real world. There will always be times where do you do the right thing, and still things don't go your way. However, if you keep putting yourself in +EV situations, these good decisions will pay off. Interesting read too! I believe cryptocurrencies is the way forward too. I mean check out babylonian money, its worth nothing these days.