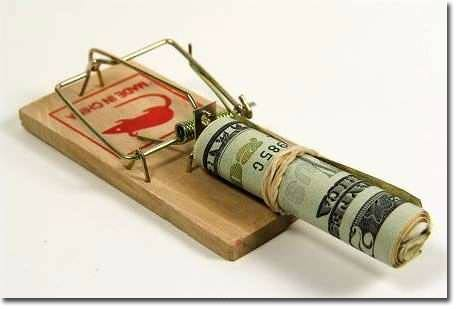

Money as debt, is this an issue?

Lets make a quasi-experiment about money issued as debt. Imagine that all the money (UNITs) existing is at some personal hands (The Moneylender). The Moneylender is ready to give 1 hundred UNITs to anyone for a period of 1 year. By the end of this period he expects to get back 110 UNITs. In such an imaginary world, all the existing money would be issued as debt. And it seems like the people in general would be in unrepayable debt to The Moneylender. But, this is not true, because companies go bankrupt and people are not responsible for each other bad decisions.

For example:

Sam, Bill and John took 100 UNITs each for their businesses. Sam and Bill made good investments in productive activity and ended up with 120 UNITs each in the end of the year. This allowed them to give back the 110 UNITs and keep 10 more UNITs for future needs. On the other hand, John wasted the money and made bad decisions. At the end of the year he sold all his property and ended up with only 60 UNITs. He returned all the money he had to The Moneylender.

Lets sum up the results:

Sam and Bill both made good fortune by using UNITs as their medium of exchange (this is the value of money). And got some UNITs for further use.

John missed the opportunity by making bad investments and got back to the point he started from, plus debt he can't repay.

The Moneylender lost 20 UNITs due to irresponsible lending practice.

If The Moneylender would continue such practice for a while, he will eventually run out of money and disappear. While successful businessmen, such as Sam and Bill, their partners and customers will use UNITs and enjoy the value that it provides as a medium of exchange.

Here we come to an obvious conclusion:

The fact that any money issued as debt alone does not create any problem.

Lets go back to our quasi-experiment and see what happens when John exercises his right to take more loans each time he can't repay the debt. After the first year he will take another loan of 100 UNITs and pay back the 110. This will leave him with 60+100-110=50 UNITs at hand and 110 UNITs in future liability. Magic doesn't exist and John is bad businessman and not going to make more money. His financial activity will enrich everyone else and literally burn The Moneylender's reserves. At some point The Moneylender will face the problem of running out of UNITs and may solve it by creating more UNITs if it is physically possible. Creation of new UNITs will reduce the value of existing UNITs which are currently in circulation. This value will not just disappear, The Moneylender will take it so he will be able to give it to John again. Now we have a problem here (stealing is bad), and the problem appeared only after The Moneylender started creating new UNITs.

The next question we would like to answer is, what is the role of the money being introduced as debt in the problem. Lets alter our quasi-experiment a bit, and stop providing the money as debt. In contrary, The Moneylender will give the money for free, without the need to return a UNIT, but he is creating new UNITs at will. It is not hard to understand, that the problem will remain the same. Each time The Moneylender creates new UNITs, it reduces the value of existing money and takes it to himself - steals it.

The conclusion is simple, the fact that money is created as debt is not part of the problem and it doesn't even contribute to the problem. The ability to create new money is the only source of problem. If you are not trying to conceal the problem by targeting irrelevant aspects, but really desire to solve it, you should identify it first and than seek for solutions (such as cryptocurrencies).

If you enjoyed the reading please resteem it, so that your followers will enjoy it as well!

Una cabeza (realmente pensante) debe buscar todas las alternativas posibles de solución posible, pues el problema no es la deuda en sí, que en muchos casos ayuda a resolver otros problemas, sino el cómo regresarás. Si las condiciones están verdaderamente claras desde el principio, el final será el mejor escenario posible.

Hope the meaning is not lost in translation :)

Totally agree with you about the fact that there is a decent level of uncertainty in conditions under which the money is usually issued as debt nowadays. The return percentage is changing in unpredictable ways. Under such circumstances, it becomes difficult to make long term planning and make business.