Why the federal budget is mostly bulls***

It is budget week in Australia, the week where the federal government unveils its plans for spending over the next four years, except not really, because promises made in the budget are seldom kept and often revised or ignored. Not that this stops most media publications from reporting on the federal budget as though it were economic lore.

Many critical of the budget have responded to the government’s reported $10 a week income tax cut by listing all the services it could be spent on had it kept our pocket change, under the trending hashtag #keepmytendollars.

This is well meaning, of course, and well aimed. Except it is not our money that is used to fund federal services. It is government money. Taxation is the act of taking money out of circulation to prevent inflation. Put more aptly, your taxes are destroyed upon receipt.

That is the ultimate insult to all this. The government has the money. It chooses not to spend it on the public. But it will happily dish out for the private sector in the form of generous subsidies and corporate tax cuts, and of course, defence spending. So I thought I’d take the opportunity to remind you, dear readers, that:

a) the federal budget is mostly propaganda, and

b) our taxes don’t pay for anything federally.

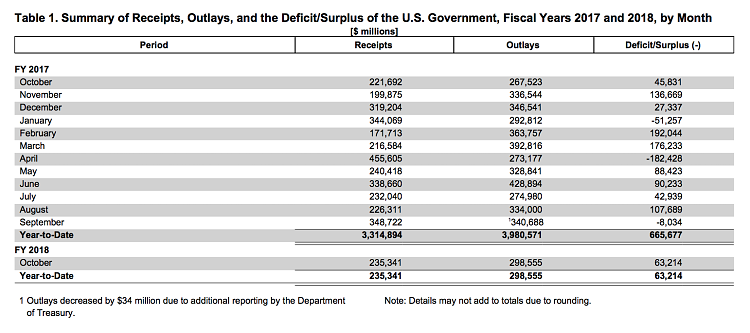

Monthly Treasury Statement of receipts and outlays of the United States Government

Taxation is literally the act of taking currency out of circulation to prevent inflation. Putting your taxes towards federal spending would defeat the purpose of taxation in the first place.

Besides which, if taxes really did pay for federal spending (it doesn’t), government budgets wouldn’t almost always be in deficit.

.png)

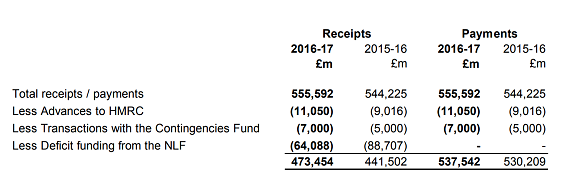

UK Consolidated Fund Account 2016–17, courtesy of the Comptroller and Auditor General to the Houses of Parliament.

Taxation is literally the act of taking currency out of circulation to prevent inflation. Putting your taxes towards federal spending would defeat the purpose of taxation in the first place.

Besides which, if taxes really did pay for federal spending (it doesn’t), government budgets wouldn’t almost always be in deficit.

According to official figures (see above before @ing me), the US Federal Government spent $3.9 trillion, taxed $3.3 trillion, and recorded a budget deficit of $665 billion over 2017.

In the UK, the federal government spent £555.992 billion; and recouped £474.454 billion in taxes across 2016/2017, leaving a deficit of: £81.538 billion.

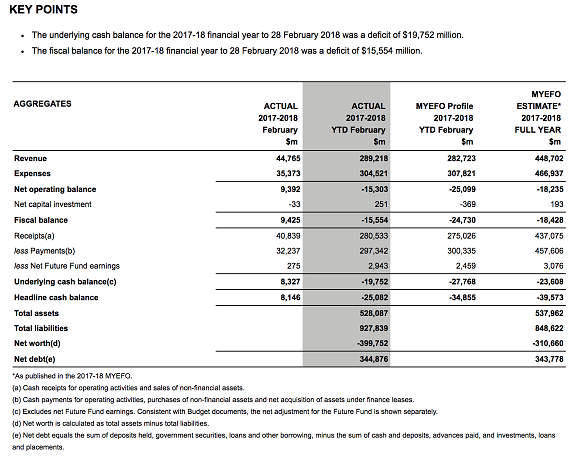

In Australia, the government spent $304,521 million and recouped $289,218 million in taxes, leaving a deficit of $15,303 million, or the official figure of $15,554 million if you include the $251 million in net capital investment.

If your taxes really paid for services, governments would not be out billions of dollars almost all the time.

Australian Government General Government sector monthly financial statements February 2018.

On the occasions government budgets have been in surplus, this still isn’t because your taxes paid for anything.

A surplus is what happens when governments spends less than it taxes, (and what the hell point is that?). Surpluses also almost always accompany or precede financial crises.

Economist Dr Cameron Murray says the federal budget document has no teeth.

“Government can spend, or not, on anything it wants regardless of what the budget says,” he says. “Everything can change in six months with the mid-year review. In WA for instance, the budget forecast a $2.6b deficit, which was used to justify lots of public service cuts. The mid-year review revised this to $1 billion or less.

“It’s a political propaganda document. We should treat it like that and ignore.”

Economist Dr Steven Hail says that the government and opposition parties have their macroeconomics all wrong.

Contrary to what they would have you believe, a balanced budget does not allow the federal government to do anything at all except to drive the private and household sectors further into debt.

“The means of the Government are not determined by the amount of taxes it collects, now or in the future, except in so far as taxes are necessary to limit inflation to ensure the ecologically sustainable productive capacity of the economy,” he says.

Neither does a balanced budget ‘put the government on the road to paying down its debt and puts Australia in a position to take greater advantage of future economic opportunities’.

In fact, balancing the budget actually reduces demands for goods and services, prevents job creation and reduces infrastructure funding.

And what the government refers to as debt is simply the net financial assets of the non-government sector, in Australian dollars. It cannot be debt by definition because no body or organisation except the Reserve Bank can create Australian dollars. Doing so would be counterfeiting, which is illegal.

‘Paying down debt’ is simply the act of destroying Australian dollars, (or American dollars, or British pounds etc) by taking them out of circulation.

A balanced budgets does not protect living standards, it doesn’t create a buffer to withstand future economic shocks, nor offer Australians (or Americans or the British public etc) to better take advantage of future opportunities.

The productive capacity of the economy has nothing to do with balanced budgets and everything to do with the people, skills, physical capital, technology, infrastructure, and natural resources of the nation.

The only thing a balanced budget ensures is providing government with a continued excuse to cut public services and secure unemployment and underemployment, keeping wages low for its liberal party donors and workers competitive and compliant.

“Who in their right mind wants to drain safe dollars from Australia’s financial system under present circumstances?”, says Dr Hail.

Thank you for reading. I couldn’t afford to continue my research, or write this book, were it not for the support of my generous sponsors. Support independent journalism by sponsoring my Patreon, starting at $3 a month, or throw some money at my PayPal.

You really didn't think anyone would be held to account or prosecuted did you?

They're playing us for the fools we've become 😒