What's the impact of foreign expansion on bank risk?

Ten years after one of the deepest financial crises in history, economists are still searching for the deep-rooted causes that led to the unfolding of those events. One ground of consensus is that the crisis resulted from excessive build-up of risk and leverage in the banking sector. Banks had been exposing themselves to runnable short-term liabilities too heavily and had invested in risky portfolios in search of yield (for an overview of the causes, see Adrian and Shin 2009, Hanson et al. 2011). What incentives brought them to such behaviour with uncontrolled, and perhaps unintended, consequences is still a matter for heated debates.

Two general explanations have emerged and both triggered intensive theoretical and empirical research. The first is lax monetary policy, while the second is banking globalisation. There is extensive and solid-grounded evidence that lax monetary policy played a significant role (for an empirical contribution, see e.g. Jimenez et. al. 2014; for theoretical work on the topic, see Angeloni and Faia 2013). A number of studies have assessed the role of banking globalisation for the dynamics of credit (among others, see Claessens and van Horen 2014, 2015), but none so far has addressed the question relating bank decisions to enter foreign markets to their impacts on a battery of measures of their individual and systemic risk. This is what we set out to do in a recent paper (Faia et al. 2018).

Studying the impact of foreign expansion on bank risk is difficult primarily because of a lack of consistent granular data on the entries of banks into foreign markets. Collection of foreign entries is not possible through official datasets, but requires manual search through several sources. Previous data on foreign entries existed (see again Claessens and van Horen 2014, 2015). However, since their use was related to research questions on credit dynamics, the collection was mainly confined to retail activities. To gauge the consequences of their foreign expansion for bank risk requires extending the data collection to all bank activities that potentially contribute to bank asset and liability risk. This motivates our focus on European banking groups. The European banking business model is that of a universal bank, not restricted in activities. For this reason, Europe provides an excellent laboratory as banks can equally engage in retail as well as in investment banking, direct investment in foreign activities, factoring, and so on, all of which contribute to bank risk.

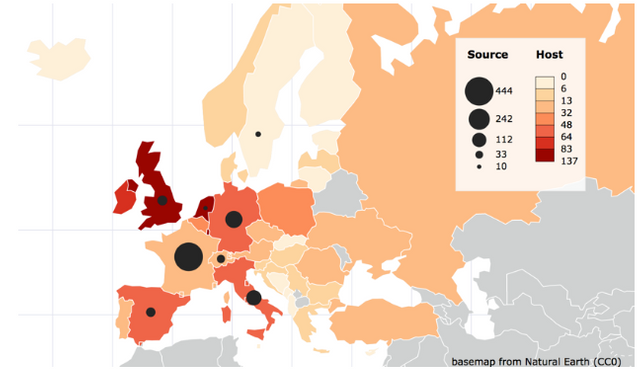

In particular, we started by collecting foreign entries for 15 European banks classified as globally systemically important banks (GSIBs) by the Basel Committee on Banking Supervision(2014), at the end of 2015 over a 10-year time period from 2005 to 2014. Figure 1 shows the geographical distribution of the 852 recorded openings1 between 2005 and 2014. It reveals how concentrated the GSIBs are in Western Europe with French banks expanding the most. Openings mostly happen in Western Europe too, especially in large financial centres such as the UK, Luxembourg, and the Netherlands.

Figure 1 Expansion of banks in Europe, 2005–2014

Next, we matched our entry data with several balance sheet variables and a rich set of risk metrics. We use several standard risk metrics taken from the literature. Most importantly, we consider both individual and systemic risk metrics. For individual risk we use market-based metrics as well book-based indicators founded on banks’ internal risk models. This makes sure that our results are not driven by either exuberant market conditions or biased internal risk assessment. The metrics of individual risk we consider are credit default swap (CDS) price, loan-loss provision ratio, the standard deviation of returns, the Z-score, and the leverage ratio. As systemic risk metrics we use the conditional capital short-fall, the long-run marginal expected shortfall and the ΔCoVaR computed using either CDS prices or equity prices.

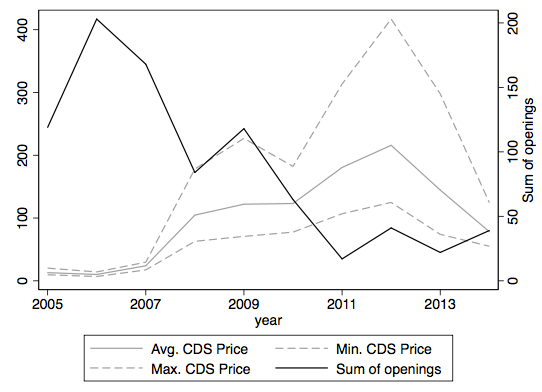

Figure 2 CDS trend and bank expansion, 2005–2014

Figure 2 shows the time series of the average CDS price (that corresponds to the market perception of riskiness) and the total foreign openings of the 15 GSIBs in our sample. It reveals a clear negative correlation between risk and openings during the 2005–2014 period. Similar patterns can be observed for the other risk metrics.

A methodological challenge in assessing whether this type of correlation actually reveals a causal impact of foreign expansion on lower risk lies in the quest for a suitable instrument of expansion that is not affected or co-varying with risk itself. We constructed our instrument through a gravity model, whereby foreign entries are regressed upon several indicators of distance.[2] Our empirical analysis relating the various risk measures to the gravity instrument reveals unequivocally that in our sample of European banks there is strong and robust evidence that banks’ foreign expansion decreases risk, not only from an individual viewpoint but also from a systemic viewpoint. The result has important policy implications as it casts a shadow on the idea that banking globalisation was one of the crisis’s culprits.

We dug further into the channels determining this result. Specifically we tested a novel, and somewhat neglected, channel related to bank competition.

From a theoretical standpoint, when a bank expands to a foreign market where competitive pressure differs for its home market, the implications for the bank’s riskiness are ambiguous. Consider a simple imperfectly competitive setup in which banks raise deposits from households to finance firms’ projects through loans. On the assets side, loans are risky due to firms’ moral hazard arising from limited liability (Boyd and De Nicolo 2005, Faia and Ottaviano 2017). On the liabilities side, as deposits are short-term liabilities whereas loans are partially illiquid long-term assets, liquidity mismatch exposes banks to bank run vulnerability (e.g. Rochet and Vives 2004). The impact of more competition on overall bank risk is ambiguous because not only may more competition increase or decrease the amounts of deposits raised and loans extended by the bank, but also the change in firm risk-taking on the assets side may dominate or be dominated by the opposite change in bank run-vulnerability on the liabilities side.

Despite theoretical ambiguity, our empirical analysis finds that expansion in foreign markets that are more competitive than the home one reduces individual bank risk. Results are less clear-cut for systemic risk. This is understandable. Systemic risk is likely to depend upon a number of market-based characteristics (such as the type of interconnections) and other macro externalities that go beyond competition.

In this respect, our results also suggest that the consolidation of the banking industry promoted by regulators to promote stability in the aftermath of the financial crisis may entail some unintended consequences for bank riskiness through the competition channel.