State of Bitcoins

"5 bitcoins?!"

On behalf of the entire cryptoverse, I cringed when my wife's little sister asked why there are 5 bitcoins.

I helped align the entire world on one telecom system. As a result we can take our phones and go anywhere in the world and use them, and can call anyone. Economy of scale made it so cheap that everyone could get one. There are now 7.7 billion paying subscriptions, more than the people on earth - on one compatible system.

In bitcoin, some opinions differ on the optimal value of a constant in the code, whether the "best" value is 1, 2 or 8 MB. Instead of working that out, or compromising on say 4, they each go and build their own bitcoin, incompatible with the other two. Then comes a fourth guy and differs in opinion on whether the best hash algorithm is SHA256 or Equihash. Then he also does another, incompatible bitcoin. A fifth guy, disagrees completely with the other 4, and voila, we have 5 bitcoins. As a result, the poor local car salesman has to put up 5 different payment systems with 5 different prices, to sell that lambo car. Hardly the optimal way to gain universal acceptance for bitcoin as a payment currency. How can this even happen?

To understand this, we have to first understand that bitcoin, as most open source, is a decentralized effort. There is no CEO, no technical coordinator, no me. No-one is in charge. It is like coming to office where there is no boss, no-one leading the work and everyone can do whatever they want. Worse, you can take anyone else's work and say "I'll just take your work and add my name at the bottom". How can a system like that create something that gets a 100 billion dollar market cap? Because it clearly works. Look at how open source has taken over many industries in the world.

The reason why open source still works is because the best and most used solutions get a self-reinforcing circle: Better solution -> more users -> more interest -> more developers -> better solutions. While probably bitcoin variant 834, which we will surely see at some point, may instead find itself in a dwingling circle of less users -> less interest -> difficulty to recruit developers -> solutions starting to lag -> less users. Somehow the market figures out what is best, and it is okay to have more choices. Now this is true in general, but it is not so good for peer-to-peer services, relying on that both parties use the same system.

These are intelligent people, and they realize that by forking like this, they could potentially destroy much of the universal acceptance that was the whole point of bitcoin. So why are they doing that? What is it that makes them feel so strongly about it, that they are willing to risk the very thing they are fighting for? I don't think it's money, most have enough.

The Battle of the 5 Bitcoins

This is how it could sound like:

Bitcoin Core: Hey Bitcoin should scale not just from 5 to 50 transactions per second, but to 50,000 or 50 million, to be a viable payment alternative. Bitcoin in it's original architecture, doesn't scale easily to those numbers so let's add a layer on top, transacted outside bitcoin, and then recorded back on-chain. Problem solved!

Bitcoin Cash: Not so fast Mr Core! If we add a settlement layer on top, we are back to companies with CEO's and all the things we wanted to get rid of with a decentralized payment system in the first place. We simply can't do that, says BCH. Instead let's scale the blocks to fit more transactions within the true decentralized nature of the original bitcoin.

Bitcoin Gold: You are all wrong says BTG. You have lost the decentralization already. It is all controlled by the centralized mining companies, to large extent in huge mining farms in China. The current algorithm makes it impossible to compete with them. We need to put the mining power back in the hands of everyday people, because the miners determine bitcoin.

2x, largely the current mining companies: Guys, when we agreed to Segwit in Bitcoin Core, you promised us that we would increase the block size to 2 MB. What is this nonsense about pulling out? I stand by my word and honor my agreements.

eBTC: Finally comes the new kid and says: Grandpas, there is a much simpler way to do all of what you are talking about. I wrote it with my thumbs. You are all old men stuck in old times.

Which is "Best"?

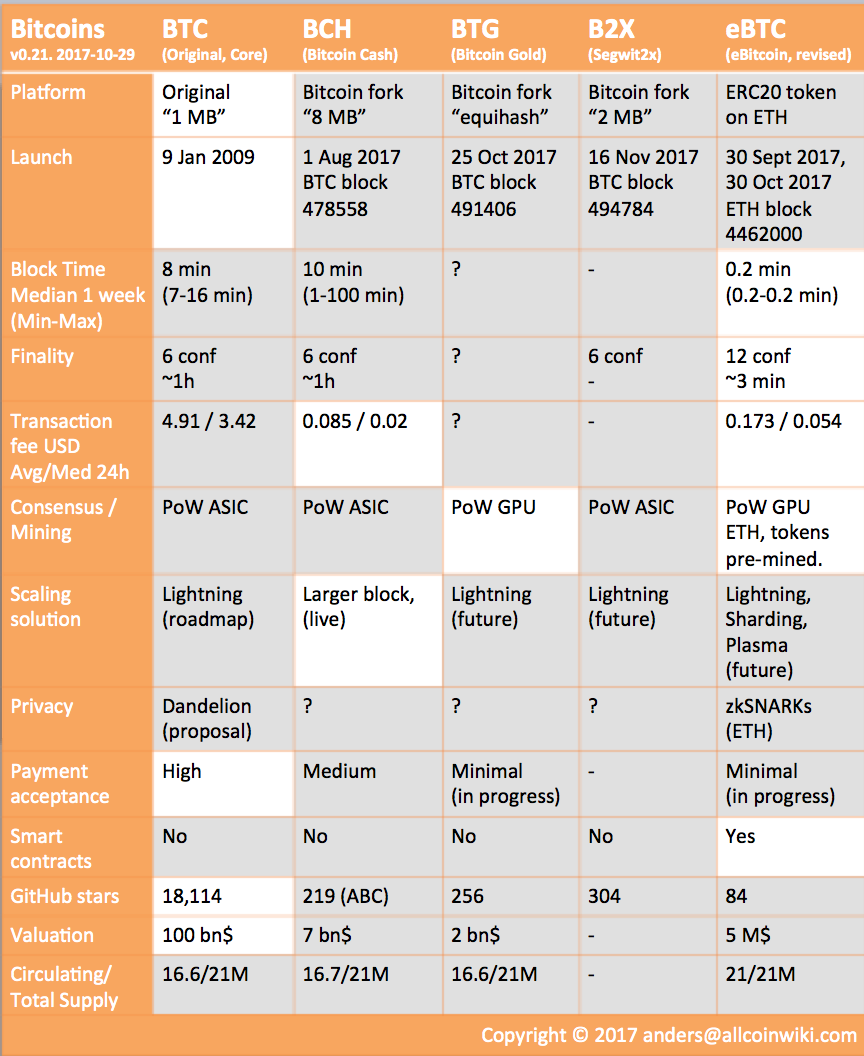

I have tried to make an exhaustive analysis in the table below, looking primarily at real performance. I've spent two decades talking about "roadmaps" and I know that working software running live in production is a very different animal from making a nice looking plan in powerpoint. I've noted the roadmaps, but I believe roadmaps when the day is reached and the code is live.

Bitcoin Cash does actually perform well in terms of transaction fees, but suffers from inconsistent block times, making it still as unpractical for payments as regular bitcoin.

Bitcoin Gold does have merits in terms of mining, but few people actually care about that.

I was surprised myself how good eBTC compares to the other 4 in real performance. It is a crazy idea, but good, clearly the wildcard. In many ways, it is "best" out of the 5 - quite a shock to many I'm sure.

Will S2X be "better" than the original? Marginally. Actually when scaling large distributed systems, you don't scale them 2x. You need to scale them at least 10 times in a go to be worth the hassle. All this fork ambiguity over a 2x increase in something is truly a horrible idea, and weakens my confidence in bitcoin. On the market it might still help. Scandals brings publicity. Publicity brings buyers (or voters).

Having said this, it is important to note "Best for what?" Bitcoin isn't a currency today. Transaction fees and transaction times are horrible and what really kills it is the volatility. You can't use a currency for actual purchases when it can be worth 20% more or less while you're doing the transaction. Most businesses face margin pressure and are high precision operations.

Which One is Bitcoin?

Like I started, I think we will have more than one bitcoin going forward. It is a consequence of having no boss and no clear informal leader. If Satoshi Nakamoto rose tomorrow and said he thinks Bitcoin X should be the bitcoin, that might change, but I personally think he is no longer with us unfortunately, and there is no other natural leader.

BCH, with it's die-hard absolutely-no layer on top, may prevail, with a small share of the volume, like today. There will remain enough people who feel strongly about this matter. And as I noted, since bitcoin isn't primarily a payment currency today, the scaling that the Lightning network brings, isn't needed yet. 8 MB would have been just fine today for exchange trading and an occational lambo. BCH could have done much better with better communications and politics.

I doubt Bitcoin Gold will make it, I think too few people care enough about the actual cause.

Is 2x or 1x the Bitcoin? The 100 billion dollar question? I don't know. A few days ago I felt fairly certain that Core would prevail and I'm still guessing that will be the case. But what will determine it is the exchanges. If I sell my Alts, what is the trading pair? Where does the money go? Remember, bitcoin isn't a payment currency, it's a trading instrument. If I sell my OMG or WTC (which I won't) where does the money go? Currently the exchanges are split here. Later they cannot be. When an exchange customer sends BTC from A to B, it can't be opposite chains. People would lose money and blame the exchanges. So there will be a consensus on this. Right now I'm leaning towards Core, but I am far less certain than a few days back. Monitor the exchange statements!

My Skin in the Game

So what did I do? This is not trading advice, just what I did personally, and for full disclosure:

I traded BCH once but aren't keeping any and I'm not looking to buy.

I never bought any BTG.

I have not bet on either BT1 or BT2. I feel both would be risky without knowing the outcome of how the exchanges will list BTC in the Alt/BTC trading pairs.

But I did buy eBTC and I bought more a few days back before the token swap. That is really the wildcard. As can be seen in the table, technically it is combining the best aspects of the other 4, by just piggy-backing on Ethereum that is a generation newer than Bitcoin. Will eBTC make it? Is it too crazy or can it actually work? It is a long shot and it will, as all start-ups, come down to execution. But if they do, I'm sure not going to stand on the side and miss a bitcoin train a second time. So I spent 1k to bought that Bitcoin pizza size of 10,000 eBTC coins that I didn't buy in 2010. Now I can sleep well at night, free from FOMO :-)

Bitcoins Compared v0.21

I hope you found this useful. I will update this page as the situation develops. If you have insights, errors spotted, welcome to write to me at [email protected]

I wish you all green lights and a great day ahead.

Author: Anders Larsson, M.Sc.

Source: https://allcoinwiki.com/bitcoin/

eBTC have a solid community and good dev team... Hope this simple idea become a giant soon

I look only to the good qualities of men. Not being faultless myself, I won't presume to probe into the faults of others.

- Mahatma Gandhi

Congratulations @talkatives! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @talkatives! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!