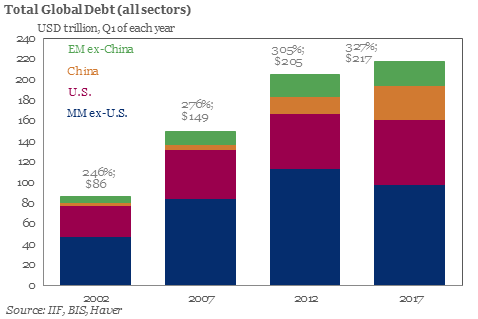

Global Debt Hits ALL-TIME RECORD HIGH! This is Why Interest Rates Are Record Low!

Global debt has been rising. Is that a surprise to anyone? There are no countries which can reduce their debt simply because in order for a country to create something, it must be born out of debt. Debt is the birthplace of all creation in this banker-controlled world. And that’s why it is the system which they use to control everything in our lives either directly or indirectly.

LOOK THROUGH MY BOOKS!: http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

BITCOIN: 1MbAUXsHa8XRFMHjGurd7L5nRDYJYMQQmq

ETHEREUM: 0xece0Dd6D0b4617A8D94cff634C64155bb1cD8C2C

LITECOIN: LWh6fji4WrJT7FAbFvFSZ9jVNCgVM3dHod

DASH: Xj9RXrvhXbaL3prMDvdzAxM8gDB2vDiZrh

MONERO:47q5qDPkDBLRadwcSXDsri3PNniYRYY1HYAhidXWAg8xXHFFZHFi7i9GwwmZN9J5CJd8exT4WARpg2asCzkuoTmd3dfcXr6

STEEMIT: https://steemit.com/@themoneygps

DTUBE:

T-SHIRTS: http://themoneygps.com/store

Sources Used in This Video:

https://goo.gl/UpprQe

Global Debt Monitor - January 2018 | The Institute of International Finance

https://www.iif.com/publication/global-debt-monitor/global-debt-monitor-january-2018

Global Debt Hits Record $233 Trillion - Bloomberg

https://www.bloomberg.com/news/articles/2018-01-05/global-debt-hits-record-233-trillion-but-debt-to-gdp-is-falling

iif total debt 1.png (478×319)

IIF global debt q3 2017 v2.jpg (890×658)

IIF 10Y forecasts.jpg (890×651)

Report: Roughly 10 Percent of Amazon's Ohio Workforce on Food Stamps

http://freebeacon.com/politics/report-10-percent-of-amazons-ohio-workforce-on-food-stamps/

Caracas shops mobbed as Venezuela's Maduro forces price cuts

https://www.reuters.com/article/us-venezuela-economy/caracas-shops-mobbed-as-venezuelas-maduro-forces-price-cuts-idUSKBN1EV0K1

Janet-Yellen-debt.jpg (600×450)

▶️ DTube

▶️ IPFS

Do you think debt is ONE of the reasons why interest rates remain low for all these years, despite the constant propaganda that the economy is doing well?

Sure. All the governments would be bankrupt if interest rates were any higher.

But here come the cryptos to the rescue: I think they will devalue fiat (money and corresponding debt) by 90% through wealth transfer to cryptos. I explain this theory here:

https://steemit.com/cryptocurrency/@mexbit/cryptocurrencies-will-eliminate-global-debt-of-individuals-and-governments

Thank you for the upvote. We can only hope that more people will participate in this change that is occurring. It's not in the consensus that a financial institution doesn't need to be this big and powerful. People think that's how it should be so they can feel their money is "safe"

You are welcome.

I suppose you have not had the opportunity to read the post I linked. I think governments have not forbidden cryptos because having them rise another 1000 times from their current marketcap of 800 billion would devalue all the current debt 90% as the total purchasing power is distributed between Total issued central bank currency (currently 100 trillion USD) + cryptos (currently 0.8 trillion).

If this was 100 trillion USD in central bank currency and 800 trillion USD in cryptos, the purchasing power of the central bank currency AND SO ITS DEBT would fall by around 90%.

Then they can say that the devaluation of the pensions and bond debt is not their fault, but the evil crypto speculators fault. And then they introduce their own global cryptocurrency forbidding all the other cryptos we see today.

I think this is the game plan...

I checked it out. Great article. Not sure what's going to happen but anything is possible. There's a lot of speculation about government intervention into cryptos. I know there are many factors but I believe governments are always 2 steps behind.

beautiful

It's only getting crazier out there.

Resteemed!!

Thank you!

Not just difficult, impossible, that's why they are making every effort to switch to a different system to keep everyone confused. Obfuscation is their tool.

True! It's a controlled disaster.

It's also the opposite for 'consumers', with interest rates so low to promote borrowing/consumption, people don't save - they spend and borrow to record levels.

Absolutely. They're looking for a place for their money.

Has Fed been started to dump bonds?

I will look into this.