WeWork Failed IPO is the Bubble Getting Pricked

The #steemleo discord is a great place. We could use more members though. Join us at https://discord.gg/vUt3GvH

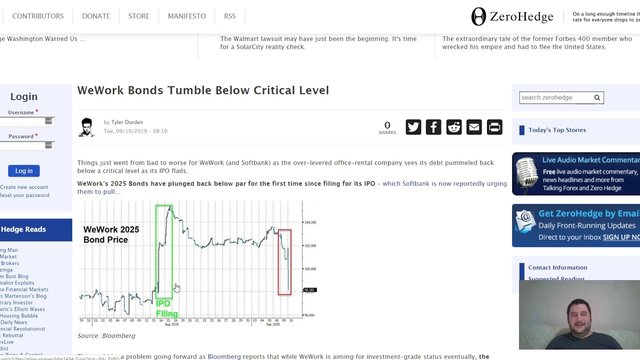

So I had this thought that the WeWork IPO that is currently in the process of failing is going to be the thing that people look back on as the moment when the bubble popped.

And I think this because it is showing that there is a limit to how much shareholders are going to fund business models that take a pile of money, soak it in gasoline, and light it on fire Joker-style.

So much of the stock boom we've been in for the past 10 years has been because of the access to cheap/free money. Once there is even the tiniest bit of interest owed on that capital, people start taking a step back and actually do some due diligence.

Is a company that is losing billions with no plan to ever reach profitability worth 20 billion dollars?

Insanity.

And I think the cold logic of the market is finally waking up to that fact.

▶️ DTube

▶️ YouTube

Edit: I meant WorldCom, not Qualcomm!

It's a solid business. It's just the valuation is out of control.

I give you Regus, a publicly traded stock in the shared office space game with about the same revenues as the We Company, just no FOMO sizzle.

Valuation: $3.6 billion.

Regus is a great company. They actually make money. WeWork does the exact same thing, but is lighting their investors' money on fire.

Softbank would be a huge loser as valuation is half as much as their seed phase! They will need to out in some more to avoid other early investors running to the exits! IPO cycle is almost done although we have Peloton coming up shortly.

Posted using Partiko iOS

Hah, I had forgotten all about Peloton. Same story, but at least they are "only" valuing losing money at 1 billion.

https://www.cnbc.com/2019/09/10/peloton-sets-ipo-range-between-26-and-29-per-share-looks-to-raise-as-much-as-1point2-billion.html

We will see if investor appetite remains as lackluster I suppose.

I had no idea WeWork is doing an IPO or anything about their financials, but I'm surprised to hear that they're losing billions. I used to work in one before I left to work on Splinterlands and there's a bunch around me that all seem pretty full and while charging pretty high rates.

Yeah, it's pretty amazing that they have managed to lose so much money in one of the oldest businesses in the world.

First google result for "wework financials"

https://www.cnbc.com/2019/08/14/wework-releases-s-1-filing-for-ipo.html

It's corporate malfeasance on a grand scale.

You wonder, interest free money is an invitation to do anything you want to do. But its purpose is two sided. One is to spur spending, because why wouldn't you want money to exchange hands as quickly as possible?

The second is to help debt ridden companies maintain their balance sheets. 1% interest is 1% higher than 0. It's a cost to borrowing money. It's a burden to a company that doesn't make money.

It's also a damning sign that everyone working at weworks might lose their job.

Weworks has a tendency to pay their high level employees 30% above market rate (what I think is actually a fair rate to be honest).

Yes, you are right that Keynsian demand pump-priming works hand-in-glove with inflating away debts.

The major problem with this whole approach is that it trades the health of the currency and the overall economy for avoiding a crash right now. If real productivity grows fast enough to keep pace with the damage, then it can continue. And let's be honest, the powers that be have done a decent job of walking that fine line between the two over the past 80 years or so.

Now we have instantaneous communications, a very competitive global labor market, and currency choices though. Personally, I don't think they are going to be able to keep this game going too much longer. 7 or 8 billion people makes for a massive amount of momentum, but I think fiat currencies are in their last 20-30 years of life.

When the world switches to trustless alternatives like crypto, all of these games that are being played and the crazy behaviors they encourage will either disappear or be dramatically reduced.

I interviewed for a high level position there and got some of the low down on how they work. Essentially, they can't turn a profit because they keep spending money to aquire and fit out. There's a point where they are turning a dime on enough tables that it can cover basic costs, but rent is litterally too damn high (as well as all the freebies they give away).

So, they are turning to other forms of making money such as providing turn key services for creating a new space for enterprise level clients, gyms, schools etc. Litterally anything to diversify their income sources.

At the end of the day though, it's hard to imagine consistent profits from them unless they become a sort of architectural design build firm. One that is active in tenant fit out only that is. But at that price, their valuation is going to orders of magnitude lower than what they say they are worth now.