What is the reason for the sudden increase in the price of all pulses in India?

This is an El Nino year and that means for the first time in decades India has had a back-to-back drought years. El Niño could help California’s drought — but it will make India’s much worse and This is the worst drought in the history of Marathwada

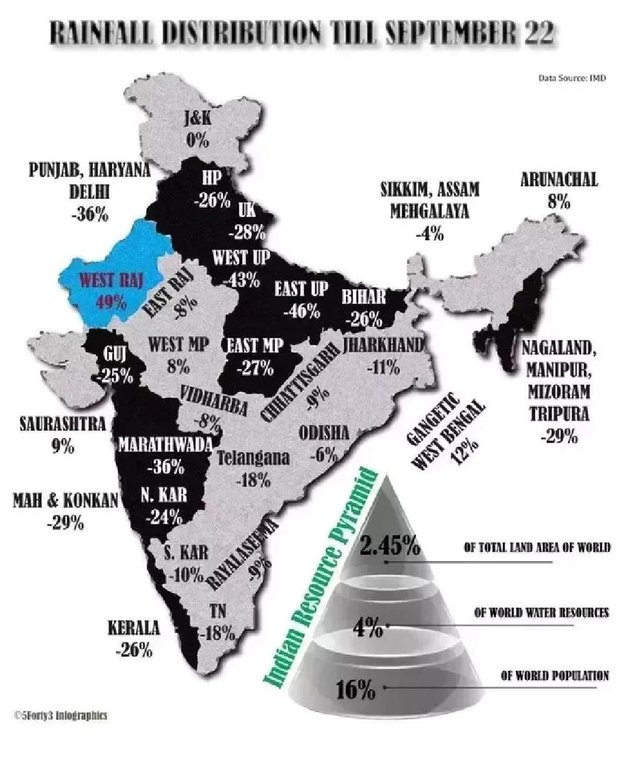

Look at the drop in rainfall across India. The gangetic plains are especially significantly affected.

The Great Indian Drought Circus

With this climate change & dry spell, there is a significant drop in a production of many pulses. Indian drought a bonanza for Canadian growers of pulses

Besides the climate change, there is also multi-decade mismanagement of Indian pulse production with rice & wheat taking a bigger share of land. This means there is very little surplus to lean back on during the lean times. India needs a pulses revolution

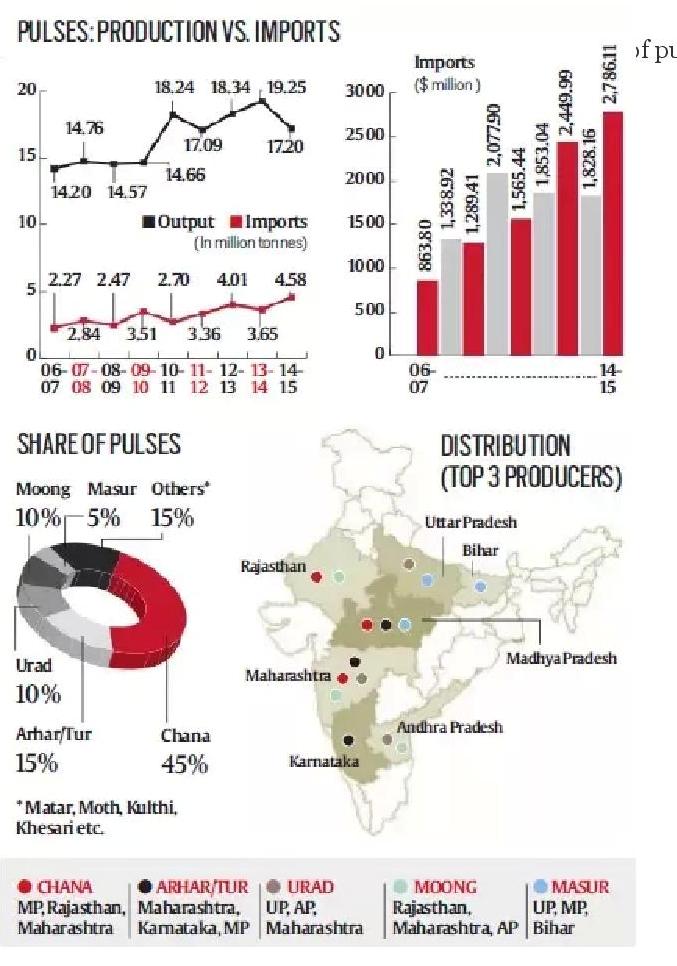

Based on the Directorate of Economics and Statistics,the production of pulses was 17.2 million tonnes against an expected estimate of approximately 19 million tonnes. In addition to this production-supply gap of 2 million tonnes, our country imports 4 million tonnes so there is a significant gap in supply that can normalize the consumption this year.

While the obvious reason is a weak monsoon,but in the subsections below I will try to explain how this crisis could have been averted from escalating if the right measures which of course the government officials knew could have been taken at the right time.

Most Obvious is Corruption – We have to keep in mind that pulses have a whole market in themselves like any other commodity say gold or silver. Every commodity trader in pulses knew of a weak year ahead and was planning of importing pulses in advance which would have kept the prices of pulses in check to an extent. This is what we call a forward trade where buyer and seller enter into a contract on a fixed price for a future transaction irrespective of the price that day when contract is fulfilled.

This is what a trader in Delhi’s Azaadpur Mandi had to say about why traders there did not go ahead with the planned imports in advance, “

This is indeed what has happened with these importers hoarding large amounts of pulses running in lakhs of tonnes. Wholesale international prices have spiked up after July in comparison to domestic prices.If only, the traders would have gone ahead with their forward trades in July,prices would never have doubled,at least.

Poor Price Stabilization Fund- The PSF is a corpus of funds that has been formed to help both the producers and the consumers.If the price is too high,the governments buys and supplies that commodity in bulk and vice-versa.Although the plan looks foolproof,it is nothing more than a joke and political gambit to show the reporter how active the government is. In reality,when a minister was asked how much this fund actually contained,the answer was a shocking meager Rs 500 crores. While this fund should be increased at least 10 times to be effective,the total amount should be tied to the volatility in the wholesale prices of a basket of goods that require government intervention like onion and sugar.

In-elasticity in commodity like pulses – If you watch news channels today you will find a common investigative journalistic take “While the production has declined by 12%,the prices have increased by 100%.This flies against economic theory of demand and supply”. I would never know whether our media is really bad when it comes to basic economics or sensationalism was again preferred over reason.

There is a concept in economics called Elasticity. Elasticity of a good is defined as

Elasticity in demand/supply =(%changein quantity)/(%change in price)

This measures how sensitive a commodity in sensitive to its price. The elasticity of pulses is less than 1,having the implication that in an inelastic commodity like pulses,if the price increases by say 33%,the quantity supplied increases by only, say 10%.If a product has an elasticity of 1,a 33% increase in price would lead to a 33% supply in price.

This explains why despite a 100% increase in prices,there is still a shortage of pulses being imported to our country.When a country is too much dependent on the consumption of an inelastic commodity which is pulses in this case,long term policy actions should be actively pursued,some of them being forecasting the production estimates from future in advance rather than simply taking previous 3 years’ average which is pretty lame,promoting soyabean and eggs(marketing them as vegetarian by taking some pandits on board) as substitutes for pulses and promoting pulses among the rapidly growing vegetarian population abroad.

2.6k Views · View Upvoters

Promoted by Groww

Invest in mutual funds online.

Groww helps you get started without any hassles. Start with small amounts and withdraw anytime.

Sign up at groww.in

Mohana Krishna

Mohana Krishna, An Economics enthusiast

Answered Oct 21 2015

Causes for surge in prices:

India, for the first time since 1986 and 1987, is facing back-to-back monsoon failures. Further in India, not even 10% of the area under cultivation of major pulses (especially in kharif) have irrigation cover. As a result these crops have borne the brunt of deficient monsoons. Adding to this the unseasonal rain and hailstorm early this year had caused damage to few pulse crops grown in rabi.

Then there is a concept of ‘Minimum Support Price (MSP)’ to assure farmers growing a particular crop that it will be bought at a price, not less than certain price(MSP) which shields the farmers from extraneous effects such as inflation, deflation, deficient monsoon, low demand etc. and assuring them of the income that balances their investment. Based on the MSP offered by government for various crops, the farmers usually choose which crop to grow through cost-benefit analysis. In recent years because of higher MSP for wheat over pulses and high demand for wheat in international market, many farmers switched to growing wheat. These two factors led to an additional shortfall of 2 million tonnes in domestic pulses production.

Usually the government balances such a shortfall in domestic production of any crop with imports. However unlike sugar, wheat etc., the total global pulses production is around 70 million tonnes out of which around 15 million tonnes is available for world trade after domestic consumption which is far less than India’s domestic production of around 17 million tonnes. Last year our imports stood at 4.58 million tonnes. Moreover taking advantage of India’s domestic pulses production shortfall, the international suppliers are flaring up prices despite low demand for agro-commodities in global market.

Hello, please follow the rules of the group Steemit for Resteem ↕ and you will be resteemed by the most active members in the group.

You have to resteem a post from the group before you post yours there.

Here is : HOW TO RESTEEM ON STEEMIT ?

And we don't accept posts upvoted by cheetah, write your own post, not copy past !