July Income from Dividends, Options, Crypto Coins, and Lending Club

Welcome to my July dividend and options income post. This year has gone by so fast for me. I cannot believe the year is more than halfway over. In this post I share dividend income, options income, and Lending Club income.

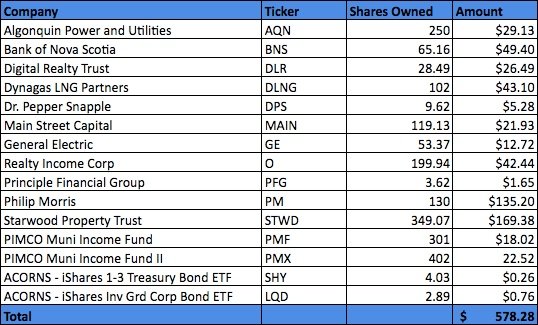

It's been a great dividend year for me. July marks the seventh consecutive month this year where I've set a monthly dividend income record. In July, I earned $578.28 in dividend income. Not as impressive as June's Dividends, where I almost passed $1,000. Comparing July 2016 dividend income to 2017, I earned $78.43 more in dividends this year.

I also closed 4 options contracts, which earned me another $269.70. This month, I'm adding an additional revenue source, Cryptocurrency income. That's right, I started investing in Cryptocurrencies. Most of these are long-term holds, but when I do sell, I'll report them here. In July, I sold 5 Etherium coins and 26 Litecoins. These sales made me $1,582.63. I'm treating this income just like dividend income. I reinvested the money into more coins. Lastly, I earned $51.99 in Lending Club interest. My total July income from all of these sources is $2,483.

I set a 2017 goal of $7,500 in dividend income and $7,500 in options income. To succeed, I need to earn an average monthly total of $625 in dividends and $625 in options. I'm ahead on dividends but falling behind on options. I have many open contracts expiring in November, so I'm not throwing in the towel just yet. If I let these expire, I'll still come in right around $7,500 in options income.

My current 2017 dividend income is $4,690.20. This is an annual pace of $8,040. My current 2017 options income is $4,169.56. This is an annual pace of $7,148. I'm confident that I will reach my dividend income goal; not so confident on hitting the options goal. There's still 5-months left to this year, anything can happen.

July Dividend Income

I was paid dividends from 15 sources. My largest dividend income came from Starwood Property Trust, followed by Philip Morris. My average daily dividend income totaled $19.28. My 2017 dividend income totals by month can be found on my Dividend Tracker page.

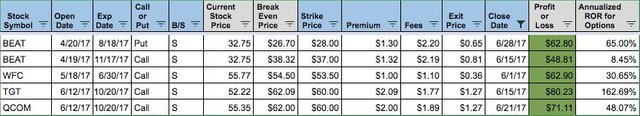

July Options Income

I closed four contracts in July, three covered calls and one cash secured put. Total income after expenses was $269.70.

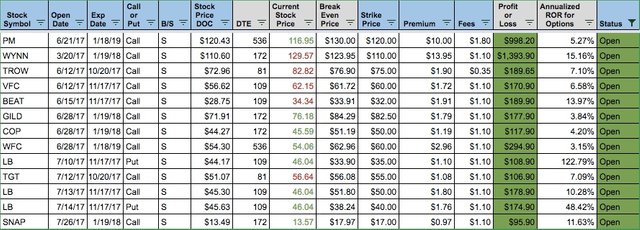

I have a bunch of open options, many expiring later in the year. I typically like to sell 30-60 day contracts, but to earn enough premium to make the risk worth it, I've been selling options expiring at the end of 2017 and early 2018. The image below lists all 13 of my open option contracts. I didn't blog about all of these contracts, but I did write a posts - closing two Qualcomm contracts, selling a TGT and QCOM contracts and selling a few L Brands contracts. I also bought 100 shares of L Brands and sold a covered call against the shares. If I let all of these expire, my realized revenue will be $4,199. My annual options income by month can be found on my Options Tracker page.

One last update that I didn't blog about. I bought 100 shares of SNAP Inc. I'm not in love with this company, but the price has fallen dramatically and I think there's upside here. I also sold a covered call against SNAP. My current cost basis is $12.54 per share. SNAP is reporting earnings next Friday, if they beat earnings, I expect a large price spike. If not, the stock should tumble lower. I'll likely add 100 more shares if there's an earning miss.

That's it for me. It was a record income month! I hope it was the same for you.

How much money did you make in July?

I'm jealous, I wish my profit/loss column was all green! Keep up the solid picks!

Thanks. The first chart are closed and green due to revenue after expenses. For full disclosure, on the second chart they are all green because the options are still open. So they may not stay that way, but they look good now. ;-)