Distributed Blockchains - More Important Than The Internet

Distributed blockchains are a frustrating beast to understand, especially for tech professionals with experience of building large-scale centralized data systems. I was once in the same boat.

Honestly, if someone were to ask me to build the slowest, most expensive and just plain inefficient database, a distributed blockchain would seem to be the top contender. Every node has a copy of the entire database. Every node reprocesses all records to verify consensus from day one. Data synchronization traffic is huge and only one node allowed to add new records to the database. If that’s not enough, let's burn some electricity to decide which node should win the privilege to append that new block!

And mass media headlines just add to that frustration.

The deck below is a tailored address to the most common questions asked by technology experts as they delve into the strange world of blockchain technology and aim to understand the logic of it.

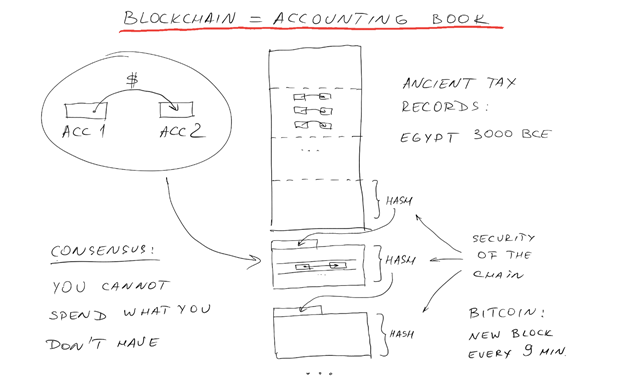

Slide 1: Blockchain = Accounting Book

For starters, there is really nothing new about the blockchain itself. It is a simple ledger, an accounting book, the most ancient tech known to humans.

- Blockchain is a list of records, stating that so many tokens have been transferred from one account to another.

- A “Block” is an aggregation of records that are grouped together before being added to the blockchain.

- "Chain" means that a hash from the previous block is included in has calculations of the next block, and so the entire blockchain becomes immutably linked.

- "Consensus" pretty much means "you cannot spend what you don't have".

Note: I’ll often simplify things to avoid "being lost in the woods".

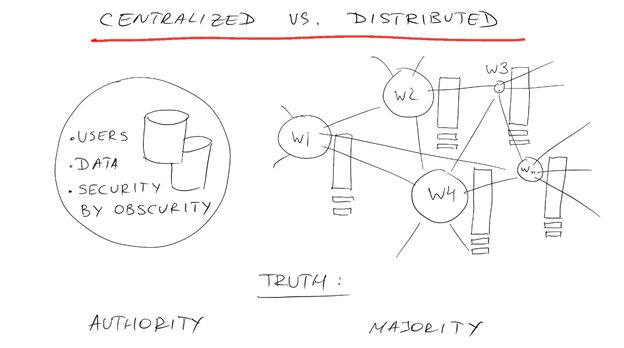

Slide 2: Centralized vs Distributed

If at the bank I transfer money between two accounts that belong to me, only my bank knows about the transaction. Here, my bank is the ultimate authority.

On the distributed blockchain - everybody knows about every transaction. Each node is the same and each one keeps a copy of all the transactions in a simple text form. Truth is confirmed by majority instead of authority.

There are some blockchains (ex. Zcash) that make it impossible to decipher records, but this is a different topic. Most blockchains are not encrypted at all.

That said, there is no personal identifiable information on the blockchain. All account numbers are just… long numbers.

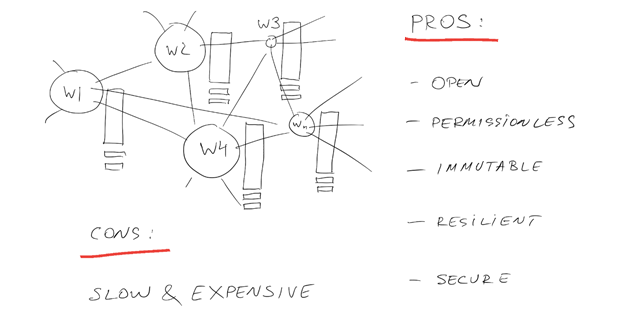

Slide 3: Advantages & Disadvantages

Blockchain is an expensive and slow database. But its architecture offers unique benefits. It’s:

- Open – anybody can launch a node and anyone can build services on top of it. Blockchain serves people as much at it serves bots, computers, IoT and more; it is an example of true net neutrality (transferring $.10 of value or $1B has the same cost & speed).

- Permissionless - you don't need permission to open an account or to post transactions or use any other blockchain services; there is no central authority on the blockchain.

- Immutable – once a record is added to the blockchain it will remain there unchanged, visible to everyone, forever.

- Resilient – it’s impossible to seize funds or even prevent future transactions from any account. In order to stop the blockchain, all telecommunications must be stopped (signed transactions can be sent using SMS), and as long as a single node on a yacht in the middle of an ocean still works, the entire blockchain is still operational.

- Secure – there isn’t much to hack on the blockchain, all records are already public.

Centralized systems (as well as private blockchains) do not have these properties.

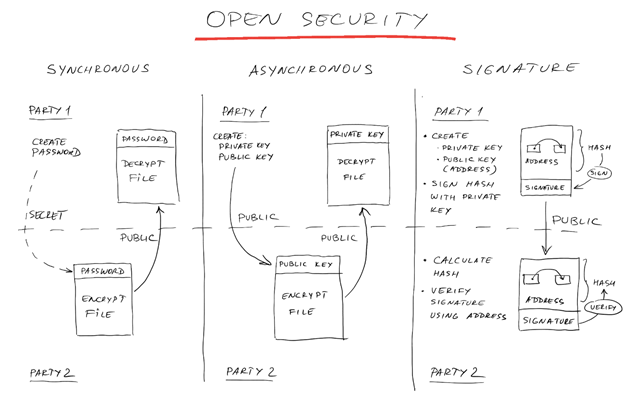

Slide 4: Open Security

Symmetric-key encryption uses the same keys for both encryption and decryption (password protected zip file).

Asymmetric-key encryption uses a public key for encryption and a matching private key for decryption (submitting bids over a non-secure network).

Digital Signature – when the hash of a document (i.e. transaction) is encrypted by a private key, but can be decrypted and verified using a public key.

On a blockchain, the public key is the wallet address.

Each transaction (hash) on the blockchain must be signed by the private key of the sender and all nodes use the public key (sender’s wallet address) to decrypt the signature and ensure it matches the transaction hash.

This is how users prove wallet ownership - they can spend money from it by broadcasting signed transactions to any node. Transactions are signed offline.

Note: private keys should never be entered or transmitted online.

Slide 5: Your Keys, Your Bitcoin

There is no "forgot password" procedure on blockchains. No one has a copy of your private key. If you lose it, you lose access to your wallet and all the money in it.

Slide 6: Elliptic Curve Cryptography

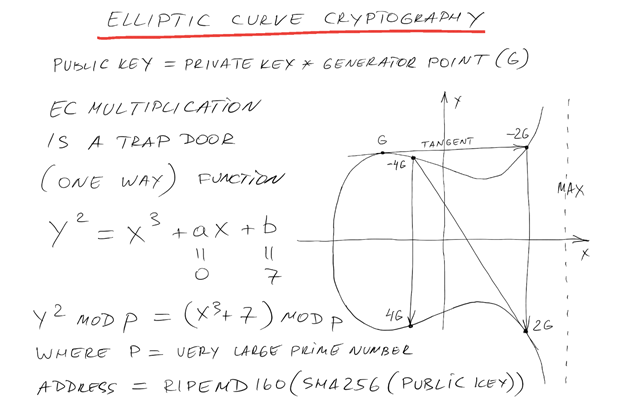

Your money on distributed blockchains is protected by elliptic curve cryptography.

In order to create a wallet, you randomly generate a 256-bit long number and call it your private key.

Then you "multiply" it by a number G (Generator point) and receive a public key (wallet address). That's it.

Multiplication on elliptic curve is a special procedure that works only one way (i.e. division is not possible) and is repeated many times.

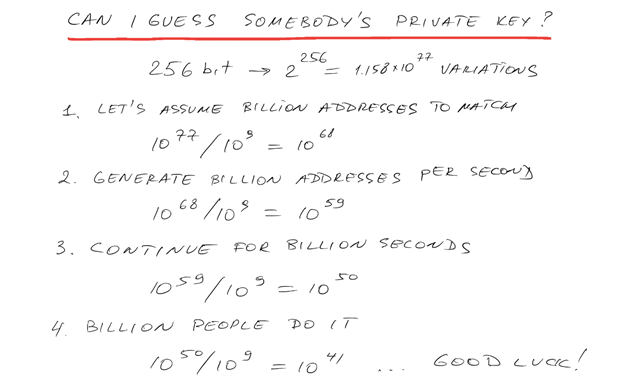

Slide 7: Can I Guess Somebody’s Private Key?

In theory it can happen, but in reality, number of combinations rivals number of atoms in the universe.

There is no "this login is already in use" verification on blockchains.

Slide 8: Can Bitcoin be hacked?

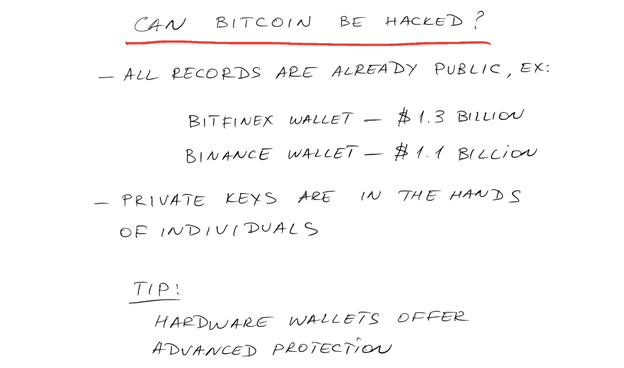

Since the entire blockchain is public, anyone can see the balance of any account, including the largest ones. Huge amounts are stored in plain sight of hackers all over the world, yet no successful hacks were reported.

And if it ever does happen, a copy of the blockchain can be launched as a separate blockchain (aka hard fork) with a snapshot taken 1 block prior to the hack and a new encryption method.

Note: A hardware wallet (around $80) is a compact USB device that can be used to broadcast signed transactions. The private key never leaves that device. In case of a loss, the wallet can be restored from a combination of 24 words, which can be printed on paper and safely stored. The USB key itself is protected by a pin. After 3 wrong attempts, the hardware resets.

Multi-signature accounts can be used to store larger amounts.

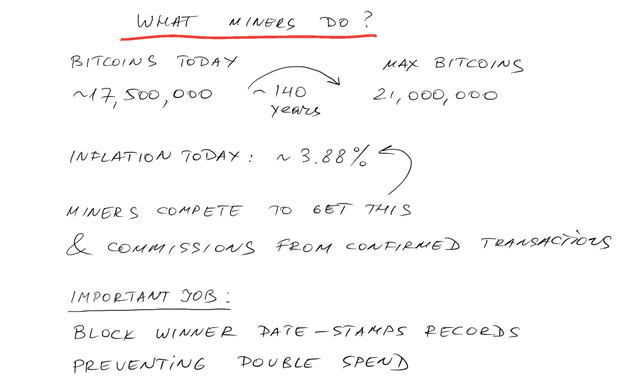

Slide 9: What Do Miners Do?

Satoshi Nakamoto, the genius mind behind the 9 page Bitcoin Whitepaper, proposed a practical solution for solving the double spend problem in a distributed network. He created a math competition between mining nodes for the right to add the next block to the blockchain (i.e. trusted timestamping).

The winning miner receives a reward: newly minted Bitcoins as well as commissions for processing transactions included in the block. Current Bitcoin inflation is 3.88% and a new block is mined every 9 minutes. Inflation trajectory and other parameters were set at Bitcoin inception 9 years ago and are not subject to change.

Besides the proof-of-work mining systems, there are proof-of-stake, delegated proof-of-stake, proof-of-brain, proof-of-activity and other systems.

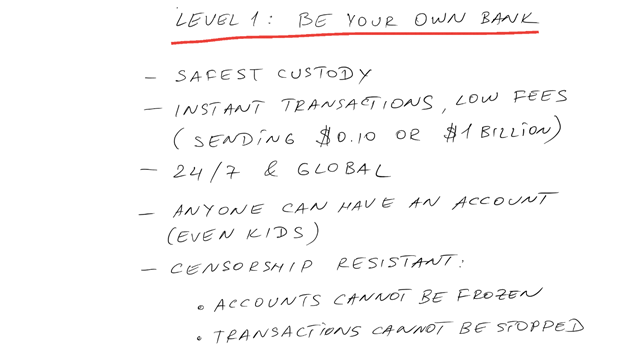

Slide 10: Level 1: Be Your Own Bank

Currency is the first application that can run on distributed blockchains.

We use banks to keep our funds safely and to transfer funds where they need to go.

Bitcoin does these functions better, cheaper, faster, around the clock, immutably, permissionlessly, globally, with no risk of freezing and more.

Note: At this stage Bitcoin and other cryptocurrencies are highly volatile. Bitcoin market cap is just $100B. For a global currency this is just the beginning. It's like a small fish swimming among whales and with a swing of a tail they can send it flying up, down and sideways. But being indestructible (antifragile) it just keeps growing and improving.

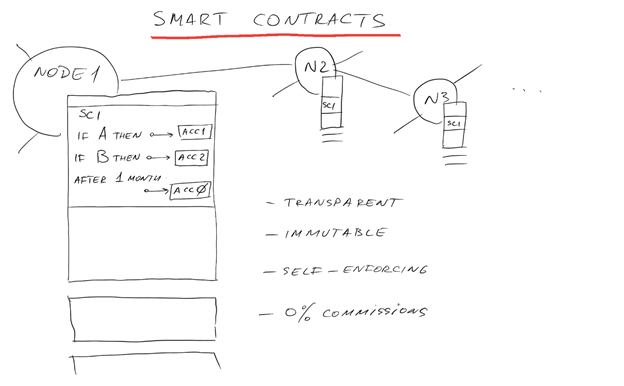

Slide 11: Smart Contracts

Smart contracts are programs that can be recorded on the blockchain and activated by the transfer of funds to a contract address. Smart contracts are self-executing and provide better security as compared to traditional contract laws. These transactions are transparent and irreversible.

Smart contracts can automate complex business rules and processes to replace 3rd parties and intermediaries in many common business transactions, while dramatically reducing transactional costs; small network processing fees may apply.

Note: Many business processes require stability of transactional currency: low margins, long-term agreements and more. Stablecoins are cryptocurrencies that are pegged to assets, such as USD, Euro, gold, etc., which can be exchanged for underlying assets (or equivalent value) at any time. Stablecoins can be used in smart contracts.

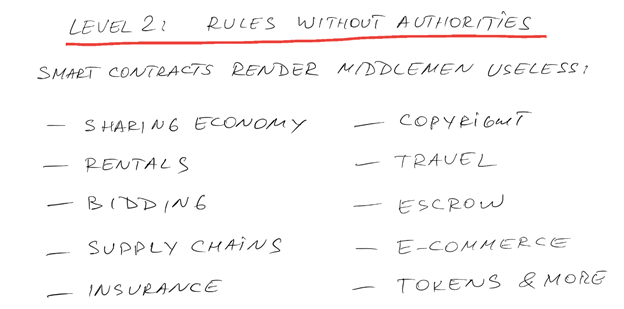

Slide 12: Level 2: Rules Without Authorities

Traditional business models for middlemen include commissions, but smart contracts can be easily copied and modified to exclude commissions, and then used by customers and suppliers without intermediaries.

Established businesses have seen many technologies and inventions come and go, and have so far been able to adapt successfully. But the distributed nature of the blockchain poses an entirely new challenge - openness and permissionless innovation on the fringes of the network.

That is why established businesses often attempt to launch private blockchains or limit blockchain use to just record keeping like supply chain tracking, maintenance schedules, etc. In a way, this echoes the Intranet era, when the open Internet was deemed too slow, too transparent, too unsecure, and too unpredictable for real business. But rapid innovation on the Internet turned all these ambitious Intranets into stale pools of dated information and ugly interfaces.

Blockchain that lost its distributed nature is no longer open, permissionless, immutable, resilient, or even secure. Private blockchains are simply expensive and slow databases.

Effective business models on distributed blockchains are very possible, and they no longer rely on simplistic commissions or access obscurity. Effective business models on open blockchains can be implemented using different types or combinations of tokens, while aligning interests of business owners and their clients. This is a huge and exciting topic, which extends way beyond the scope of this article.

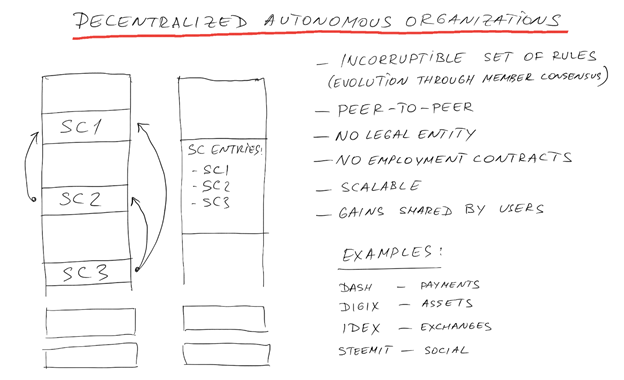

Slide 13: Level 2 - Decentralized Autonomous Organizations

A collection of smart contracts that can interact with each other allows creation of very complicated structures that can mimic operations of entire companies without any human managerial interventions at all.

Welcome to the uncharted waters of DAOs (or DACs - Decentralized Autonomous Corporations) that exist only on the blockchain as a combination of self-enforcing rules. Some DAOs provide services worth hundreds of millions of dollars (ex., IDEX) yet they are not even registered as a company in any jurisdiction. DAOs can hire people to do certain jobs (ex., DASH blockchain hires developers, Steem hires content creators and curators).

In most cases DAOs do not have direct beneficiaries, instead they may have an underlying token that appreciates in value as more users use its services. DAOs may have dedicated development teams that create smart contracts, but these contracts are deployed to the blockchain by clients, rather than the central authority.

Note: Bug fixing and updating DAO software might be a very difficult process, which requires all users to switch to a new copy of the DAO or participate in a time-consuming voting process.

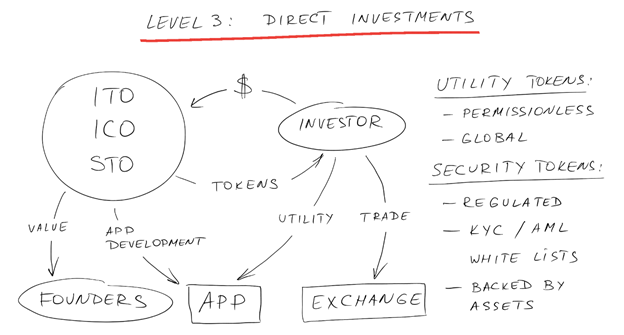

Slide 14: Level 3: Direct Investments

Smart contracts enable a number of new forms of crowdfunding. The key to the success of these new forms of fundraising is simplicity. An investor sends the money to a trusted contract on the blockchain and receives company tokens, which can often be immediately traded or used to engage company services.

Much of the discussion around Initial Coin Offerings (ICOs) has been about mixing two distinct functions in one token: utility and security. Securities are regulated and require additional procedures, such as know your customer (KYC) and anti-money laundering (AML) / anti-corruption due diligence and more.

The more recent approach is to separate utility tokens (distributed through an airdrop or other non-financial means) and security tokens, that are sold through the process known as Security Token Offering (STOs) where only qualified investors can participate.

Security tokens may represent shares in companies, but they also can be backed by other assets, such as real estate, accounts receivables, inventory and more, thus offering flexibility for fundraising and access to capital. STOs are expected to unlock tremendous amounts of capital.

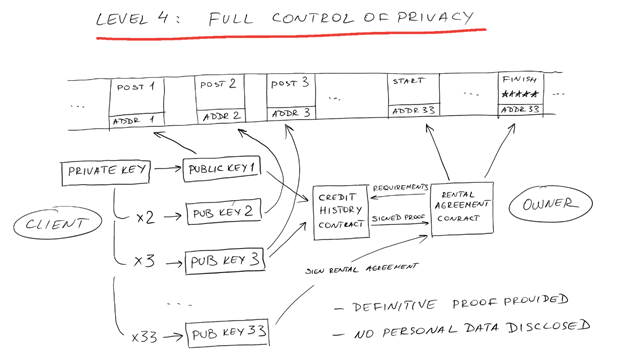

Slide 15: Level 4 - Control Your Privacy

Information on distributed blockchains is stored openly and while account ownership is not recorded, it may not be enough to protect certain types of personal information, such as health records, rental history and more.

It’s possible to manage multiple identities using a single private key. Simple rules can be used to generate secondary private keys with matching public addresses. Now each sensitive transaction can be submitted to the blockchain under a different identity, making it impossible for an external observer to establish a connection between these records.

The user preserves full control of multiple identities and sensitive information stored on the blockchain.

There are methods and services being developed which allow users to provide cryptographic assurance to requesting parties confirming their rental history, for example, without disclosing the connection between identities.

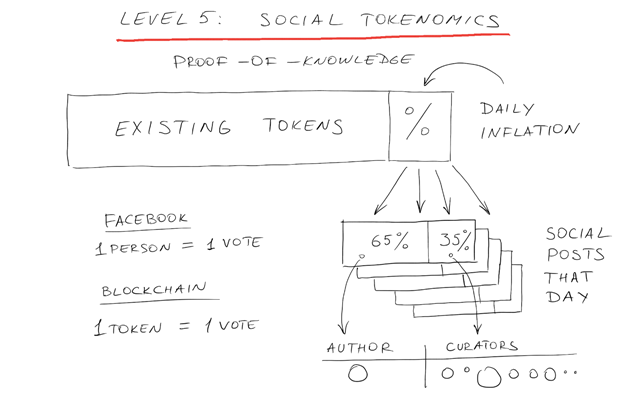

Slide 16: Level 5 - Social Tokenomics

Social blockchain projects allow users to earn cryptocurrency by doing something useful and fun. For example, Steem blockchain distributes daily inflation to new posts according to the number of received upvotes. Rewards are given to both authors and curators. Voting power is defined by quantity of vested tokens the user has on their account.

Authors of posts are only rewarded when the community recognizes the value of their input. Over time users can build a reputation and domain (subject) expertise.

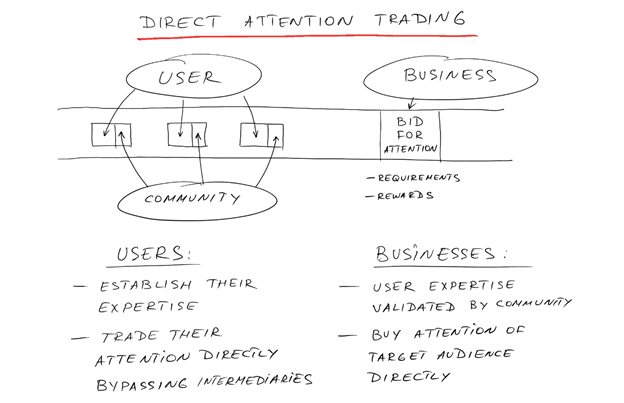

Slide 17: Direct Attention Trading

Once users have established domain expertise, businesses can bid for attention of target audiences directly through the blockchain, entirely bypassing now redundant intermediaries. For example, a manufacturer of outdoor clothing can place a bid on the blockchain offering a $5 reward to users with proven expertise in outdoor activities (such as hiking, camping, fishing) for watching a video featuring their new breathable rain jacket. Users are then free to accept the offer, ignore it, or even offer their attention for a higher price.

Social blockchains have the capacity to redefine the rules of the advertising industry as we know it today.

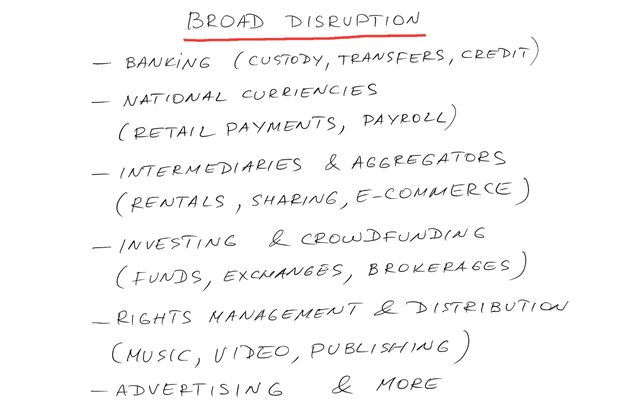

Slide 18: Broad Disruption of Industries

Just when you think you have a good idea and a practical scenario for application of a distributed blockchain, you discover there are at least dozen well-funded projects that are ahead of you. You look further, study their whitepapers, and learn how well thought-through their models are. Yes, this is how fast things are happening in the blockchain space.

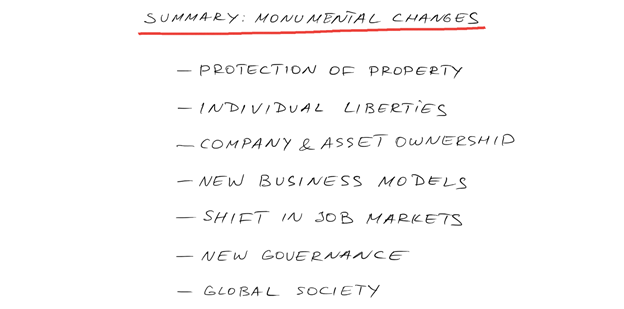

Slide 19: Conclusions - Monumental Change Is Inevitable

If you think you can "go on with business as usual", get ready for a surprise.

This is a great post @grampo, the steem blockchain is lucky to have someone as talented as you creating content here.

A very well written description of what blockchain is and why it's so important. Will be sharing this on a few other platforms and coming back to read it again. A lot of information to absorb!

Might even throw it out to the linked in crowed who are still convinced Bitcoin is drug money 😝

@kabir88

Great post! I didn't learn anything but then again I've been researching blockchain 3 hours a day for the last year.

This post offers the simplest explanations of the most blockchain topics I've ever seen.

Ha! 3 hours! You must be a king of moderation! Once I plunged myself into this "rabbit hole" I spend way more than 3 hours ;-)

I am very excited about building Attention and Reference Trading marketplaces on Steem. This can bring many new parties to Steem platform. Allowing businesses to bid directly for customer attention through the blockchain is going to put value where it belongs - in the hands of customers, not intermediaries!

Interesting article! I resteemed. Thank you.

Posted using Partiko iOS

Whooo, very much informations about blockchain ,A lot of information in just a single post.i have got now more idea about blockchain.

I Really appreciate it.

Posted using Partiko Android

Wow Friend thanks for the simple explanation, as my grandfather would say. "You ate my corduroy"

Although it is in English I will give you Resteem so that your explanation reaches more users.

Great presentation and idea to make slides on piece of paper, then scan it and put into post.

Very helpfull information was included, quality post confirmed ✔

Amazing post! Voted and re-steemed and shared on Twitter. Awesome job at explaining Blockchain Technology and its applications :)

Fantastic post! I learned a lot from your descriptions.

Welcome to Steem! So good to have you here!

Wow, this is like a condensed encyclopedia of Blockchain! Thanks so much. I haven't read the entire thing, yet, because it's so jam-packed with valuable info--and your illustrations are great too. I like to see a representation of what the blockchain is....your's is easy to understand.

Many Thanks from this old Newbie who can't post much.

Very well explained!

Posted using Partiko Android