Digital Currency Enthusiasts Expect Ethereum to Become Larger than Bitcoin.

Ethereum is closing in on Bitcoin in terms of market capitalization, trading volume and Google Trends. In terms of other key indicators, Ethereum has already surpassed Bitcoin. This has been a longtime coming not only for Ethereum supporters, but, also, for Bitcoiners who have worried about the digital currency’s scaling issues.

Get exclusive analysis of bitcoin and learn from our trading tutorials. Join Hacked.com for just $39 now.

These flips in key indicators between the two largest cryptographic assets are tracked by a website, Flippening.watch.

In the past 24 hours (at the time of writing), there have been 235,604 Ethereum transactions. But, despite wild success as a ‘peer-to-peer electronic cash’ system, there have been only 216,887 Bitcoin transactions. Ethereum’s transaction capabilities have not even been its main feature advertised by proponents. That would be its smart contract and decentralized application functions.

But, ‘the Flippening’ doesn’t stop there. Miners of ether, Ethereum’s native digital token, are enjoying more mining rewards than their bitcoin counterparts. In the last 24 hours, $9,396,000 has been rewarded to ether miners. But, just 5,302,800 has been rewarded to bitcoin miners. Moreover, there are more nodes (30,070) than Bitcoin mining nodes (7,552) as of June 11.

Bitcoin’s market capitalization is still larger than Ethereum, which is 66.7% of the former’s. There are more Bitcoin’s being traded than ether, but as ShapeShift announced last week, volume of Bitcoin going into Ethereum was causing slight delays on that platform.

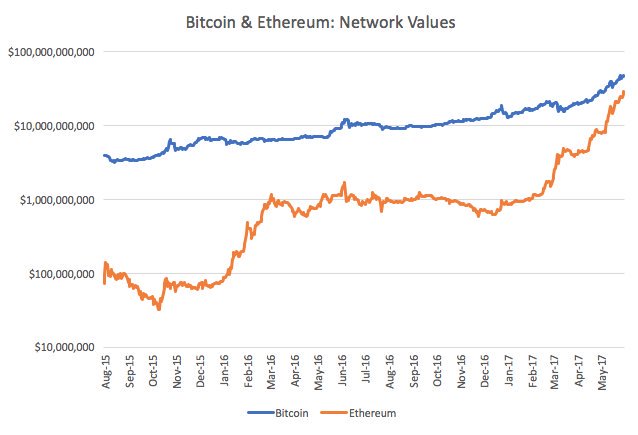

Bitcoin, despite being at an all-time high, has seen its overall share acrpss the crypto-assets complex shrink in recent months, with Ethereum closing a lot of the gap between the two while trading at all-time highs.

Bitcoin has seen its growth stagnate in recent years as discussion about future development has grown heated and created rivalries within the Bitcoin creation community. Ethereum, enjoying the support of large multinational corporations and financial institutions via blockchain consortiums, can today process data faster than Bitcoin. This enables higher volume of lightweight finance pouring through the system and at less expensive rates. Currently, the average Bitcoin transaction costs about $1.50.

While Ethereum theoretically can handle lightweight finance transaction a la Bitcoin, it is proposed and designed to do much more. Smart contracts are meant to fuel decentralized applications known as dApps. Ethereum pledges smart contract and dApp technology will distribute business and legal transactions normally facilitated by banks, public registries and the legal system.

Intel, Microsoft and Samsung are experimenting with Ethereum. Meanwhile, large corporations that once accepted Bitcoin on their website, have rescinded acceptance.

Bitcoin’s dominance rate might be falling as its utility is falling when compared to other blockchain projects. Further, infighting within its creation community is a source for uncertainty.

While Ethereum is not a bitcoin competitor, the value of Ether is increasing as more people join the Ethereum community at a faster clip than those forming around Bitcoin.

Ethereum, which is currently approaching a $30 billion network value, is swiftly closing the gap on Bitcoin’s $50 billion market cap.

Assuming things stay on track, Ethereum could surpass Bitcoin’s market capitalization by the year’s end. Although Ethereum proponents will see this as a victory, and some Bitcoin proponents will see this as a failure, the reality is both systems have been very successful.

hope so, I can't afford bitcoin anymore!

That's a fact, ETH will take over bitcoin market cap by this summer 🙌🏼🙌🏼🙌🏼

Yes, I think it will happens soon.

I doubt ETH will surpass BTC longterm. People want a safe place to PARK their wealth and Bitcoin is ideal for this. Who cares how many transactions something has?? I don't own Bitcoin so I can buy a cup of coffee I hold it because it is a safe haven asset with scarcity.

Don't get me wrong, I love ETH as much as the next person but it will mainly be used for smart contracts and transactions.

Time will tell.