What are the Prospects, Pros and Cons of Getting paid in Cryptocurrency?

A good numbers of companies are already trying to create ways to pay their employees with cryptocurrencies. Although this concept may seem appealing and mostly welcome especially among the crypto-community, there are several obstacles that have – at present time – kept it from widespread adoption.

Earlier in December 2017 a company by the name, GMO Internet Co. Ltd. announced its intentions to start paying up to 100,000 yen (roughly around $900) per month by Bitcoin to its employees, the public’s reaction was, as expected, definitively uncertain. People seemed to be torn between the fierce volatility of cryptocurrencies on one end and the obvious potential for explosive growth on the other.

THE WINDS OF CHANGE

Fast forward a few months, and we see a serious turn in the tides. According to Uphold, a multi-purpose digital money platform currently in partnership with Bitwage, a payroll processing firm, Netflix, Starbucks, Airbnb and other large corporations already pay their workers through Bitwage. This means that any worker could ask for any portion of his salary to be paid with Bitcoin.

Strong arguments are being made about the advantages of cryptocurrency payments within the gig economy. The transparency of blockchain-based technologies, combined with the speed of digital payments and the opportunity to circumvent banking intermediaries is undoubtedly appealing to those occupied in the sharing economy.

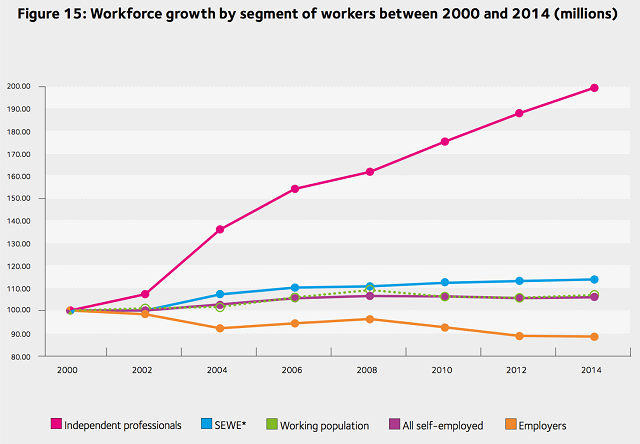

Furthermore, the potential for enabling secure peer-to-peer payments is undoubtedly attractive for every participant in the relationship. It’s also true that we’ve seen a serious increase in the number of people occupying freelancing positions over the last decade.

“This could be a win-win for workers and the platforms.” Says Saif Benjaafar, director of the Initiative on the Sharing Economy at the University of Minnesota.

THE ROADBLOCKS AHEAD

While there square measure composed edges of blockchain integration inside the sharing economy, it would be timely to leap the gun with conclusions.

“Payments exploitation cryptocurrency created to freelance contractors square measure nonexempt,” reminds rain forest Ozelli, a CPA, and a professional.

What is a lot of, employers square measure beholden to issue 1099 kind to the freelance contractors they’re partaking. However, you can’t very enter a payment of one,000 Bitcoin on the 1099 bureau kind simply however.

Now, it’s true that some corporations square measure changing edict into cryptocurrency for employers. However, they have a tendency to charge some hefty fees for that, reasonably devastation the complete “no third party” thought of the blockchain.

In different words, sheer body burden may be standing within the means of any cryptocurrency growth. is that this a nasty issue, though?

Share your thoughts about this here. Would you receive your regular payment in cryptocurrency if it were an option? will the protection and transparency of blockchain-based technologies outweigh the present market volatility and uncertainty?