Are We In For A Long Depression?

I came across an article that discusses this topic.

In the United State, the Great Depression gets all the attention. It was a global situation that lasted for a decade. The reason why it gets so much attention is that it was so quick in the making. We saw the "Roaring 20s" come to an immediate halt.

It was also a deep one. Things feel off a cliff and millions were affected for life. Talk to people who went through it and you will get a quick sense of how it never left them.

There are another situation that does not get the same attention and could be mirroring what we see today. This one was not a result of what Greenspan called "Irrational exuberance" as much as a technological driven one.

In the late 1800s, the United States experienced their longest recession on record. From 1873-1879, the United States was in a recession. After that, there were 4 more quarters which qualified, bring the total to 161 months in a 13 year period.

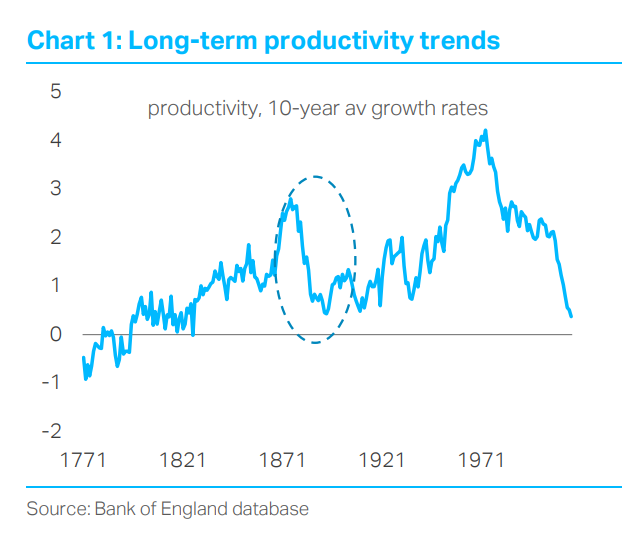

The parallels start with the low period of productivity. Both then and now show, potentially, similar situations.

This low period of productivity results in deflation.

Perkins also calls attention to deflation. While most analysts agree that the effects of globalization, technological innovation, and a shift to a services-oriented economy away from manufacturing have all combined to keep inflation tepid, “these deflationary pressures were even stronger in the late 1800s, producing a sustained period of failing prices,” he writes. “U.K. inflation averaged -1.4% between 1873 and 1888.”

We all know the central banks of the world have spent the better part of the last decade printing money like it is going out of style. This caused a major problem since the traditional result is inflation. Yet, outside a few countries where there are other issues, inflation is rather tame. We do see some potential bubbles in asset prices but across the board inflation has not resulted. This is perplexing to the bankers who are using the typical playbook.

Another similarity is the impact on jobs. We are noticing a carving out of the middle class. This also was present during the late 1800s. Technologies such as the telephone, automobile, and others started to impact society over a 20-30 year period. This caused great disruption.

Globalization was also seen for the first time, at least on a mass scale.

The second half of the 19th century brought about a surge of globalization, Perkins noted, that was just as disruptive to people then as the one we’ve just lived through. “Industrialization plus huge advancements in transportation and communication allowed mass production and the shipping of agricultural products and cheap manufactured goods.”

It is probably not surprising, then, that populism as we know it now originated in the late 1800s. “The word ‘populist’ first appeared in 1891, as the name for a dynamic movement launched by farmers and workers in the Midwestern and Southern United States. Most socialist parties were also founded in the late 1800s. Some feared a Marxist revolution.”

Are we seeing a repeat of that time period? Could we be in for another 10+ year run where things are truly awful?

My view is no.

While we are likely to see a recession, perhaps even major, in the next few years, I think that is the extend of where the parallels are. Yes, a collapse in the markets could set things off like the last time. And while we have a technology fueled situation, things are a lot different.

To start, when technology causes the problems, it often solves them by adding to the productivity. This is what happened in the late 1800s. The new innovations got implemented so that, by the early 1900s, people were using telephones and cars.

Today, we are exiting a period where the technologies were developed yet had little impact on productivity. The last 20 years was a down period for technology. This does not mean that innovation and research was not taking place, because it was. However, this did not result in the society altering products that send productivity much higher. Outside of the smart phone, it was a rather quiet period on that front.

What we witnessed over the last 20 years was the breakout of the technologies developed the two decades before. The 1980s and 1990s saw the introduction of the personal computer, internet, cable television, mobile phone, and in home gaming. All of these because huge industries over the last 20 years, each resulting in trillions of dollars in added productivity globally.

The next two decades will see the rise of 3D printing, AI, XR, quantum computing, advanced communication, and synthetic biology, all of which will create serious impacts on society. While they are deflationary in nature, they are also faster moving than what took place in the late 1800s.

To give an example, the telephone took over 60 years to read 70% of the population of the United States. The smart phone achieved the same penetration rate in under 7.

My view is that the shift in demographics means many technologies will be implemented in under a decade. Quite simply, the anti-tech people are dying. As the older generations pass away, the younger ones are left. They are the technology people, the ones who are willing to embrace new things.

This will only accelerate the acceptance of societal changing technologies. We have mechanisms that deliver them quicker than ever before. Globally, as long as someone is online, they have the ability to access the latest and greatest in terms of knowledge. This accelerates everything like we never saw before.

Thus, ultimately, whatever down period we have, from a technology perspective, will be much shorter. The reduction in productivity the last decade is due to the lull in the release of technology. In my estimation, we are at the point where we see some technologies released on a wide scale.

This will see the production numbers flying over the next 10-15 years.

If you found this article informative, please give an upvote and resteem.

I definitely agree with you. The recent epidemic outbreak like the current Corona is an indication for economic trend shifts. Certainly, more of this till everyone gradually gets to appreciate crytocurrency. Thanks for storing it here.

Posted via Steemleo

Hello,

Your post has been manually curated by a @stem.curate curator.

We are dedicated to supporting great content, like yours on the STEMGeeks tribe.

If you like what we are doing, please show your support as well by following our Steem Auto curation trail.

Please join us on discord.

Congratulations @taskmaster4450le! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.