Deflation is already here, but what does it mean for our future?

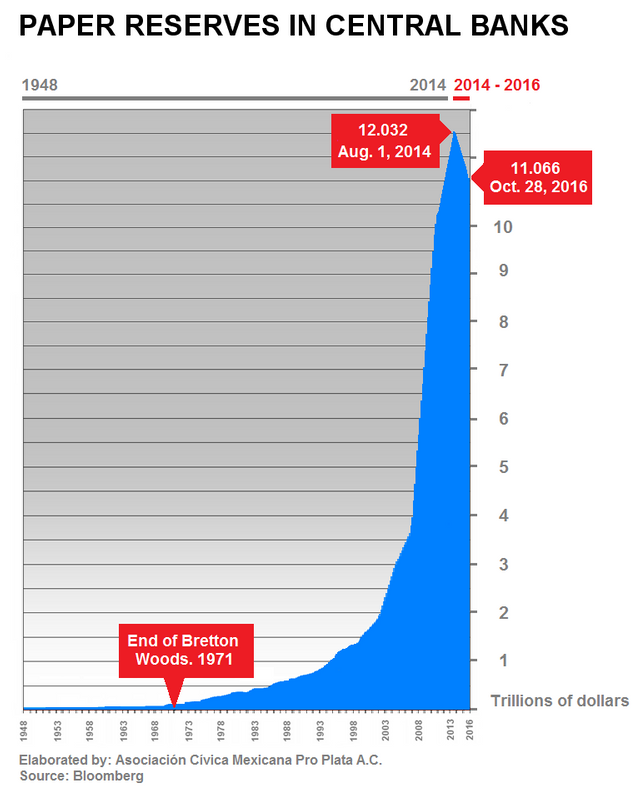

I came across an interesting article showing international reserves in central banks peaked globally in August 2014: http://www.plata.com.mx/mplata/articulos/articlesFilt.asp?fiidarticulo=299

These reserves are basically US and European Treasury bonds that are held as credit by net exporting countries like China, which allows the West to run huge trade deficits and keep spending more than we produce.

Reserves have never fallen before since the 1971 Bretton Woods agreement, when USD became the world reserve currency and the debt based inflationary money system took off.

Not even in 2008 during the huge credit contraction, because the modern banking system is designed and leveraged in such a way that we need ever expanding credit (and thus reserves) or the whole thing collapses.

The peak in August 2014 also coincides with when the FED officially ended QE3, oil collapsed as a result, and interest rates started going negative. All hugely deflationary events.

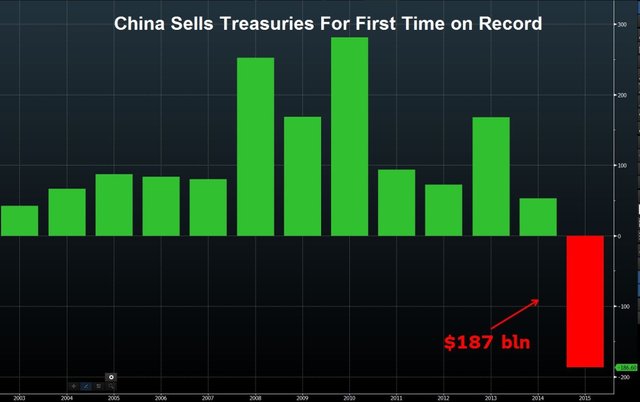

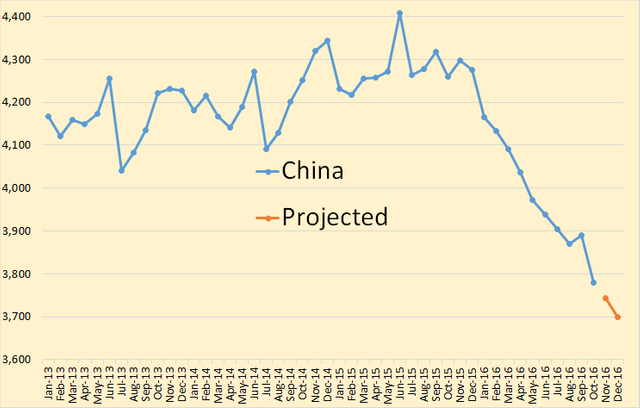

So China obviously stopped buying US Treasuries, and has actually been a net seller since 2015, which explains the decline in reserves and the rise in USD (when you sell Treasuries, you effectively buy USD which increases demand).

The media blurb is that they have been selling Treasuries to prop up their currency yuan because of capital outflows, but this doesn't really add up...so what have they been doing instead with their trade surplus and dollars?

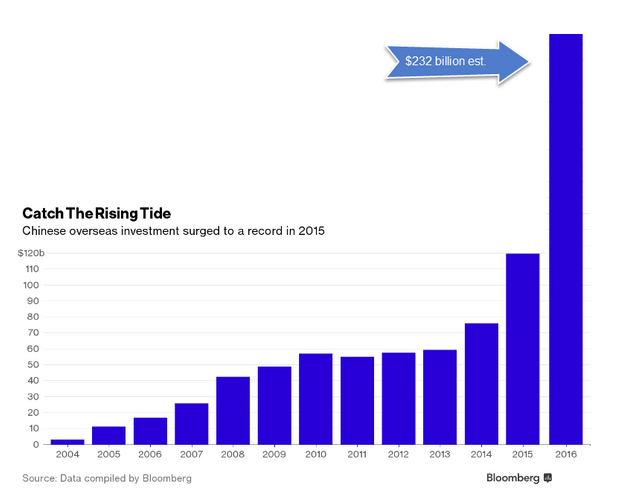

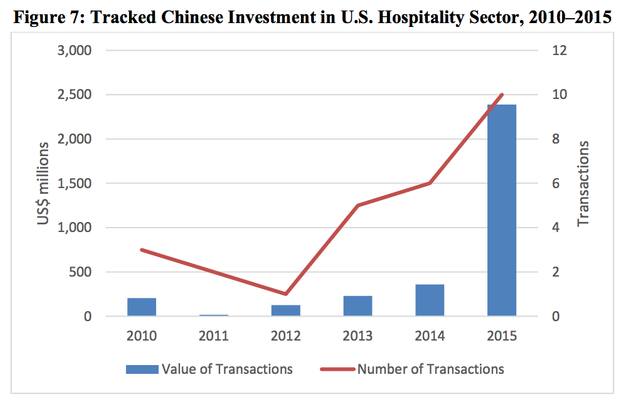

1 - Buying up companies - Chinese overseas acquisitions have exploded since 2014 and they are trying to convert as many of their dollars into tangible assets, while they are still worth something - hotels, tech companies, biotech you name it: https://skift.com/2016/08/04/4-charts-showing-the-5-billion-boom-in-chinese-investment-in-u-s-hotels/

2 - Buying up oil - China is the world's largest buyer of oil, and their consumption is growing, but since 2015 their own internal oil production has collapsed (likely due to falling EROI).

So they have had to make up the difference from overseas, not just buying crude oil but also investing in oil operations, and providing loans-for-oil to exporters like Ecuador and Venezuela: http://www.nytimes.com/2015/07/26/business/international/chinas-global-ambitions-with-loans-and-strings-attached.html

In recent years, state-controlled Chinese oil companies have acquired big stakes in oil operations in Cameroon, Canada, Kazakhstan, Kyrgyzstan, Iraq, Nigeria, São Tomé and Príncipe, Sudan, Uganda, the United States and Venezuela: http://money.cnn.com/2015/10/26/news/companies/china-texas-oilfields/index.html

3 - Infrastructure loans - China Development Bank lends 3x more than the World Bank to overseas developing countries, turning their dollars into real assets with real returns: http://www.scmp.com/business/banking-finance/article/1285686/its-almost-free-money-chinese-banks-offer-cheap-loans

As of August 2015, China had over $1 trillion in overseas investments: http://www.mekkographics.com/chinas-1-trillion-in-overseas-investments/

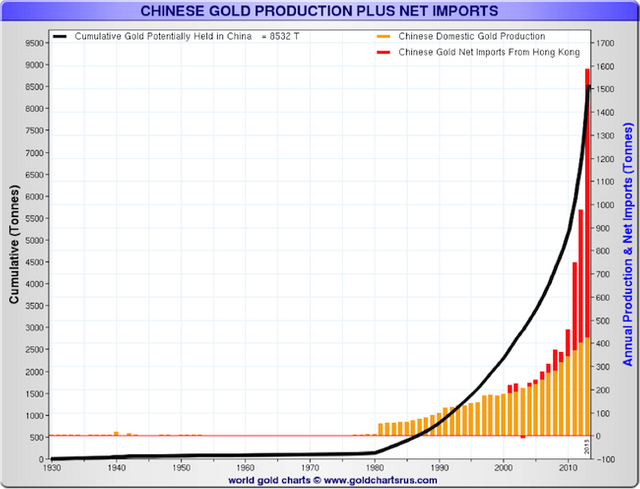

4 - Buying up gold - gold is the only other reserve asset recognised by central banks, and China obviously understands the next economic system after the US petrodollar will be based on it. So they have been furiously buying up as much gold as they can, to put them in a good position when the time comes.

There's lots of speculation that their gold reserves are being under reported to allow them to acquire more without raising attention, so this could be a source of 'capital outflows' as they get rid of Treasuries and convert their US dollars into physical gold.

In summary, China is accelerating their de-dollarization strategy and buying up real assets in preparation for the deflation endgame, while the media keep us distracted with Trump vs Clinton and pumping paper assets at all time highs, giving us the illusion of wealth.

This buying spree is sometimes mis-reported in the Western media as capital outflows (people and investors pulling their money out of China), which is a bit misleading - some Chinese are trying to get their money out in anticipation of Chinese currency devaluation, but foreign direct investment (FDI) into China is actually up 4.2% in 2016 YoY: http://www.tradingeconomics.com/china/foreign-direct-investment

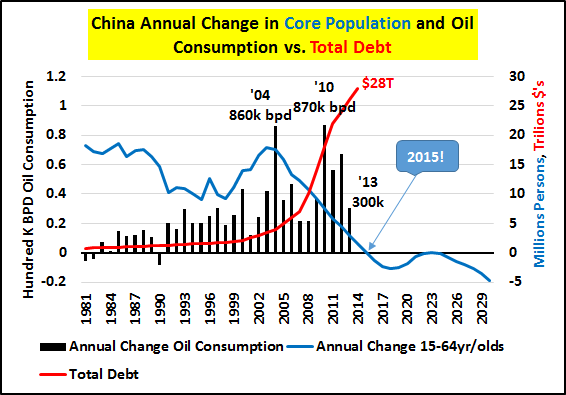

Why has this happened now? Well China went into their own massive credit expansion in 2008, to prop up internal consumption with debt as their working population growth started declining, and 2014-15 was when it went negative:

The media lie has always been that China has to create domestic consumption and their own middle class to stop relying on US exports, but that just isn't possible with their ageing demographics and a debt based money system.

Great info. Thanks for posting

China is all up in Canada buying land, real estate and companies. Mad dash for real tangible wealth vs. paper fiat digital nothing.