DefiBox review-DeFi platform on the EOS blockchain

Good afternoon to all viewers and subscribers of my cryptocurrency blog! Today I would like to tell you about a young but a very promising DeFi project – DefiBox.

What is DefiBox?

DefiBox is a representative of the DeFi industry, that is, decentralized finances. However, unlike the vast majority of other DeFi projects, DefiBox is operating on the EOS blockchain, not Ethereum.

This project was launched on July 21, 2020. DefiBox is a relatively young project, so now it has only 2 protocols embedded in its functionality – its own USN stablecoin connected to the US dollar as well as the Swap Protocol – that is, a decentralized exchanger that allows you to exchange various tokens produced on the EOS blockchain, both between EOS ones and the main EOS crypto currencies without any third parties involved.

However, in the future, a much larger number of protocols will appear on DefiBox, mostly due to the fact that DefiBox is not just another young startup developed by enthusiasts. Instead, it is funded by NewDEX which is the largest decentralized exchange on the EOS blockchain operating since 2018.

.png)

The DefiBox project itself is a decentralized one and it is managed through the DefiBox DAO – that is also a decentralized autonomous organization where users can vote with the help of BOX tokens.

.png)

And yes, undoubtedly, the DefiBox project also has its own token – BOX that can already be earned on the platform thus ensuring liquidity during the exchange.

This is to put it briefly. Next, I will analyze all these aspects of DefiBox in more detail in order for you to understand the scale and this project prospects.

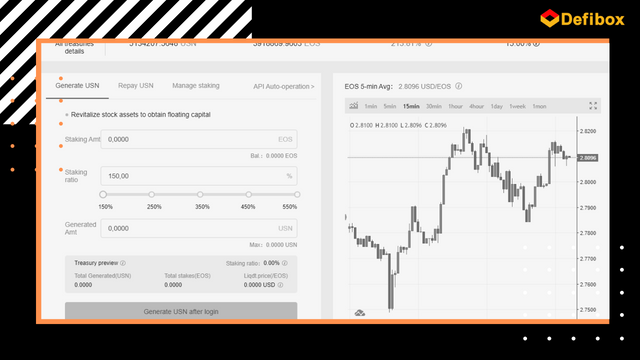

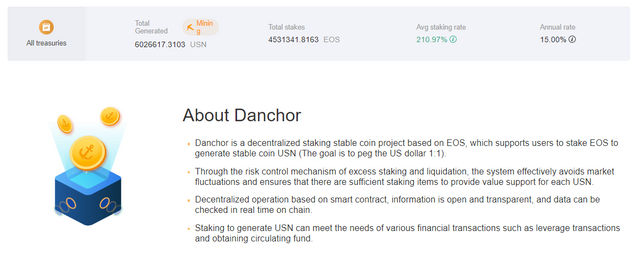

USN, its own stablecoin

It may seem strange to some people that now every DeFi platform strives to issue its own stablecoin, because now there are quite a lot of centralized stablecoins, for example, USDT, USDC, PAX, and so on. However, firstly, all these popular stablecoins are centralized and managed by private companies and here stem certain troubles and risks, to the point that they can cancel and block transactions of their own tokens, despite them being issued on an independent blockchain.

And there are many claims related to drug money laundering stating that USDT is involved. And secondly, there are practically no more or less large and actively used stablecoins on the EOS blockchain.

And in general, it is more convenient for each platform to have its own stablecoin, where you can conduct staking, reward users, and so on.

So the DefiBox could not stand aside and created their own USN stablecoin, which is always approximately equal to one US dollar in terms of its price. To be more precise, USN used to be a separate project, also sponsored by the NewDEX exchange, and it was called Danchor Token, but it now has become a part of the DefiBox project.

Everyone can generate this stablecoin by giving EOS coins as collateral and receiving a profit of up to 15% per annum. At the same time, the USN operates completely independently and is managed not by private companies, but by the EOS blockchain smart contracts and members of the DefiBox DAO.

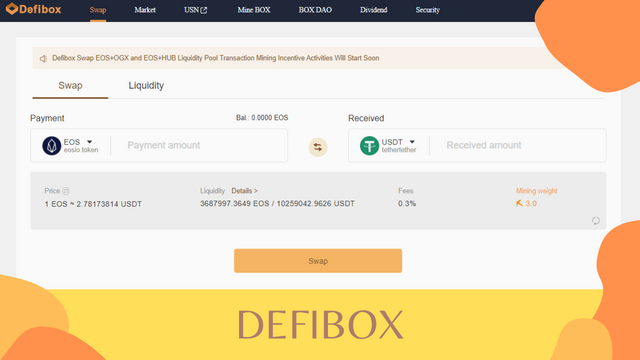

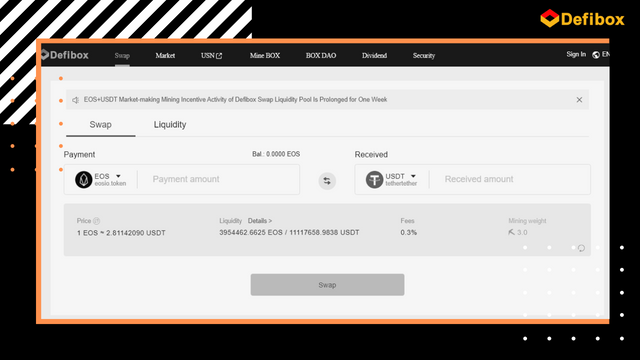

Token exchange in DefiBox

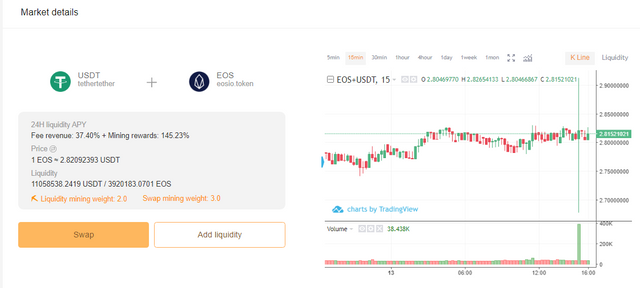

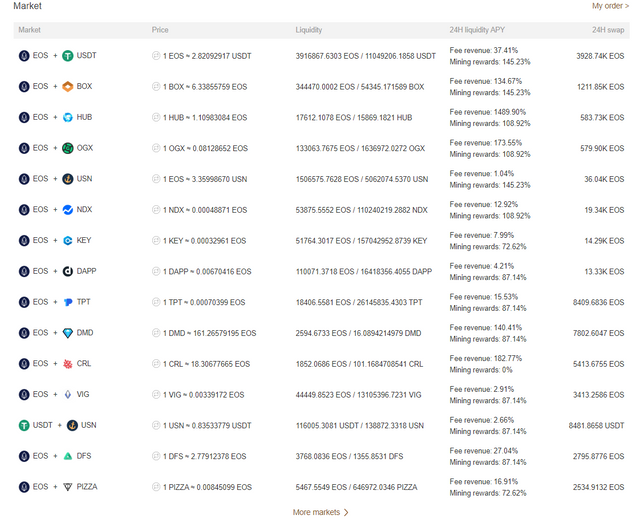

As I have already said, the second financial protocol in DefiBox is a decentralized exchange. Here users can exchange EOS coins for various tokens, and, of course, exchange the same tokens.

.png)

At the moment, there are 29 tokens in the DefiBox exchange listing that can be exchanged. The Commission is only 0.3% of the exchange amount, and it is considered to be quite low.

All transactions are conducted between the users themselves and managed by the EOS blockchain smart contracts, just as it happens on the well-known Uniswap Ethereum exchange. DefiBox Swap compensates the lack of liquidity by creating liquidity pools.

Everyone can fill these pools by sending EOS coins and tokens to the pool that are necessary for exchange. In this case, the reward is comprised of both exchange fees and BOX token generation (that will be covered in more detail in the next paragraph).

Commissions for market makers are 0.2% of the exchange amount and are borne evenly among all the liquidity pool depositors.

BOX – DefiBox platform own token

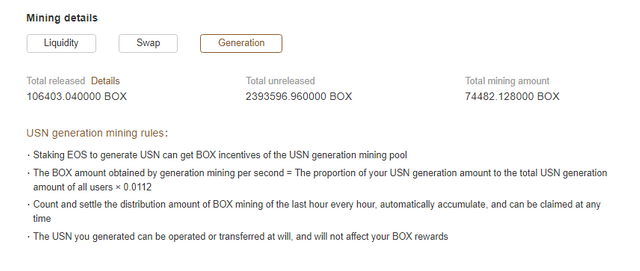

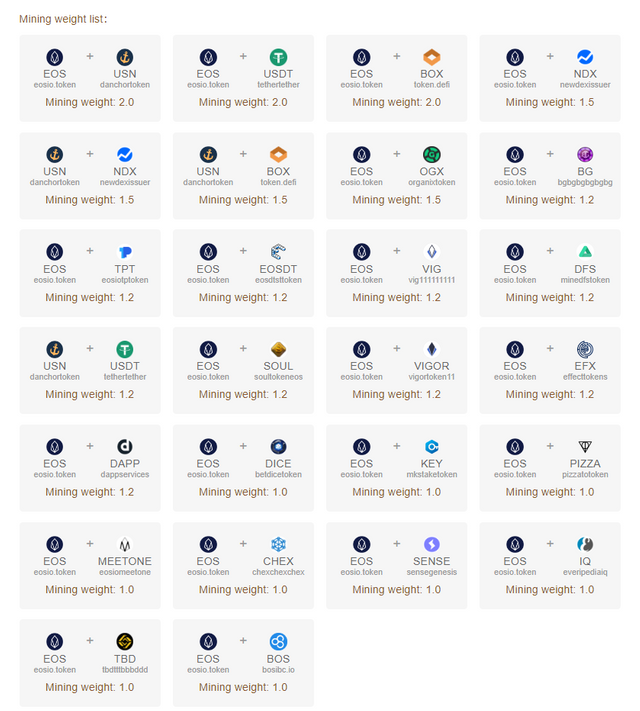

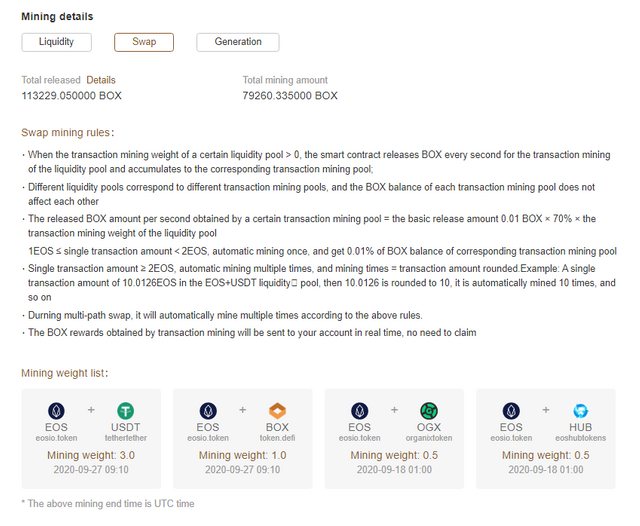

In addition, rewards for ensuring liquidity in a decentralized exchange are also paid in the DefiBox platform own token – BOX token. Moreover, if I have understood it correctly, tokens for rewards are generated by the smart contract itself every few seconds.

So, in such a way the issue of the token is regulated in order to prevent its oversupply onto the market, because tokens are created only as a reward for performing certain actions under the BOX Mining program.

Thus, anyone can earn money on the DefiBox platform by simply providing a certain number of tokens and/or EOS coins, freezing them on the DefiBox smart contract. Having done this, a user is rewarded with BOX tokens every few seconds, and the reward will be automatically credited to the linked wallet.

The BOX token is currently used to participate in voting. Since the DefiBox project is decentralized, it is managed by community members through the DefiBox DAO platforms accordingly. By providing a certain number of BOX tokens, you can cast your vote regarding any kind of changes on the platform. For example, such as the annual interest rate for generating a USN stablecoin.

By the way, you can also get rewards in BOX tokens for generating USN via the DefiBox platform. In addition to the BOX, you will also be paid a reward in USN tokens.

(*important note: the information stated in this section needs to be clarified, because I am not completely sure that my understanding of the BOX mechanism is correct – you can find more detailed information yourself in the DefiBox project official documentation).

Security on the DefiBox platform

Finally, I want to analyze one of the most important topics related to any DeFi project. Although many people only care about the economic component and the amount of profit they receive when working on DeFi, the issue of security should be prioritized.

After all, we have to remember that the price of many DeFi tokens is extremely unstable, and even one piece of news about the insignificant hacking of the project code can ruin the rates of its tokens to zero resulting in huge losses for all users.

The issue of ensuring security of the DefiBox was approached quite extensively and thoroughly. This is not surprising, because DefiBox was created with the support of the NewDEX exchange, which has been successfully working on the EOS blockchain since 2018 so these guys totally understand how to generally protect EOS contracts and platforms from hacking and other vulnerabilities.

Firstly, the DefiBox smart contact has been thoroughly tested not only by its developers, but also by third-party organizations such as PeckShield and SlowMist. Meanwhile, this audit was conducted not on a one-time basis, at the time when the project was only launched, but it is being conducted on an ongoing basis (for example, the last one was on August 26, 2020), so even the latest changes to DefiBox were checked and are reliable and safe.

Secondly, the DefiBox smart contract uses the multisig system. In other words, contract changes are carried out not only by the DefiBox Foundation itself, but also by other 11 third-party organizations that cooperate with DefiBox.

This means that even if one of the DefiBox developers decides to compromise the contract, for example, they will have a desire to steal the tokens stored on it, they will not be able to do this without the consent of at least 3 other organizations that are a part of the multi-signature validators.

And thirdly, the security and reliability of the DefiBox ecosystem is monitored by users themselves, stimulated by the bug bounty program. Anyone can independently audit or test the DefiBox open source code, and if there is exposed any error or vulnerability in it, they will be rewarded for reporting it. The amount of the reward depends on the severity of the vulnerability found.

Summing up

In my opinion, DefiBox is quite a promising project. For some reason, DeFi developers are very reluctant to use the fast and scalable EOS blockchain to create their applications, preferring to use Ethereum.

However, the DefiBox team has taken a bold step and set out on the arduous journey, developing, in fact, an extremely unexplored niche of EOS DeFi.

Well, now the project, I think is still quite “raw” in terms of earning opportunities. But this is also obvious because it has only been working for a couple of months. And it seems to me that the creators have invested more resources in establishing so far a small but secure platform than immediately rolling out a lot of protocols for earning money with critical vulnerabilities. And this approach is very sound and reasonable. So we can only wait for DefiBox to grow and turn into a larger and more multifunctional platform.

I hope that my article will somehow play at least a small role in popularizing this project, especially since DefiBox is now actively encouraging authors of high-quality content, and, to tell you the truth, my article was written just for the DefiBox Article Contest.

Website: https://defibox.io/

White paper: https://support.newdex.net/hc/en-us/articles/360046066792-Defibox

Twitter: https://twitter.com/Defiboxofficial

Telegram: https://t.me/Defibox

Newdex: https://newdex.io/

Proof of authorship

About the author - EOS account: catrindemau1

‘This article is for the Defibox article contest’

https://newdex.vip/events/articleContest