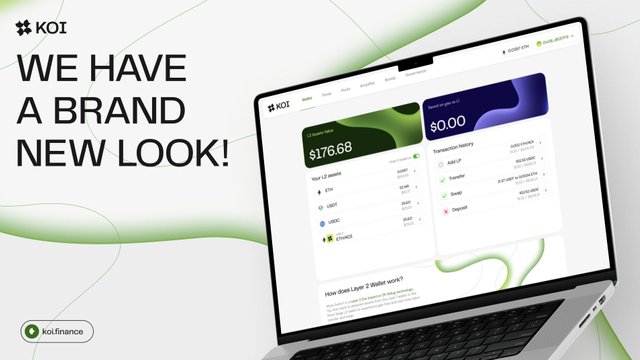

Koi finance: Experience the evolution of DeFi 2.0 with low fees and gas-less swaps.

About Koi finance

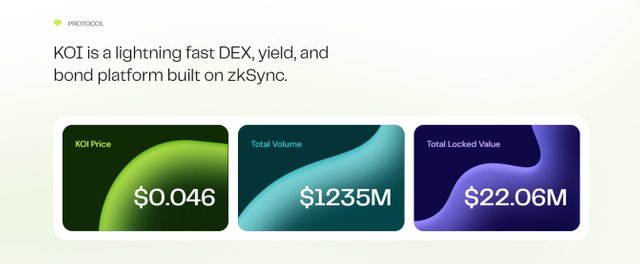

Koi is one of the largest zkRollup DeFi Platforms built on zkSync Era. Invest & trade, earn yields, and participate in Bonds all on one decentralized, community driven platform. Leverage the security of Ethereum without high gas fees. Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and AMM curves can be utilized. There can be a Normal and Stable pool for the same assets. Koi will find the best priced trade regardless of pool type. Koi comes prefabbed with a built in LP governance & delegation system. This allows for complex protocols to be built on-top of the Koi protocol, but also allows for dynamic fees within any LP pool.

Koi Bonds

Bonding is the process of trading KOI-ETH LP share to the Koi DAO for KOI. The protocol quotes an amount of KOI and a vesting period for the trade. It is important to know: when you purchase a bond, you are selling your LP share/tokens. The Koi DAO compensates you with more Koi than you’d get on the market, but your exposure becomes entirely to Koi and no longer to KOI-ETH LP.

The purpose of Koi bonds is to increase the amount of Protocol Owned Liquidity via the Koi DAO which increases the revenue towards the treasury and long term liquidity for the protocol. The benefit to bonding allows a user to purchase Koi at a lower cost basis.

Bonds are sold at a first come first serve basis. A bond ROI starts at 0% and increases slowly until it is purchased. Once purchased, the cycle is reset with a new bond and Koi is paid out over 7 days via a veKOI lock.

Koi finance FEATURES

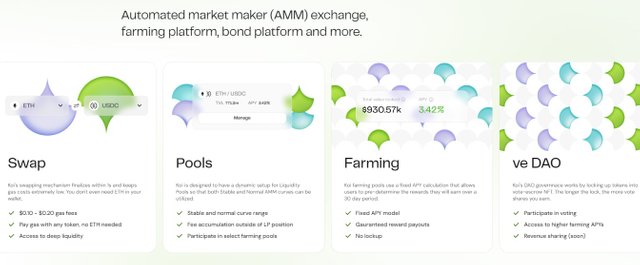

Swap: Koi's swapping mechanism finalizes within 1s and keeps gas costs extremely low. You don't even need ETH in your wallet.

- $0.10 - $0.20 gas fees

- Pay gas with any token, no ETH needed

- Access to deep liquidity

Pools: Koi is designed to have a dynamic setup for Liquidity Pools so that both Stable and Normal AMM curves can be utilized.

- Stable and normal curve range

- Fee accumulation outside of LP position

- Participate in select farming pools

Farming: Koi farming pools use a fixed APY calculation that allows users to pre-determine the rewards they will earn over a 30 day period.

- Fixed APY model

- Gauranteed reward payouts

- No lockup

ve DAO: Koi's DAO governnace works by locking up tokens into a vote-escrow NFT. The longer the lock, the more vote shares you earn.

- Participate in voting

- Access to higher farming APYs

- Revenue sharing (soon)

Koi Farming Pools

Koi farming pools is a liquidity reward protocol that allows LPs to gain additional revenue APY & take part in the Koi ecosystem. Amplifier rewards are fueled by platform revenue and fees, which come directly from the buy back and make system the Koite DAO has in place.

Do note, there are not amplifier pairs for every liquidity pair on the Switch. Rather, amplified pairs are decided up by the team and Koi DAO. There will be amplified pairs for important base liquidity pairs such as ETH/USDC, WBTC/USDC etc. These will be linked and updated on this page as those become available.

The Koi Farming pool protocol has introduced a novel system that sets it apart from traditional dynamic farming models by implementing a static APY model. This innovative approach enables the protocol, as well as its partners & users, to generate calculated revenue based on the rewards distributed to farmers.

The base APY in an amplifier is static. Additionally, if the pool has an extra amplifier APY set, the max apy is determined by a ratio of the users Ve vote share value to the lp value being deposited.

Rewards are allocated immediately upon deposit and disbursed gradually over the month based on user redemptions. If the user chooses to withdraw their funds prematurely, they forfeit the remaining unmatured rewards.

To own the max Amplified APY, you must have a vote share value of equal or greater to the value of lp being deposited.

Your veKOI votes/holdings carry over to all amplifiers. If you are providing your LP to two amplifiers, your veKOI vote share balance is not split among them. Taking the previous example, if you provided LP on two pairs using those same exact numbers as above, your APY on both would be 12.5%. This is to encourage participation in all pools.

KOI Tokenomics

Max Supply: 1,000,000,000 KOI

Circulating Supply: 500,000,000 KOI

Token Allocation: As tokens are allocated, vested, and unlocked, these numbers will be updated.

Circulating (prev. Mute token swap): 50%

Ecosystem Incentives: 30%

Future Investors (reserved): 7%

DAO: 6%

Future Advisors (reserved): 4%

Investors & Advisors (12-18 month vests): 3%

Roadmap

Big picture roadmap - subject to change

Complete

Mainnet Release

May, 2023.Farming Program: A liquidity reward protocol rolled out to incentivize high-value projects to provide liquidity on Koi. A fixed APY farming model that allows for efficient reward distributions.

Bond Infra: A Bond marketplace rolled out to give projects tooling to increase their PoL.

Paymaster: Pay fees in any tokens traded on Koi

veDAO: Vote-escrow model for Koi tokens. Get access to the KOI DAO, boosted farming APYs, and revenue sharing (Q1 2024)

Q1/Q2 2024

- Mute -> Koi rebrand & token swap

- Rebranded ecosystem with overhauled tokenomics

- veKoi revenue sharing: Integrate revenue sharing mechanisms from protocol generated fees for veKoi lockers.

- Concentrated liquidity pools, limit orders, trading strategies: Deploy and integrated concentrated liquidity pools with limit orders, range orders, recurring orders, and overlapping liquidity segmentation.

For More Information about Koi finance

Website: https://koi.finance/

Whitepaper: https://wiki.mute.io/mute/info/tokenomics-1

Twitter: https://twitter.com/koi_finance

Discord: https://discord.com/invite/muteio

Telegram Community: https://t.me/mute_iol

Author Details

Bitcointalk name : Long well

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=3382253

Bep-20 wallet address: 0x256E1269cE3FaDDF07423b9b996D424d7c89AE9C