On diversification and risk control

Defy Fund gives retail investors exposure to cryptos, forex, commodity futures, and stocks.

Why we diversify?

Most fund managers state that they diversify to reduce portfolio risk.

That is not the reason for us to trade as many classes of assets as possible.

We diversify using several DeFi platforms for the following two main reasons:

More trading opportunities:

- Trading cryptos as an asset class gives the trader the benefit of only one market. In the past five-plus years since our fund managers started trading cryptocurrencies, the crypto markets are highly correlated most of the time. Almost all of them move up and down at the same time. Furthermore, the market moves sideway 70-86% of the time.

- We trade both long (buy) and short (sell) positions during the relatively rare periods the market is trending. All of our trading strategies are determined by Market Types and we stay away from choppy markets because we are not good at catching the relative highs and lows of small movements.

- The result is that we were out of the market most of the time. This is also why sometimes you see no trading Signals when you visit here.

- By adding stocks and commodity futures to the trading baskets, we have more opportunity to stay in one of the moving markets.

Providing easy access to multiple-asset classes to overseas traders: Mos of our clients have existing investment portfolios and are seeking more exposure to assets not available in their home country. However, it has always been expensive for institutional traders, and basically impossible, for smaller retail traders to have global market access. The cost is too high, plus it is geographically and politically impossible for most of the people in less developed countries. Through smart-contract-enabled synthetic assets, decentralized finance platforms are offering anyone a chance to trade stocks, commodity futures, and any liquid assets in the world.

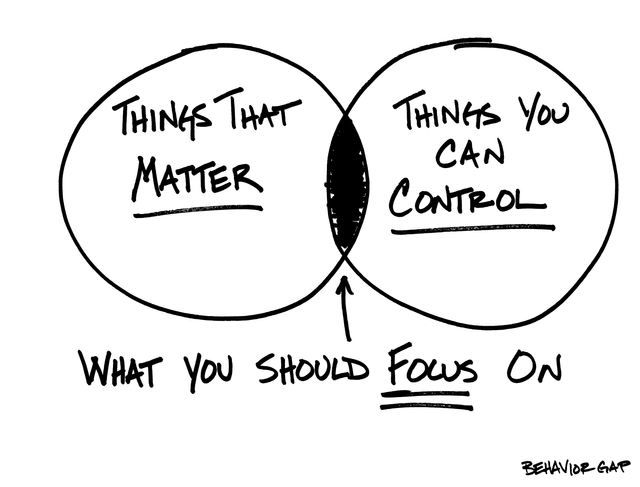

What about risk control?

Using diversification as the means of risk control is ineffective. It is often used as an excuse for incompetence.

Risk control is the starting and the endpoint of all of our trading strategy and portfolio management decisions. We use different risk control methods as the main ways to achieve trading objectives.

Every trade goes through the Risk Engine before it was generated by the Decision Engine, and it is the Risk Engine that gives the Order Server the final approval before an open order is sent.

After a position is established, the Risk Engine actively monitors the position against its original trading objective with a continuous new price feed.

In short, we consider the risk control is the single most important factor in trading success more than anything else.

For more trading/investing information, visit iob.fi DAO