Understanding the Nature of Fintropy

Fintropy may look like your regular investment platform, but before you make an abrupt judgment, you should learn more about the platform. The platform has its own strength and downside; not to mention that there are several unique features to enjoy from this unique (and promising) platform.

Fintropy and Its Overall Concept

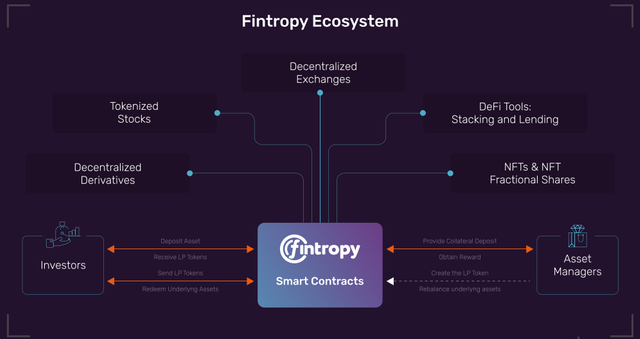

You can think of Fintropy as this multifunctional platform where you can enjoy all-in-one investment management. If you are into (or even interested in) the tokenized ETF management, this platform should be able to handle everything. The tokenization of Exchange Traded Funds allows you to manage different kinds of assets, including commodities, stocks, NFTs (Non-Fungible Tokens), and cryptocurrency.

The platform is where investors and assets managers meet. Asset managers are allowed to create and come up with their own portfolios, especially when it comes to cross-market strategies that can be aggressive. In the meantime, investors are free to choose their own pick. They have diverse and wide portfolios, and they don’t even have to go elsewhere. They can do everything within one platform only.

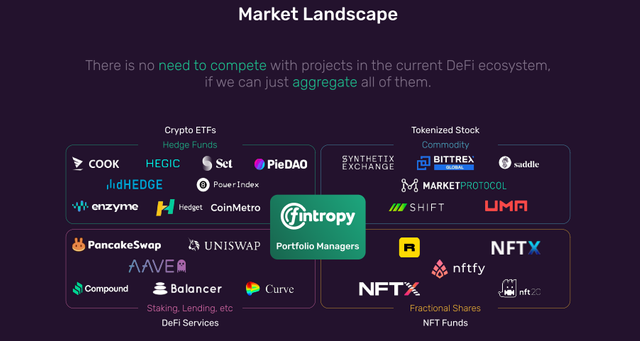

Expect to find a convenient portal so you can get to various DeFi services. The platform allows aggregation of the assets, hedge funds, or ETF from different crypto ecosystem, while maintaining security and also oversight to ensure the success of the process. Asset managers can enjoy the freedom of picking their own strategies, while investors will remain safe with their investment. These things can be achieved with this platform that can balance everything out.

Current Problems with Asset Management and Exchange Platforms

The current asset management and crypto exchange market is great, but it doesn’t have enough unification. Individuals are only allowed buying certain assets (commodities, Forex, stocks, or crypto) from certain platforms only. Investors have difficult time tracking assets. Not to mention that they will have to spend extra for the fees whenever they transfer funds (or anything else) between platforms.

Moreover, a DEX as well as a CEX often doesn’t have the desired assets by the users. They don’t provide access to strategies (like shorts or margin longs) or services (like insurance and loans) either. These DEXs and CEXs don’t interact to one another; let alone working with each other. Managing such a diverse investment set would be difficult. Let’s not forget that not having cross-chain bridges would make it difficult to make assets swaps. You can’t expect optimal crypto guidance. As a result, users would encounter difficulty to decide which would be a good investment and which would be a bad one. The problems still go on, such as: lack of trading tools’ simplification and gamification (like price feeds and charting) and the need to constantly monitoring the transactions.

Don’t forget about the different nature of the platforms either. Some platforms are quite strict. They aren’t flexible or versatile. In most cases, they apply arbitrary regulations and strict requirements. All of these things prevent users from accessing the platforms properly and stifle their investment ability. If this continues on, it will affect global economy negatively because it will prevent economic growth and trade. Traditional commodities and stock markets would be inaccessible, especially in the global scale, because assets are typically limited to centralized brokerages and banks. In short, individuals won’t have any access to a regular brokerage.

How Fintropy Comes to the Rescue

Let’s say that you want to invest with complete asset portfolios, including commodities, NFTs, crypto, and stocks. If you go with the regular investment system, you may have to create a dozen (and separate) accounts within various platforms. As your investment and diversification strategy develops, the number would add up. Imagine that you may have to invest in Coinbase, as well as Kucoin, for instance. If you want a tokenized stock, you may have to go with Synthetix Exchange or Binance. If you want to invest in crypto, you may have to choose between Tokensets or PieDao. If you want to choose the NFTs, you may have to choose between Rarible or Opensea. There are just so many different options and complications!

Fintropy makes everything simpler and easier. You only need to access Fintropy and enjoy aggregating your assets from different platforms and across the DeFi. Not only you can enjoy the ultimate trading experience, but the process is also made super simple and effective. Don’t you love simplicity when you don’t have to compromise the possibility of making profits?

You find everything in this platform, including professional asset managers. They have their own portfolios, which you can choose to meet your investment preference. Choose the suitable asset manager to manage your investment, and you can also choose what kind of assets you want to own. So, it’s a perfect platform for both investors and asset managers, as everyone will enjoy win-win outcome and profit.

Keep in mind that this may not be the platform for everyone. But if you want flexibility and freedom for investing, and you want to minimize the possibility of loss, then Fintropy is your go-to platform.

Fintropy Roadmap

Website: https://www.fintropy.io/

Intro Desk: https://www.fintropy.io/fintropy.pdf

Live Demo: https://preview.fintropy.io/

Social Media:

Twitter: https://twitter.com/fintropy

Youtube: https://www.youtube.com/channel/UCv1AymR_ToqPi4IrFqg57xA

Reddit: https://www.reddit.com/r/fintropy/

Medium: https://fintropy.medium.com/

Telegram: https://t.me/fintropy

Posted by kurniawan05

Profile link: https://bitcointalk.org/index.php?action=profile;u=1187741