Fintropy, a Platform to Manage Your Investment Diversification

If you are wondering about the special traits of Fintropy and how it is different from other platforms, then you need to read on. This platform enables investors to focus and manage ETF (Exchange Traded Funds), allowing you to invest (and save) money in various investment types. Of course, this platform does offer several strength and perks, but what are they?

Understanding ETF

Think of ETF as investment tool or a vehicle, consisting of (closed) end funds and also mutual hybrid funds. In ETF, there are various assets available, such as commodities, stocks, bonds, and others. You are free to trade them on market exchange. ETF allows investors to diversify their investment. As an investor, you can buy small positions and then diversify your positions within a targeted specific sector. You are also able to enjoy different asset forms, from the traditional investment types to the alternative assets (like currencies or goods). In short, you are given the flexibility (and also freedom) to manage your own investment.

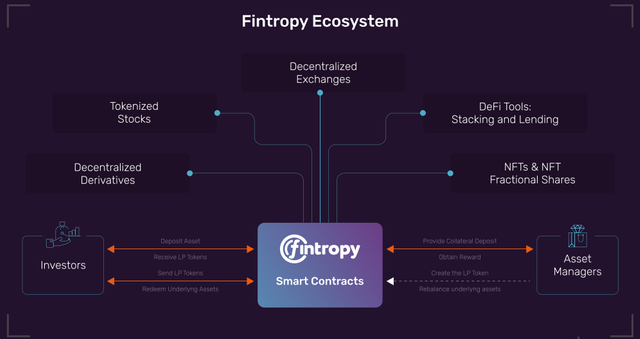

About Fintropy

Fintropy is designed as a (tokenized) management platform for ETF. There are different benefits to enjoy from this platform:

• It is a platform for actively (managed) funds. It has experienced and professional asset managers for consistent and continuous portfolio rebalancing

• It is about strategy and asset diversification. Investors are free to choose whatever assets they like, including commodities, stocks, NFTs, or crypto.

• It encourages transparency and security. It is a approval-based DAO governance for the whitelist of portfolio assets.

• It offers various investment tools. It helps you to rebalance investment portfolio by using unique methods or strategies with the available assets.

Fintropy’s Stages

The team behind Fintropy’s success has planned their own stages in details. In fact, they have broken everything in detailed stages and steps, making monitoring and implementation easier.

• For a starter, within the first quarter of 2021, the project started. Concept has been clarified and team is assembled. They have also created plans for the token sale, including the structure and legal aspect.

• Within the second quarter of 2021, it’s time for UI and architecture design. It also includes Polygon-based MVP release, along with public security audit and mobile app development

• Within the third quarter of 2021, token sale would be held. Uniswap listing would be done along with mobile app deployment featuring asset managers

• On the fourth quarter of 2021, there would be full-scale (and real) DeFi tools and DAO Governance. Top cryptocurrency (exchange) listing will take place, along with Polkadot Parathread Integration

• On the first quarter of 2022, cross-chain bridge and gamification features will take place. On the same period, the platform will focus on AI-powered trading and tokenized stocks integration.

The Real Deal

Everyone involved in the development of this platform is serious – they want the platform to be successful. All the stages are expected to run on time. Now, the platform is on the second quarter of 2021, which means that they are focusing on the tech’s development.

• Smart Contract Audit

And one of their attempts in boosting security and protection is to make sure that the platform is completely secure. Fintropy has completed auditing process on the 14th October 2021. They hired Hacken OÜ to perform Security Analysis and (Smart Contract) Code Review. The platform understands that crypto market can be vulnerable to attacks, contract issues, and frauds.

They chose Hacken because it is one of the leading and trusted Security Consulting Company focusing on blockchain security. They have been hired by Minto, Centrality, Nasdex, xDAO, and Polka Markets – as some of the clients. According to Hacken’s assessment, the smart contract of Fintropy is proven to be well-secured. They have analyzed many aspects, including automated checks, manual audit, and code functionality.

• The Mobile App

Fintropy promises that asset management can be done easily. With the mobile app, it can be done even effortlessly. The mobile app is created so users can manage their assets and investment anytime, anywhere; even when they are on the go.

• Token Distribution

Although token sales will take place on the third quarter, it doesn’t mean that they haven’t planned everything. You need to remember that token plays a crucial part in crypto platform because it is the main drive that runs the ecosystem. And in Fintropy, it’s not different.

From total supply of 30 million, 33% (around 10 million) of the token would go to private sale, whereas only 6.6% (around 2 million) of token will go to public sale. Around 20% (6 million) would go to liquidity, 7% (2.1 million) will go to advisors and teams, and 7% (2.1 million) will go to marketing. Only 1% (300,000) will be saved in reserve. The remaining: 7% (2.1 million) will go to DAO treasure and 18% (5.4 million) will be for staking rewards. They have been preparing for the sales.

Conclusion

If you are thinking about having various assets diversification, and you are looking for the right place to manage everything, then you are in the right place. Fintropy should be able to help you manage and run your investment in the safest manner possible.

Website: https://www.fintropy.io/

Intro Desk: https://www.fintropy.io/fintropy.pdf

Live Demo: https://preview.fintropy.io/

Social Media:

Twitter: https://twitter.com/fintropy

Youtube: https://www.youtube.com/channel/UCv1AymR_ToqPi4IrFqg57xA

Reddit: https://www.reddit.com/r/fintropy/

Medium: https://fintropy.medium.com/

Telegram: https://t.me/fintropy

Posted by kurniawan05

Profile link: https://bitcointalk.org/index.php?action=profile;u=1187741