💸 DeFi investment logic - changing positions

Current positions

1inch, ETH, DPI

Ending positions

YFI (in YFI v2 vault), ibETHv2 (earing ALPHA), DPI (safety index ;)

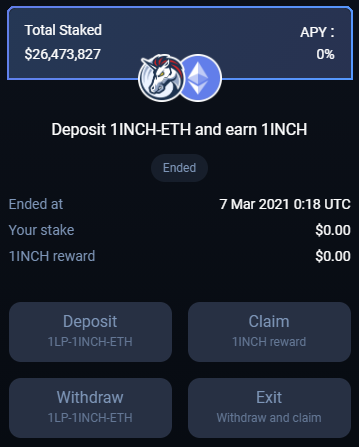

The 1inch-ETH farming rewards pool ended recently and I have been looking for another place to put my value so that it can be useful. I got about ~3k in 1inch rewards and my overall position appreciated ~250%. I bought 1inch @ $1.5, $1.00, and a little more @ $2.

1INCH-ETH farming endedDaily chart for 1inch-USDT (2021–03–06).Once the pool ended, 1INCH was around $4.00. It looked like 1INCH was about to make a decision, from a technical analysis perspective. So I decided to wait a couple more days to see what happens to the price.

Sold @ 4.48Turns out my the decision was up until it hit a resistance @ $4.5. I was staring at the market depth (Level 2) and could see many 1INCH tokens sitting at $4.49, $4.50, $4.51. There would have had to been over 1 million worth of value bought just to break through the resistance @ $4.50.

Usually when this happens, I'll sell my position at the consolidation and wait to see if it breaks above $4.50.

In this case, I could sell at $4.48 (which I did) and then wait to see if $4.50 breaks. If it does I could jump back in and suffer a $0.03 cent loss.

1INCH price as of writing this has dropped to ~ $4.20 (blaze it). So here I could continue to trade 1INCH, looking to buy the bounce at the lower resistance (as it is still within our technical range), but I this causes me too much anxiety and stress having to pay attention constantly to this price.

❓ What is my logic for not wanting to invest in 1INCH

Only 1/10 of their tokens are in circulation

Only 60% of the remaining tokens to be released are for community incentives. The remaining are for backers and devs

At the beginning of DeFi when 1inch was the only dex aggregator, seemed like a no brain investment. But as the space is maturing, as new projects are being developed, I have realized that the team behind the token is more important for long term success.

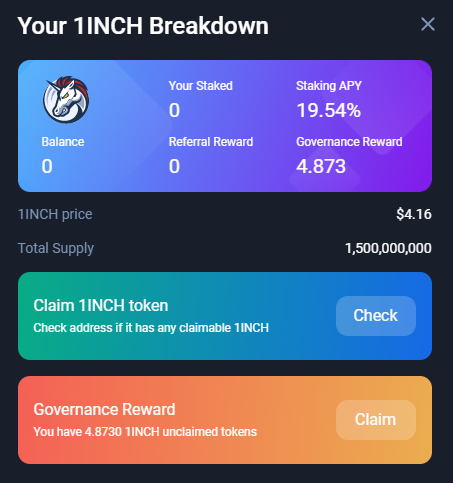

1INCH is very attractive right now as it is currently the highest APY governance staking solution

What I don't like is how the staking APY is generated. The staking APY revenue is sourced from swap fees and price impact fees.

Aggregators are attractive right now due to the amount of liquidity available to source. (which isn't a tremendous amount). Meaning if you are swapping <50k, for example, you may have to use 4–5 different liquidity pools to maximize your swap return. So for now, 1INCH is great! But as time goes on, I can only imagine the saturation of the popular liquidity pools will grow. Which will decrease the price impact fees for this platform. Which will then decrease the revenue of the platform.

It's also just an aggregator. I don't see why other platforms, even Uniswap, start integrating this functionality somehow.

This all being said, it's just my logic. I've made a lot of stupid decisions in the past that have had pages and pages of logic backing my move and still being wrong. Maybe one day I'll be 100% right.

Where am I moving my value to?

Alpha Homora v2 - ibETHv2

Yearn v2 vault - YFI

Alpha Homora v2 - ibETHv2

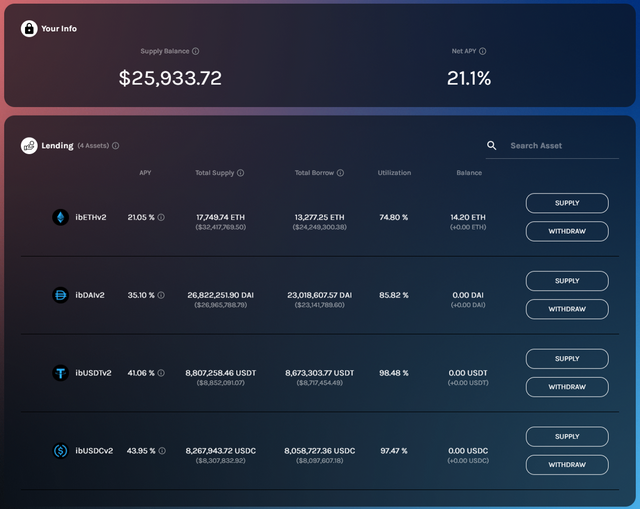

for the next month Alpha Finance has rewards going for supplying ETH that was in the 1INCH-ETH rewards pool to their Alpha Homora v2 app. read here 👉 link

https://homora-v2.alphafinance.io/earn

What I really like about this position is that when you supply ETH you are not exposed to impermanent loss. Which is quite an annoying thing to handle when dealing with liquidity pools. This is not a liquidity pool! It is a lending contract. This ETH is used by those leveraging their farming positions.

The utilization rate is quite low (74.8%) and equates to ~ 1% return per year. I think Alpha Homora v2 will start to integrate new ETH products that can utilize this v2 lending pool.

The rewards state that they will be distributing 7% of 4,950,000 ALPHA tokens to ibETHv2 lenders (346,500 ALPHA) and will last 1 month

This equates to…

total ALPHA reward / ETH supplied (17.749.74 👉~18k)

346,500 / 18000 = 19.25 ALPHA / ETH supplied

19.25 * 14.20 = 273.35 ALPHA / mo

ALPHA-USDT price as of writing

Assuming ALPHA = ~ $2.00 after a month

273.25 * 2 = $546.7

So all the math boiled down, we get ~$546.7 USD which is…

546.7 / 26 270 = 0.0208

2.08%

This position allows you to generate a guaranteed ~2% return on your initial ETH deposit.

"2% is nothing WTF. I could generate 5000% APY in this new liquidity rewards pool!"

k…

another thing on top of this is that I am very interest in ETH's price target for the next month or so. So I figured may as well get an extra $500 if I am holding ETH anyways.

NOTE: This $500 is actually ALPHA tokens. Meaning an asset that can fluctuate in value. (I may gain $5000 this month if ALPHA goes to $20!) Which I want anyways. I like the projects, the platform roadmap, and they have one of the smartest people in the world on their team… Literally 3rd in the world for Math Olympiad) (read here)

Yearn v2 vault - YFI

https://yearn.finance/vaults/

Yearn is sweet. One of my first ever DeFi investments back in 2020. They have improved a lot since then. (especially the UI/UX). Plus Andre Cronje is literally the Elon Musk of DeFi.

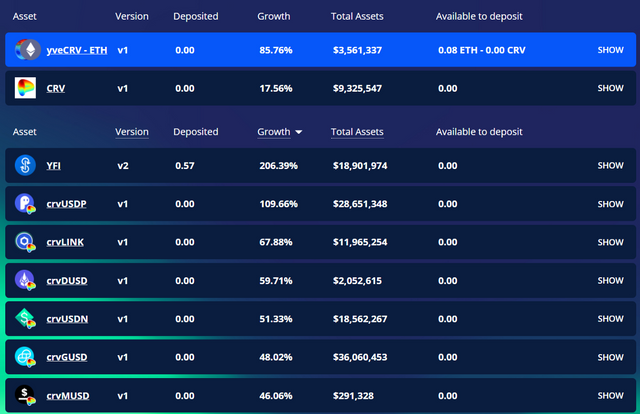

They just recently added the YFI v2 vault and it has been yielding <200% APY for the past week or so.

I like YFI as an investment currently. It's close to it's ATH, which is always a fun thing to be a part of.

YFI-USDT Daily chartYearn partners is a sweet addition to the platform as well.

The governance forum is also the most active and seems to have the smartest people within it. I suggest just browsing the vaults proposal section to just get a taste of how this team operates: https://gov.yearn.finance/c/proposals/vaults/9

Welp, that's my maneuver for this month. Follow me for more DeFi content. I'm always open to chatting with anyone who wants to listen. Good luck with your DeFi positions!

Book a FREE appointment with me 👉 DeFiknowledge.com

🟦 Twitter 👉 Stuart (@DeFiKnowledge) | Twitter