Understand the ACycle gameplay in one article

Algorithmic stablecoins have become a favorite in the defi world since their in 2020. The first thing that appeared was AMPL’s crude single currency algorithm model, that is, when inflation is greater than 1 US dollar, inflation is increased, and when it is less than 1 US dollar, deflation is destroyed. This crude method This led to a rapid collapse of AMPL after reaching a high point in the middle and short term last year.

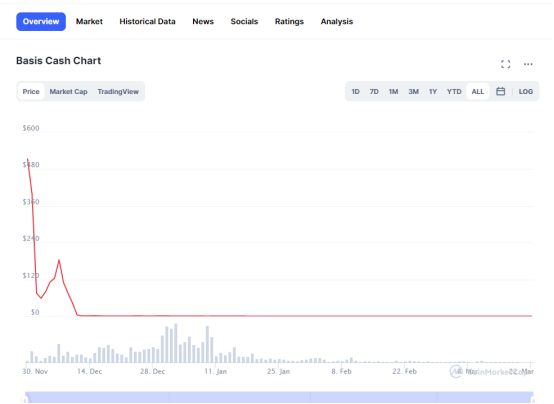

Later, several innovative algorithmic stablecoins appeared one after another. Basis Cash is considered to be one of the representative projects of algorithmic stablecoins to open a multi-currency ecosystem. The Basis Cash protocol contains three tokens, Basis Cash (BAC), Basis Share (BAS) and Basis Bond (BAB), where BAB is not transferable. BAC is one of the stablecoins, anchored at $1; BAS is equity tokens, which can be used to distribute newly minted BAC tokens; BAB is a bond, and the price of BAB is equal to the square of the price of BAC. For example, when BAC is $0.7, the price of BAB It is 0.7 BAC (0.49 USD).

When BAC is higher than $1, the system first allows bond holders to redeem BAC. If there is still BAC generated at this time, it will be distributed to the Boardroom in the form of seigniorage, and the user will mortgage BAS to earn the daily seigniorage of BAC.

Unfortunately, because the Basis Cash system still couldn’t solve the selling pressure from additional issuance, it quickly fell into the altar after the market opened.

Is there an algorithmic stablecoin that can withstand the pressure from additional issuance and eliminate the panic caused by deflation?

I found a so-called fourth-generation algorithmic stable currency project Acycle.io in the medium, using a four-currency economic model: stable currency ACC, bond currency ACB, dividend currency ACF, and governance currency ACG. By carefully studying its white paper, let’s take a look at how it works.

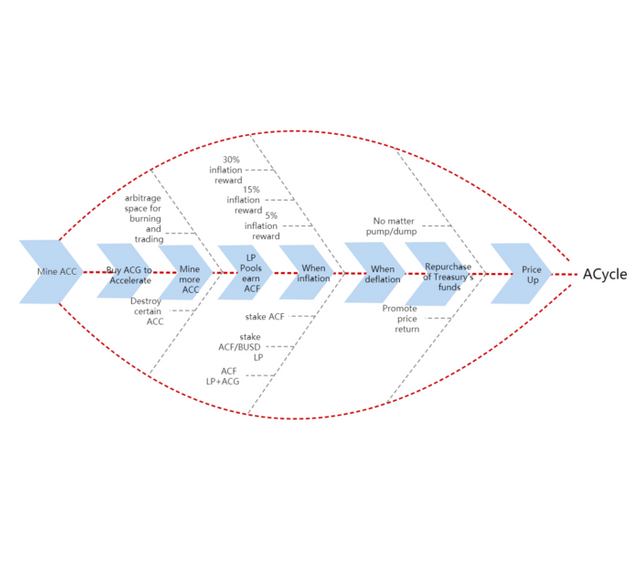

According to its white paper, its core token is ACF. After the ACF mining pool is opened, 50% of the additional issuance of ACC can be obtained by pledged ACF and related transaction pairs (the remaining 50% will be returned to the national treasury, which will be discussed in detail later); deflation When it happens, the pledge of ACF and its related trading pairs can be subsidized by ACB. Therefore, in theory, no matter whether its stable currency ACC rises or falls, investors will not lose money, provided that they hold ACF.

There is no doubt that ACF is the core token of this system. Another highlight is that the system also has an accelerated mining and destruction mechanism: ACG is necessary to accelerate mining, and ACG needs to be obtained through ACC destruction.

So let’s sort out the logic of the project:

To mine, you have to replace ACG with ACC, otherwise others can mine faster than you — offset the selling pressure caused by the additional issuance of ACC

In case of inflation, you have to provide two pools of liquidity to get ACF in order to get dividends-otherwise the additional issuance will not be possible for you

During deflation, you will be subsidized by ACB. If you calculate the value of fiat currency, you will not lose — lock in ACC and ACF to hold confidence and promote price recovery

Probably the logic flow can be explained with a picture:

At present, the project has been open for half of a day, and TVL has exceeded 1 million US dollars. It can be seen that it has attracted some people’s attention. As the mechanism becomes more and more familiar to everyone, I believe that TVL breaking ten million is just around the corner. As for how it will perform next, it is up to the market to judge.

*Investment is risky, you need to be cautious when entering the market

check :acycle.io(with Binance Smart Chain)

You've got a free upvote from witness fuli.

Peace & Love!