Another new star of DeFi was born! EVAA broke the DeFi pattern and subverted the ecology!

This year’s DeFi brought us one surprise after another. Since Compound started liquidity mining, tokens in the DeFi market have followed suit and prospered in an instant. The world’s biggest cryptocurrency market platform even opened a dedicated area for the DeFi token market to match market demand.

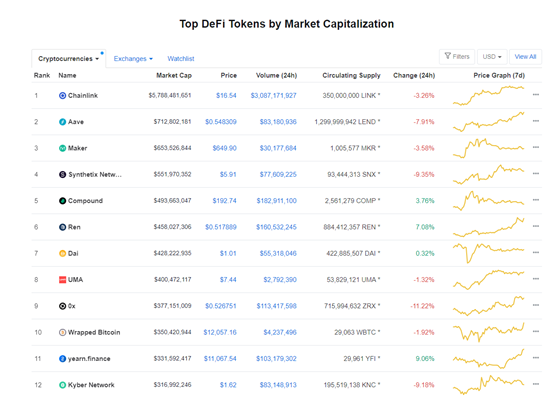

Picture from CoinmarketCap

Taking Chainlink as an example, which is the number one in the DeFi rankings.Many DeFi products have to rely on its oracles to obtain market prices, which creates a large amount of LINK demand (Editor’s note: Link is the token of Chainlink). So since the beginning of this year, the price of Link has risen all the way, the highest increase has exceeded 10 times. Others include AAVE’s increase of more than 30 times, SNX’s increase of more than 12 times.

The picture shows AAVE with the highest increase of more than 30 times, data from CoinmarketCap

Why does DeFi receive the market’s popularity?

We analyzed the following reasons through market data.

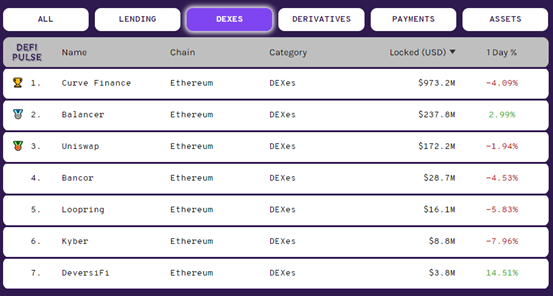

The first is the gradual improvement of new blockchain infrastructure: the rise of DeFi is inseparable from the development of decentralized exchanges such as Uniswap. When the market was sluggish, Uniswap gave another way out for market funds: to provide liquidity to Uniswap to obtain fee sharing. At the same time, other decentralized exchanges (DEX) also have certain incentives to promote digital currency users to increase liquidity in the market or conduct arbitrage.

The picture shows the ranking of DEX locked positions by market value, data from DEFI PULSE

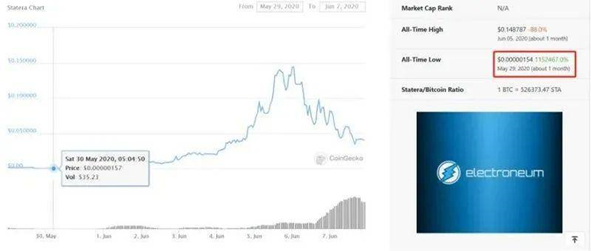

The second point is to benefit the myth and continue FOMO to drive market sentiment. Take STA as an example. STA is a deflationary token listed on Uniswap, which increased by 100,000 times in 6 days on Uniswap. After each transaction is completed, a certain percentage of the token will be destroyed. As long as the transaction continues, the total amount of tokens will continue to shrink.

STA rose by about 100,000 times

Now that the myth of creating wealth is considered to have disappeared, there are few hundred times currency in the market, let alone thousand times currency or ten thousand times currency. But such a myth has appeared on Uniswap.

And the third point is that the smart contracts and transaction depth of DeFi tokens are public, and they have unmatched advantages over centralized exchanges. Uniswap does not have any listing fees, which solves a big problem for many blockchain entrepreneurs; Uniswap’s pending orders are automatically matched based on the volume of buying and selling orders, so centralized exchanges intervene in market value and fake orders and fake data no longer exist; coupled with the liquidity mining and Decentralized Autonomous Organizaztion (DAO) blessings of many DeFi tokens, both users and project initiators are obviously more advantageous than traditional centralized exchanges.

Another new star of DeFi was born!

According to the official information of EVAA, EVAA is a platform developed based on the Ethereum underlying chain. It was developed by Spotech, the top Russian geek technical team, in one year. The deployment contract has been completed on the Rinkeby test network and will be officially released on the main network in the near future. . EVAA is committed to creating new financial services, providing financial services such as payment, clearing, and lending to users around the world, so that everyone can enjoy fair, transparent, and equal financial services anytime, anywhere.

EVAA is a decentralized financial platform. The platform has two currencies: EAA and USD-linked stablecoin EAC. The number of stablecoins is the value of the virtual currency pledged by the platform, and each EAC corresponds to 1 U.S. dollar.

Users can store their virtual currency on the platform, the platform pays an annualized interest of 8%, and the interest will be calculated and paid immediately after the transfer.

EVAA is a decentralized financial platform. The platform has two currencies: EAA and USD-linked stablecoin EAC. The number of stablecoins is the value of the virtual currency pledged by the platform. Each EAC corresponds to 1 USD.

You may ask, why would you lock in higher-value ETH or BAT or BTC to issue lower-value EAC instead of directly selling your crypto assets to get dollars?

The following situations may occur during this period.

You need cash now and have a crypto asset that you believe will appreciate in the future. In this scenario, you can deposit your encrypted assets in the EVAA vault and get funds immediately by issuing EAC.

You need cash now, but you don’t want to trigger the risk of a tax incident by selling crypto assets. You can withdraw loans by issuing EAC.

Investment leverage. If you believe that your crypto assets will appreciate in the future, you can leverage your assets to maximize your benefits.

In all the above processes, EVA will inevitably be consumed to promote the deflationary effect of the entire economic system, thereby stimulating price increases.

DeFi is unstoppable. Relying on the superiority of technology and the reasonable design of mechanism, EEVA may create another DeFi myth.